The stock market has never been more accessible than it is now. Thanks to the Internet and subsequent technical developments, a system that was previously thought to be solely for professionals has been made available to the general public. The times of picking up the phone to call a finance counsellor or licensed asset manager are over, with ordinary consumers shifting to online brokerage firms where they manage their own assets.

Almost every reputable online brokerage now has a mobile application that allows professional investors to monitor the market while on the road. There are smartphone applications for almost anything nowadays. Do you want to order food, talk to a buddy, mail a parcel, or get a ride to work? There’s a mobile app for just that. Investment is no exception.

Furthermore, these applications are provided by organizations with a few of the strongest Wall Street reputations, providing the customer with a piece of mind that their money is in good hands. Some programmers are intended for investment firms who make many transactions per week or per day, whereas others are intended for equity investors who wish to set it and leave it.

Investment Apps For Ongoing Investment

Investing is no exception. Whatever experience you’re searching for, there’s probably an option below that fits your needs as a shareholder. Here are the apps discussed that can hel you out on your investments at ease.

1. Betterment

It is more than simply an investment app; it is a trailblazer in the self – driving market. Users may link a bank account or debit card to their trading account to make manual contributions or set up regular disbursements for automated investments. Once you’ve deposited cash into your account and established your objectives and investment strategy thresholds, the app will do the majority of work for you, distributing your money as you’ve specified and allowing you to go on with your day. Among the most notable functions provided by the app are:

- Risk Tolerance Adjustments- The software allows you to customize your asset allocation depending on your tolerance for risk. Investors who are somewhat not willing to take muh risk will put more money into safer bonds, while people who are highly comfortable with risk will put more money into the stock market through exchange-traded funds (ETFs) and asset classes.

- Tax-Loss Harvesting- Tax-loss harvesting is the process of selling an investment that has incurred losses. Just at the end of the year, such losses are recorded to the IRS, lowering your overall tax burden.

- A Goal-Oriented Platform. Setting financial objectives is one of the first stages in opening an account. Your objectives may include having a specific amount of money set aside for retirement, a deposit on a property, or a scholarship fund.

- Automated Investing- Using the Betterment app, investing may be totally automated. All you have to do is link your bank account or debit card to the site and tell it how much money you want to invest weekly, bimonthly, or monthly.

- Reasonable Management Fees- Investment ought to be a low-cost activity. After all, the purpose is to generate money, not spend it, and excessive fees dramatically reduce your protracted productivity.

2. Acorns

It is another robo-advisor software that allows you to purchase without conducting much investigation. The app offers a full personal financial experience, including digital checking and savings accounts as well as the possibility to invest. Besides having no minimum purchase restriction, it was also created to teach users how and where to leverage the power of micro-investing, or the practice of getting numerous tiny deposits all throughout the month that build up to considerable value over the years.

Here are some of the features that investors appreciate about the Acorns app:

- Automated Investing- Acorns takes automated investing to the next level. Not only can you arrange specified sums of money to be deposited to your account on a weekly, bimonthly, or monthly basis, but the company’s emphasis on micro-investing allows you to round up all of your transactions to the tune of millions of dollars and invest your spare money.

- Allocation Control- The software also provides significant and sustained control over the investment portfolio, making it easier to manage risk throughout your investing portfolio. To do just that, divide the allocations percentage between equities and bonds, with greater-risk portfolios including a larger proportion of stocks and lower-risk portfolios comprising a smaller share of stocks.

- Educational Materials- The app was created to bring financial knowledge to the public, and it succeeded admirably. You’ll have access to fascinating instructional resources through the app, which will help newcomers become pros.

- Low Fees- The platform’s costs are quite low, ranging from $1 per month to $5 per month depending upon of the type of account you have.

- Earning Capabilities.- The app not just allows you to make money as an entrepreneur, but it also allows you to earn money while you purchase through agreements with some of the world’s largest shops.

3. Robinhood

Robinhood, founded in 2013, is a reasonably young discount stockbroker. The platform has swiftly taken the industry by storm, garnering a wide audience, mostly millennials looking for a streamlined experience with total control over their money.

