With credit cards becoming such a fad, it does not come as a surprise that one of the largest retailers in the world offers one of their own. Retailers across the globe have tie-ups with different credit card companies.

This ensures that their customers can take advantage of the features they have to offer. However, the biggest drawback of most credit cards is that they come with really high-interest rates and also minimum payment options. These pretty much make up for all the discounts that are offered with the card.

Walmart Credit Card

If you are also in the process of opting for a Walmart Credit Card, then the following article covers how it fares in the market. There is a lot of competition for this retailer card, and after reading a detailed discussion on it, you can figure if this card is actually worth your money or not. Much like every other card out there, even the Walmart Credit Card comes with its balanced share of pros and cons. Let’s elaborate upon both in the following article:

Walmart Rewards Program

Before we delve into how the Walmart Credit Cards work, let’s take a look at the Walmart Rewards program as well. So, the reason why this is valid is that all Walmart credit cards become a part of Walmart’s 3-2-1 Save Rewards Program. It works on the basic principle of you receiving cash back through a statement credit for each purchase that you make. This is how this program works:

- 3% is eligible for purchases made at Walmart online portal

- 2% is qualified for Walmart Gas Stations and Murphy USA

- 1% is eligible for Walmart purchases or other eligible places with the MasterCard

All the purchases made at Walmart.com are eligible for a 3% cashback. This does not only include the in-store items but also grocery delivery purchases and the grocery pick-up options. When you pay for them online, you will get a 3% cashback while it is 1% when paid in-store.

The best part about the rewards earned with Walmart Credit Card and the Walmart MasterCard is that they will never expire. Additionally, there is no limitation to the rewards which you can make, as far as it is inside the valid credit limit.

Major Retailer: 2 Credit Cards

Walmart has two different branded cards, which pretty much have the same benefits, albeit with slight differences.

- The Walmart MasterCard is eligible for usage anywhere. This basically means that you will get a reward for any of the purchases made in places where MasterCard is eligible. The main details of this card include:

- Main cashback benefits- 3% cashback at Walmart.com, 2% Walmart Gas Stations, Murphy’s the USA and 1% in places where Mastercard is accepted

- The annual fee is 0 USD

- The annual percentage rate is between 18.90% to 24.90%.

- Late Fees and penalties can be anywhere up to 38 USD

- The Walmart Credit Card, on the other hand, can only be used in Walmart affiliated entities only. These include- Walmart.com, Walmart and Murphy Gas Stations and Sam’s Club stores. Some of the main features of this card include:

- Main cashback benefits- 3% cashback at Walmart.com, 2% Walmart Gas Stations, Murphy’s the USA and 1% in Walmart Supercenters, Neighborhood Markets, and Sam’s Club

- The annual fee is 0 USD

- The annual percentage rate is 24.90%.

- Late Fees and penalties can be anywhere up to 38 USD

So, if you see the main difference lies between the APR that is charges as well as the eligible places where you can use it.

Read More: Walmart Money Center

Features of Walmart MasterCard and Credit Card

The main features of both Walmart cards include the following:

- Both do not have any annual fee at all

- They are both eligible for free online FICO credit score checks

- You can opt for electronic statements and get these score checks

- Most other companies charge a fee of 20 USD for telling you your score

- They offer complete fraud protection

- Gives you access for about six to twelve months

It is highly advantageous for people who regularly shop at Walmart. You can earn cashback at every juncture, and each purchase for you would prove to be beneficial.

Drawbacks of Walmart MasterCard and Credit Card

Now, that we are well aware of the features, here are some drawbacks of the Walmart Master Card that you should know about:

- While the fees of this credit card might dissuade you from opting for it, here are some additional drawbacks that you should choose.

- Cardholders are eligible for receiving only 3% cash back for using their card at Walmart.com

- Additionally, for frequent online shoppers, the credit statement can keep on piling

- For people whose credit history is not strong enough, earning cashback outside Walmart is not even an option

- At a glance, both Walmart MasterCard and the Credit Card have very high annual percentage rates and late fees too. Both of these can pile up quickly and put you in quite a fix.

However, there are many ways to navigate these cons. Firstly, since they do not come with an annual fee, just having the card and using it in eligible places is going to ensure you a cashback for all purchases.

If you are financially disciplined, you can easily avoid the fees by paying off all the balance in full on a monthly basis. Additionally, if you wish to work on your credit, then you would probably get a lower credit limit which basically means that you would not need to spend too much on the card.

Pricing of the Walmart Credit Card: The Real Catch

Much like every other credit card, the very first point of comparison for this card is also the pricing. Here is an overview of the fees which as per us should be your primary decisive factor:

Walmart Mastercard

- The annual percentage rate of this card is between 18.90% to 24.90%.

- The cash advance APR is variable between 21.90% to 27.90%.

- The cash advance transaction fee is 3% of the cash advance amount or 5 USD.

- The late fee lies between 27 USD to 38 USD

- The foreign transaction fee for this card is about 3%.

Walmart Credit Card

- The annual percentage rate of this card is variable around 24.90%.

