Improve Your Credit Score: Credit scores can have a significant impact on a person’s financial life. The difference between approving a new loan or a new credit card or refusing to do so just depends upon a credit score. There are many free-floating credit scores, but most of them are not the true FICO scores that lenders relate to and use as part of their decision making.

However, FICO is working to improve this situation by giving banks and credit unions free and continuous access to the actual results they use for credit decisions while they have an account.

FICO works with more than 130 financial institutions to provide free access to the FICO scores of more than 250 million consumer accounts. If you are wondering, what is your FICO score?

Best Ways To Get Your FICO Score For Free:

Here we have mentioned eight different ways to get your FICO score for free.

- Discover Credit Scorecard

- American Express credit cards

- Citibank credit cards

- Bank of America

- Chase

- Walmart credit card accounts

- Credit unions

- Ally Bank

Discover The Credit Card:

The Discover Credit Scorecard is one of the best ways to get free access to your FICO credit. This program is free if you are a Discover client or not. In the beginning, some personal information is requested, including your social security number. Afterward, you will be asked questions to verify your identity.

You may be wondering how this affects your balance. Since there is no comprehensive advice, this does not affect your credit. And luckily, here’s the situation among the eight options in your list to access your FICO results for free.

With the Discover Credit Scorecard, your score will be updated every 30 days and you will never be penalized for scoring your score. While you’re working on the constitution of your balance, you can use the Discover credit card to track your FICO score.

In addition to monthly access to your free FICO balance, you’ll learn more about the factors that make up your points. Discover Credit Scorecard can help you focus on the things that serve your creditworthiness as well as the things that may keep you down.

American Express Credit Cards:

With American Express credit cards, cardholders have access to their free FICO score as well as the 12-month history of these scores. The specified FICO value is based on your Experian credit report. Your FICO score is available through your American Express online account and is updated regularly.

Citibank Credit Cards:

Citibank is another leading credit card company that provides you with your free FICO score. The results are totally based on your Equifax credit reports which get updated monthly.

Bank of America:

Bank of America offers authorized cardholders free access to their FICO score. The indicated score is based on your TransUnion credit report and is updated monthly. You also have access to some useful graphics.

The first follows his latest results over time, so he can see how he behaved month after month. This can be helpful if you have worked to increase your balance. The second graph shows the average values of national FICO values. That way you can compare your score with others.

Chase:

As a Chase Slate cardholder, you will receive your FICO score every month according to your Experian free credit report. Although, there are not any fees associated with this which is a great feature.

Walmart Credit Card Accounts:

Generally, retail credit cards do not give you access to your credit scores. The Walmart credit card and the Walmart Mastercard are exceptions. The Walmart Credit Card issued by Synchrony Bank and the Walmart Mastercard provide free access to your FICO score when you sign up to receive electronic bank statements.

Credit Co-operatives:

If you do not want to use credit cards, you can also get your FICO points for free through a credit union. Not everyone offers this benefit, but if it belongs to one, it’s worth considering. Some of the largest credit unions offering free FICO grades are the Pentagon Federal Credit Union and the DCU Credit Union.

Ally Bank:

If you’re considering buying a new car, Ally Bank will give you a free FICO score using Ally Auto’s online services or the Ally Auto Mobile Pay app.

You Can Also Opt For VantageScore Credit Scores:

VantageScore is the second most popular credit rating model in the US. The three major credit agencies pooled their resources in 2006 to create this new rating.

Although more and more lenders are using this new type of rating, it is still not as popular as the FICO. FICO scores are currently used by 90% of major lenders in credit decisions. VantageScores, however, is gaining in popularity.

Because free VantageScores are easier to obtain than free FICO results, you can use your VantageScores as a proxy to track your FICO results if you can not access free FICO results.