The software, which is popular among both aggressive traders and buy-and-hold investors, delivers a compelling customer experience in a convenient style, making it one of the top investing and trading applications on the marketplace currently.

Those that use the software frequently rave about:

- Complete Portfolio Control- Robinhood is not a robot and will not advise you on which investments to make. Instead, the platform provides its users with total control over the individual stocks in their portfolio, making it an excellent choice for people with a moderate-to-high awareness of the stock market and how to invest.

- No Minimum Requirements- There is no minimum bank deposit to utilize the site, making it available to everyone.

- Fractional Shares- Some stocks are exorbitantly priced. A single share of Amazon.com, for example, would cost you more than $3,000. The application was among the first to provide a fraction of shares, allowing users to buy in dollar quantities rather than part of share counts and rendering these high-cost equities accessible to everybody.

- Commission Free- You will not have to pay commissions to make transactions while using the app. The only expenses involved with trading are regulatory fees, which are a tenth of a cent.

- Robinhood Gold- Many customers choose for the Gold membership, which costs only $5 per month. Gold membership grants you access to expert analysis, margins, and Level 2 market data, providing you with additional information with which to make profitable trades.

- Free Stock- Lastly, the application not only encourages beginners to participate with a straightforward style and commission-free trading; it also provides new users with free shares.

4. Webull

Webull, which was founded in 2017, is the newest investment app on this list, so don’t let it deter you.

This FinTech application offers investment from the palms of your hand to another degree, offering a wildly popular choice among youthful traders eager to get more involved in the stock market.

The following benefits are available to platform users:

- Market-Leading Tools- Webull is intended both for long-term shareholders and aggressive speculators. The functioning of the site is very well suited to both populations. When you’re using the app, you’ll have access to technology indications and custom graphing features, as well as high-quality actual information, making it much easier to time your share trading entry and exit.

- No Minimums- There are no minimal contributions or account balance limitations, offering the investor yet another choice that expands market access for anyone.

- Free Stock- The software provides its users with free stock shares. It extended on the offer made by Robinhood by providing two free shares. When you establish an account, the first share, worth between $2.50 and $250, is added to it. If you make an initial investment of $100 or more, the second share, worth anywhere from $8 to $1,600, will be added to your account.

- No Commissions- The software allows you to trade stocks, derivatives, and ETFs without paying any fees. Only one cost you’ll have to pay are those linked with your market actions. And there are other applications that provide no-commission dealing, it’s one of just a handful that provides option trading.

- Cryptocurrency- Cryptocurrency is increasingly becoming popular by the day, but there are few conventional brokers who provide accessibility to such classes of assets. Webull allows you to invest in prominent digital coins such as Bitcoin, Etherium, Bitcoin Cash, Dogecoin, Ethereum Classic, SHIBUSD, ZEC, Cardano, XLM, and Litecoin.

5. TD Ameritrade

TD Ameritrade, founded in 1975, is a more conventional broker that introduced an internet site when technology advancement led to a shift in how consumers invest and deal.

Thinkorswim, the company’s latest investment platform, was created by traders for traders, and it offers some of the most advanced dealing and investment technology on the market today.

The topics are frequently mentioned by platform users:

- Educational Materials- The application is more than just a way to perform stock and ETF trades; it also provides access to some of the greatest educational content accessible. Experienced traders and other top-tier Wall Street specialists selected and curated the resources to quickly transform a novice into a professional.

- Detailed Charting and Trading Tools- The system was launched by trading specialists who understand the tools required to thrive in the stock market. It’s hardly surprising that the programme has some of the most user-friendly trading tools and charting features available.

- Profit and Risk Analysis- This feature is unlikely to be seen anywhere else. You have the ability to examine the possible profit and loss that might be made before placing a deal. Even though there is no way to anticipate an asset’s future price with certainty, the profit and risk analysis tool is surprisingly accurate, providing you with a clear picture of what you may expect from each investment.

- Live News- There are numerous websites that provide instructional resources, but this app takes a step further by providing access to current market news. This ensures that you are up to date on any news related to the commodities in which you trade.