- The cash advance APR is not applicable for this card.

- The cash advance transaction fee is not applicable.

- The late fee lies between 27 USD to 38 USD

- The foreign transaction fee for this card is not applicable.

Additional Options for Walmart Cards

Do not be disheartened if your application for both- Walmart MasterCard and Walmart Credit Card are rejected. In case, you still want to take advantage of the rewards program, when you can opt for Walmart Money Card. This a prepaid card provided by Green Dot Bank which comes in both variants- Visa and MasterCard.

Like all the other cards, the Walmart MoneyCard is also eligible for enrollment in the rewards program- the 3-2-1 program. You can get really special discounts, sales notices and you would not even need a bank account for using this prepaid card.

With this card, your paycheck can be deposited directly too. However, the Walmart Money card comes with monthly fees so that is something you may want to account for before choosing this option.

Application Process For Walmart Credit Card

Walmart Credit Card comes with a very easy process. You can apply for it online, or even through the Kiosk in the Walmart stores. And You will always find representatives around, so you do not have to worry about undertaking this process. You can even call up MasterCard and go for this option.

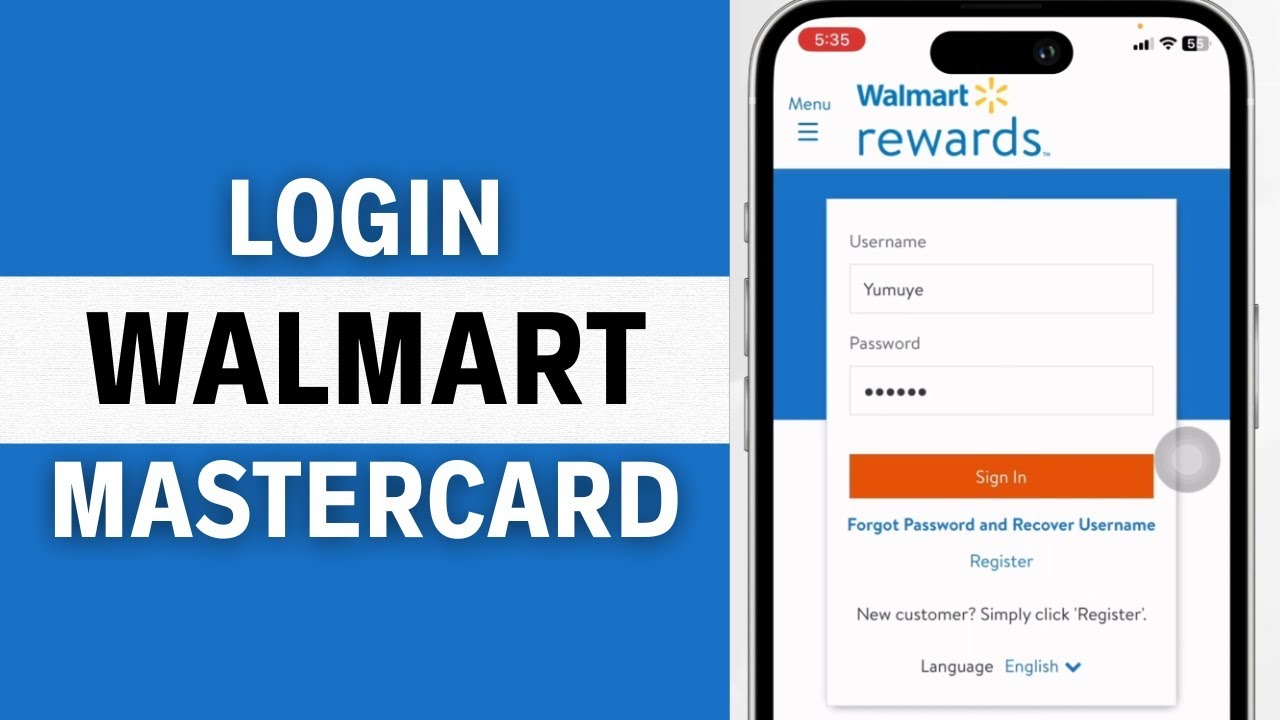

Log In and Manage Your Walmart Credit Card Account

After you get a credit card, the process is straightforward. You can simply log in and manage your account on the portal. Here are the options you would find in the online management platform:

- View your statement when you need

- Pay your bills on time

- Set up account alerts as you wish

- Opt for paperless statements as per your choice

Our Verdict

So, let’s come to the final point. Is the Walmart Card worth it or not? For people who frequently visit Walmart for grocery shopping, this is definitely a good option. Even for people who fill tanks at Murphy USA or Walmart, this option is good.

However, the basic point is that you should be financially disciplined. With any credit card, if you do not end up paying your entire balance on a monthly basis, then you would be slammed with high APR as well as really late fees. Otherwise, the penalties can become really tough for you to handle.

If neither of the three cards appeals to you, then we would recommend you consider all of your options carefully before choosing the best one for yourself.

Read More:

Check FICO For Free Score And Improve Your Credit Score

List Of Best Bad Credit Loans For 2020

Leave a Reply