PayPal was in the beginning, one of the most revolutionary pieces of technology around the world. At its peak, there was not that much interest in PayPal alternatives. It allowed you to quickly send and accept money from friends and family and it also ensured that the money was far safer than many of the other options available. This became huge once eBay emerged as both sellers and buyers were concerned about fraudulent activity.

In addition to safety, PayPal Alternatives has sound invoicing, eCommerce, payment processing, and reporting tools. It allowed you to accept payments for services and products without any problems. The PayPal interface is still pretty robust. However, one thing to consider is that the main reason PayPal is still so popular is that people are so used to it.

List Of Online Payment Applications

Recently, quite a few other PayPal alternatives have emerged with lower rates, better customer service, and even better interfaces. In the digital age, many of our financial transactions – whether shopping, paying bills, or monitoring our investments – take place online. It has made more old-fashioned methods, like writing a check or taking out cash from an ATM, seem obsolete and inconvenient.

The use of credit cards as well as online shopping portals has exploded and so have different kinds of online payment systems. You’re familiar with the most popular among them: PayPal cards and payment.

However, there are other e-commerce systems designed for “informal” transactions, the ones that aren’t meant for a business but rather to be taking place between friends or family members: these transactions are called peer-to-peer payment systems.

With peer-to-peer payment apps, it’s easy to pay a friend or your family. The payment can be for anything. Whether for your half of a shared dinner, your share of the rent or for that concert ticket your friend graciously offered to buy with his credit card. All this can be done using nothing but your smartphone.

There are a few online payment systems which even allow you to do both i.e. to make purchases and transfer money person to person.

Venmo:

Venmo is a subsidiary of PayPal Alternatives and is a new online payment system that is amazingly popular among the millennial generation. It’s basically a digital wallet that lets you send money to your contacts. It’s very personalized too.

It has an in-built feed designed for you where you can leave comments about a transaction. This is very much like a social media platform. Venmo makes it free to send money from your bank account, but if you pay by credit card there is a three percent charge.

Venmo is generally used to send money to someone you know personally. Instead of writing them a cheque, you can directly transfer the money via your smartphone. For example, if you are sharing a hotel room with your friend, you can connect with your friend on Venmo and transfer half the money directly to your friend’s bank account.

If both bank accounts are connected to the respective Venmo accounts, you just have to connect to your friend on Venmo and click to transfer money. It is almost effortless.

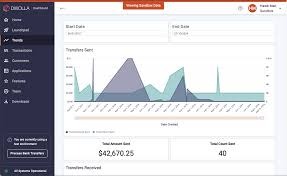

Dwolla:

Dwolla is very similar to Venmo in its essence as it allows you to send money directly to contact through the app. However, with Dwolla, any transfer that is over $10 comes with a $0.25 fee. The process of transferring money through the Dwolla app is very smooth and easy.

However, it has an astringent verification process at the time of sign up as you may even be required to send a photo verification and wait a couple of business days for approval. Dwolla is only available in the United States and this makes it very constrained as compared to the other options.

Dwolla’s though has its own advantage, of course. It never costs more than $0.25 per transaction to move money, regardless whatever be the amount. With Dwolla, you can also speed up the transfer process with next-day transfers.

Google Pay:

Google Pay allows you to send money directly from your bank account linked to your email address or contact number to any email address for free. However, ending money that you want to charge to your credit card carries a 2.9 per cent fee.

Google Pay provides an additional benefit of letting users make purchases online and in stores. Those stores, however, must accept Google Pay as a payment. Not all businesses do money transfer from Google Pay as of now. Hence, unlike some of the other online payment systems, Google Pay can be used to transfer money and to make purchases.

Skrill:

Skrill is another online payment system that is based in the UK. It allows you to transfer money to another person directly. It charges $0.1 when transferring money. Skrill, like Google Pay, can also be used for making purchases wherever it is accepted.

Skrill is another online payment system that is based in the UK. It allows you to transfer money to another person directly. It charges $0.1 when transferring money. Skrill, like Google Pay, can also be used for making purchases wherever it is accepted.

Moreover, you can also use Skrill for online gambling. This is something you can’t use PayPal for!

Payoneer:

Payoneer is an online payment system which is a peer-to-peer payment system that allows you to transfer money to anyone and anywhere in the world. It also allows you to make purchases. It also provides you with a pre-paid Mastercard which can be used anywhere Mastercard is accepted.

Payoneer is extremely popular for freelance purposes because Payoneer has a great relationship with many freelancing sites. However, it has its own downside too. It has a variety of different fee levels ($0, $2, or more) and depending on how you use the service, you have to choose one.

Payza:

Payza is a peer-to-peer payment app allowing users to transfer money to another person for free. However, there is a fee for exchanging currencies. Payza can also be linked to your credit card as well as your bank account very easily.

2Checkout:

2Checkout is a brilliant global checkout platform for businesses. Compatible in 15 language options, and 87 currencies, merchants can use 2Checkout to accommodate a host of customers.

The fees depend on the country you’re in. In the U.S. you’ll have to pay a rate of 2.9 percent plus $0.30 for every successful transaction.

Read More: Money Sending Apps Of 2020

Intuit:

This comes from the makers of TurboTax, Mint, and Quickbooks. Intuit offers small businesses the ability to accept payments via Quickbooks.

Through the online version, all bank transfers can be done absolutely free, but credit card payments accepted through Quickbooks come with a small fee of 2.9 percent plus $0.25 per transaction. The desktop version may get a little pricier.

ProPay:

ProPay provides payment processing tools for businesses of all kinds. Whether your business is small, on the road, or global, you can work with ProPay.

One can also pre-order a chip card reader to make accepting payments more secure. ProPay has three tiers of plans.

WePay:

WePay is very unique in a way that it focuses on software and platform companies. It provides payment, risk, and support products to all of these companies. They were bought by JPMorgan in 2017, and are now being offered to all JPMorgan companies.

A very good example of a WePay customer is the popular crowdfunding site, GoFundMe.

Read More:

How To Change Your Credit Card Due Date?

50 Small Businesses Ideas You Can Start On Your Own

I was just looking for Paypal alternative apps and i got the best online payment apps from this blog. Thanks for sharing this great stuff!

I use Google Pay and We-pay apps for money transaction and these both are best apps for money sending. Nice collection. I will share this blog with my friends. Keep posting.