- Trading without restrictions- TD Ameritrade has no platform fees and offers zero-commission trading on all stocks and ETFs domiciled in the United States. Except for a fixed $0.65 cost per contract, standard options trades are commission-free.

6. Stash

Stash is a financial wellness software that is user-friendly compared to conventional investment and financial operations.

With Stash, you’ll be allowed to prepare for the future while collecting shares as a reward for using the company’s products.

- A Goal-Oriented Platform- When you sign up for the app, one of the first things you’ll do is complete a series of questions aimed to help you clearly identify your financial goals. By answering these questions, you will provide the app with all of the information it requires to make suggestions in order to put you on the right track to accomplishing your goals.

- Access to Individual Stocks- The majority of robo-advisors choose the assets for you, giving you little choice over what you invest in. Stash, on the other hand, allows investors to select their own equities, providing them greater choice over what they invest in. Furthermore, fractional shares are available, allowing access even for the most costly stocks with minimum expenditure.

- Stock-Back Debit Card- There are other wealth management applications that provide personal bank accounts with spending cards, but this software is rather different. Stash has a rewards card that gives you 5% back. Unlike all other rewards cards that pay users in cash or points, the Stash Stock-Back Card pays you in stock shares, automatically boosting the value of your portfolio and investing you in many of the companies you use.

7. E*Trade

E*Trade has already been delivering superior banking services to traders and investors since 1982, and its parent business, Morgan Stanley, was formed in 1931, implying that the professionals behind the app are some of Wall Street’s most veteran and well-respected specialists.

Customers of E*Trade benefit from:

- Cryptocurrency access- E*Trade provides you with access to a variety of investing alternatives, including standard stocks, bonds, and ETFs. The firm was also an early supporter of digital currency, establishing one of the first major online investment platforms to provide access to cryptocurrency. As a result, it has risen to the top of the digital currency market.

- Educational Materials- Morgan Stanley appreciates the importance of education, as one would anticipate from one of the world’s financial giants. That knowledge has evolved into a comprehensive collection of investing education resources via its subsidiary’s mobile app. These resources are intended to benefit investors at all levels, from beginners to pros.

- Zero Commissions- You will not be charged any commissions on making transactions for stocks or ETFs, except for a fixed $0.65 cost per contract. In addition, the organization is the largest in terms of low-cost contracts and profits.

8. WealthFront

WealthFront, which was founded in 2008, is a self – driving money making app.

The application, as the title suggests, is intended to assist people on their route to become rich in all areas of accounting, from lending to leasing, spending, and, of course, investment.

Here are some of the things consumers enjoy about the app:

- Complete Financial Automation- The app advances automation to a new level. Of course, you may invest constantly with predefined sums of money, and that’s not all. If you’re using the app’s banking capabilities, when your paycheck is immediately transferred into your account, it will be automatically divided and rerouted for payments, saving, and investment depending on the objectives you’ve established.

- Control- Most robo-investing platforms offer a predefined bucket of investments into which your money is allocated based on your asset allocation preferences. The WealthFront app does the same thing, but it takes it a step farther. If you want to choose the specific stocks and other assets in your portfolio, the app allows you to do so while also providing recommendations to keep you on track.

- Goal-Oriented Planning- The software is all about planning for the future and accumulating riches. The software allows you to create objectives and receive advice on how to invest, save, and manage your money in order to achieve them.

9. Ally Invest

Ally Financial Corporation, founded in 1919, is the oldest firm on our list and one of the most successful financial institutions in the United States.

From over a century of expertise delivering exceptional service to numerous consumers, you can be confident that your money is in good hands when you choose Ally Invest.

- Complete Control- Investors have total control over how their money is invested when they use the programme. For investors searching for self-directed accounts, the firm provides a powerful brokerage account, as well as a comprehensive range of alternatives for those seeking controlled investment.

- Zero Commissions- You will not be charged commissions on stock, option, or ETF trades if you use their services. Contract costs for options are merely $0.50, making them extremely comparable with the rest of the economy.