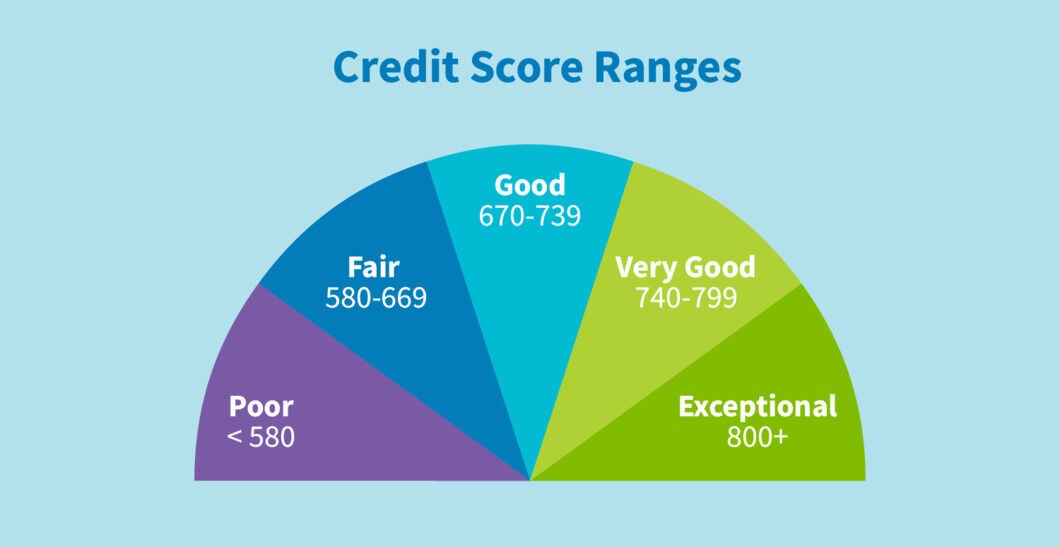

In most cases, you can assume that a good VantageScore equals a good FICO score. VantageScores are also similar to FICO scores. For example, if your VantageScores are active, it’s probably your FICO scores as well. and if your VantageScores are not available, it’s probably your FICO results as well.

Credit card issuers and companies that offer free VantageScore credit scores include

- American Express

- Bankrate

- Capital One

- Chase

- Credit.com

- Credit Karma

- Mint

- US Bank.

Why Credit Ratings Are Important?

As mentioned earlier, your credit rating affects many aspects of your life, such as: For example, on the interest rates of your mortgages and car loans and whether you are approved for an apartment or a job.

Since credit ratings affect all credit and credit decisions, you can not break your head and pretend it doesn’t matter. When you review your credit scores, you’ll see where you can improve. It can also help you detect errors or signs of identity theft.

However, do not forget to check the sources of your credits. There are several ways to get free credit reports, including AnnualCreditReport.com, the obligatory government page that you can access three times every 12 months.

Although these free reports do not include credit scores, they contain information about every account you have with lenders so you can check their accuracy. If you review your three reports and find that something is wrong, you can appeal to the credit bureau.

How To Fix Errors On Your Credit Report?

When you review your free credit score and are surprised by a lower than expected number, you should definitely review your credit reports.

Since most reviews are based on information from at least one of your credit reports, a low score may indicate problems in your report. Negative items such as late payments on loans or lost credit card statements can affect your credit rating.

That said, even those with a perfect credit history may be surprised by a low credit score if they do not regularly check their credit reports. Regardless of the level of organization of the credit bureau or creditor informing you, mistakes will occur. Anything, whether it’s a misspelled name or an overdue account, can cause problems with your credit report and therefore with your score.

One of the easiest ways to fix errors in your credit report is to use an accredited loan repair company. Not only can the experts of a credit repair company find and correct large errors, but they can also eliminate other problematic accounts that contain unverifiable or fraudulent information.

How You Can Improve Your Credit Score?

Developing your loan can make your life easier by qualifying for a loan or credit card. You can also get lower interest rates, better car insurance rates, and the ability to skip utility charges.

1. Request for Credit Information Errors:

An error in one of your credit reports could lower your score. Many errors in credit reports result from human error, either from a consumer or from a lender.

Examples: Your handwritten or telephone answer may be misunderstood, resulting in a misspelling of the name. A creditor can transfer numbers to a Social Security number or credit payments to a flawed account.

You can receive at least one free report every 12 months from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

Request these reports with AnnualCreditReport.com and look for errors, such as: For example, for late payments if you pay on time, or for negative information that is too old to be included in the list.

Challenge these mistakes to eliminate them. Most credit agencies have a duration of 30 days to take action and respond.

2. Pay Your Credit Cards Frequently:

Make small payments throughout the month, often referred to as micropayments, to keep your credit card balance down. You can even treat your credit card as a debit card and pay online as soon as a purchase is published.

Making multiple payments during the month is based on a credit factor known as credit usage that has a large impact on the score. If you can restrict your use, rather than allowing it to become a due date for payment, you should immediately benefit from your score.

3. Apply for a Higher Credit Limit:

If your credit limit increases and your account balance stays the same, your overall credit usage will drop immediately. Call your card issuer and ask if you can get a higher limit without a “hard” loan request. Difficult queries can temporarily reduce your score by a few points.

4. Become an Authorized User:

Ask a family member or friend with many years of credit card experience and a high credit limit to add them to your card as an authorized user. This can put a strain on your credit report, give you longer credit history, and simplify the use of credit.

The Account Holder is under no obligation to permit you to use the Card or even disclose the number in order to benefit from it. It works best for people who have little credit experience and the impact can be significant.

5. Leave Credit Cards Open:

If you are competing to improve your credit profile, avoid complicating the work by closing credit cards. If you close a credit card, you will lose the credit limit for this card when your overall credit usage is calculated. This can lead to a lower score. At least occasionally use the card so that the transmitter does not close it.

6. Combine Your Credit Cards and Loans:

If you only have credit cards or loans, consider getting the type of credit that you do not have. With both types of loans called installments where you make the same payments for a certain period of time and revolving credit. For example, a credit card where you can choose the amount to pay altogether.

7. Pay Every Bill On Time:

No strategy to increase your score works if you do not pay on time.

Because?

The payment history has the biggest impact on credit quality. Late payments can be stored in your credit reports for seven years. The influence diminishes over time and positive information can help counteract the damage even faster.

But accidents happen. If you lose payment for 30 days or more, call the creditor immediately. Make arrangements for payment and ask if the creditor will consider not reporting the payment default.

Even if the creditor does not do so, it’s worth updating the account as soon as possible. Each month, an account marked as overdue will hurt your score, and unpaid 60 days will hurt more than 30 days.

8. Delete All Collection Accounts:

Pay off your debts instead of transferring them several times to new accounts. Contact the collection agency listed in your credit report to find out if he is no longer willing to report any debt to any credit bureau (Equifax, Experian, and TransUnion) in return for the full payment.

This technically violates some of the agreements between collectors and credit bureaus. It might not be a good start, but it never hurts to give it a try.

Make sure that you receive this promise in writing before you make payment. In addition, you can argue with the three credit agencies if it is a debt that you do not recognize or that you do not consider accurate. You can lose weight and see that your credit score improves quickly.

9. Get a Credit Card:

If you have never had a credit card before, this may affect your score due to the above-mentioned account combination factor. Just make sure you pay on time: A new credit card account with a wrong payment history will hurt you and will not help you to improve your credit scores.

If your creditworthiness is correct, good or excellent, many credit card options are available. If you have bad or bad credit, read the following tips.

10. Open a Secured Credit Card:

A secured credit card is a type of credit card used to make a deposit into a checking account that “backs up” the credit line granted to you by the bank or the lender. For example, you can open an account and invest $ 200 to get a $ 200 credit limit, although some insured options provide a higher credit limit than your deposit.

You can get a secured card with bad credit, and adding a new account with a positive payment history will help show creditors that you’re back on solid foundations. If you do not pay for a secure credit card, the deposit you originally made is use to cover the balance of the card.

Bottom Line:

When comparing credit repair companies, make sure you investigate before you land. Review the company’s reputation with the Better Business Bureau and/or Consumer Affairs, and check out warning signs on their company’s website to get legit credit scores.

Let me know in the comments section below if you have any queries or suggestions regarding the same.

Read More:

How To Activate A Credit Card: Step By Step Instructions

Pros And Cons For Buying And Leasing A Car

It is truly a great and helpful piece of information. Thank you for sharing.

This website has very helpful information for Improve Your Credit Score. I will share your blog in my groups. Thanks and keep writing.