- Managed Portfolios for All Investors- When you use the company’s managed investing services, you won’t have to settle with a single investment book that’s supposed to be a one-size-fits-all solution. Instead, you’ll be able to select from a number of portfolios developed with various objectives in mind.

- Quality Educational Materials- Members get access to all kinds of articles aimed to better understand how the stock market works.

10. Charles Schwab

Charles Schwab, founded in 1971, is a conventional broker that has evolved into an online and mobile stock broker as the business has transformed. Because of its extensive expertise serving the investment community, the business has become a Wall Street powerhouse to be reckoned with.

Consumers that utilise its app benefit from the following features:

- Robo-Advised or Self-Directed- When you open a brokerage account with Charles Schwab, you have the option of using the company’s robo-advisory services or managing your own self-directed portfolio. It also provides the ability to make decisions with much control you want over your investments.

- Customization- You may personalize your experience by structuring your summary view and marketplace settings to present the information that is most relevant to you. As a consequence, you won’t have to go through various app pages to get what you’re searching for – it’ll all be in your summary view.

- Schwab Assistant. The app provides access to the Schwab Helper, a machine intelligence assistance meant to assist you on your financial journey. Your personal secretary will be capable of conducting transactions, obtaining bids, managing finances, shifting funds, much more at your command.

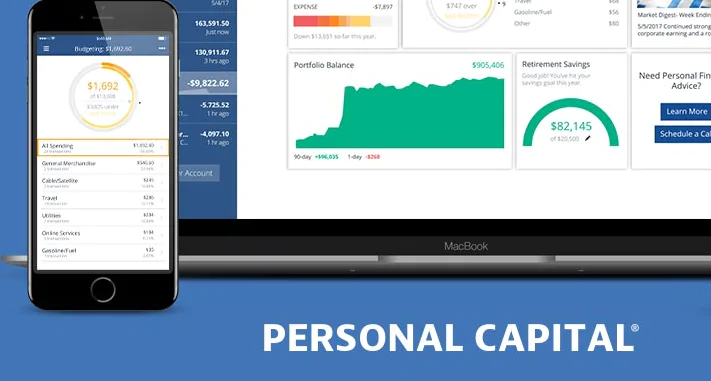

11. Personal Capital

Personal Capital is a comprehensive financial tool that may assist you in building money and planning for a pleasant retirement. Although it is not the ideal solution for individuals seeking an active approach to trading and investing, it is an excellent alternative for newbie investors or those who want to take charge of their entire financial well-being.

The following are the features that investors like the most about the app:

- Overall Financial Stability- Investing is a critical component of safeguarding your financial future, but it is not the only element to consider. You’ll be able to manage almost every element of your financial life with the Personal Capital app, ensuring that your budget and spending habits match to your financial objectives and investing requirements.

- Access to Financial Advisor- When you’re unclear what to do in almost any situation, it’s usually preferable to consult with an expert. Unfortunately, financial counsellors are not always easily available in the world of money. You’ll have access to a highly skilled team of financial advisors with a fiduciary obligation through the app, which will help you get on the correct track to accomplishing your goals. This is a fantastic resource, especially for rookie investors.

- Investment Checkup- You may use the app’s investment checkup feature to evaluate how your portfolio is performing in relation to your own financial objectives, compare your portfolio’s allocation to the target allocation indicated for achieving those goals, and see how well your assets are performing overall.

Conclusion

The potential that mobile phone applications have placed in the palms of our hands are beyond imagination. This is particularly true in the context that only a few generations earlier, reading emails on a smartphone would’ve raised eyebrows. However, technology advancement is causing fast changes in how customers behave, and the investment world is not falling behind.

people also search for like: Are micro-investing apps worth it? , How can I invest a small amount daily?, What is the easiest stock app to use?, Is micro trading profitable?, Is micro-investing profitable?, How can I earn 5000 daily in stocks?

Read More:

- Best Cheap Health Insurance Of 2022

- Where To Cash Your Stimulus Check If You Don’t Have A Bank Account

- Common Trading Mistakes And The Emotions That Accompany Them

- EBay Credit Card Login And Payment Explained

- MEGA Personal Login: Detailed Login Instructions

Leave a Reply