When a user begins to make an investment in the stock exchange market, the players on another side can have superior investing experience, skills, and results. These sites and software make the stock exchange market research mandatory to obtain knowledge while making decisions on investment aspects.

The major quality knowledge in this stock market is how to sell high and by low. The down listed investment apps and tools can pave the way to make the right investment decision and an informative one. There is a difference between gambling on the market and informative investment decisions.

Research software for finances is used professionally by individual or group investors that require up to date or real-time market information on the finances. Both types of investors use different categories of products and tools to understand the market deeper. Tock research this analysis helps them make an informative decision. These professionals usually conduct data-driven research to stay informed on various corporate pursuits, fuel up decisions, risk planning, and learn any upcoming trends which might change the investment portfolio.

With the help of artificial intelligence (AI)and its improvements, these research stages add up to their capability in conducting the elaborative and possible analysis of decision making. These financing research software are more advantageous than conventional methods because of outlook, stock ratings to choose stocks, and valid data. Hence, these are the perfect stock financing software tools and sites for best investments and results.

1. Motley Fool Rule Breakers

Rule breakers consist of honestly shaping the market from the previous 15 years by retaining true to the investors. There is a belief in success in the stock market by at least buying 15 stocks and holding them for five years in the coming time. It is important to know that stocks can fluctuate, though investment is the perfect method to maintain long term wealth.

Thus, the products of rule breaker target investors who focus on higher-growth stocks. Popularly the services hit the drum for the companies like Netflix, Tesla, Amazon and many more. The stock advisor reverts a mail each Thursday with their updates to the user.

Starting price:- It begins from $99 for commencing 1st year.

2. Motley fool Stock Advisor

It is better to invest with a motley fool stock advisor because it has crashed the market from the previous 18 years by being honest with the investing philosophy. Indeed, it is the best way to succeed in the stock market by purchasing a minimum of 15 stocks and holding them for five years. It is necessary to know the stocks’ fluctuation.

The main target of the stock advisor is to provide the best picture for the market crashing stocks from the co-founder’s desk. Also, the subscriber will get a key to the history of pieces of advice and can know how well they have done over the years.

Starting price:- The scheme begins from $99 yearly and gives a 30days refund period.

3. Seeking Alpha

It is the better option for investment research as well as stock-related decisions. It serves the necessities of newcomers and expert investors seeking a reasonably priced place for their investment requirements. Using alpha premium avails the subscriptions and assists the ratings of stock.

It shows the hoard of the stocks as per their best to worst ratings. The ratings are according to 3 distinct resources given by the website whose cross-checking and validity inherent from:-

– wall street analysis experts

– availing alpha quant model

– availing alpha contributors

However, it has more than 16 thousand live 16 thousand contributors who share a written stock performance.

Starting price:- $19.99 per month or $29.99 per year for premium.

4. Trade ideas

Trade ideas are the only stock market that gives the knowledge of how to learn investment and buy new stocks. However, it is the best for long term investors and day traders. It also provides artificial intelligence, which is known as holly. AI works as an online research analyst who takes rest but sifts from social media technicalities and helps pick solid trade advice.

The AI holly takes over more than 1 million traders throughout the day. It opens the market with more than 70 algorithms to get a higher probability of risks to invest in stocks. Thus the ideas don’t come to an end. However, it provides a trading room to pick ideas without investing money in the stocks. It also showcases the charts to know and learn the way of trading into risk smoothly. Precisely one can learn as well as invest at the same period.

Starting price:- Yearly $2268, monthly $228 for premium users.

Yearly $1068, $118 monthly for standard users

5. Million Acres Real estate winners

It is best for the real estate investors who want to purchase and hold back the stocks. It will take a little time to investigate whether there is a need for million acres real estate winners in the form of an investing guide or not. The main target of services is to get familiar with the speedy moves and mobilise success with the valuable resources.

It is a piece of cake to learn real estate values and investment alerts with the help of stock picking services. However, the million-acre real estate winners focus on convenient investment research and provide the subscriber’s point cases to consider their recommendation.

Starting price:- $149 per year.

6. Stock Rover

Stock rover is an expert in comparing, finding and evaluating the opportunities of investment. There are three plans which excel with additional features that will meet the necessities of subscribers. There is also a subscription to research report that assists the comprehensive research report of more than 8 thousand North American companies. Stock rover aids in holding the track of performance information portfolio, in-depth portfolio, rebalancing facilities, trade plans and analyzing tools.

Apart from this, the subscriber can generate hi-tech research data and a basic overview of the company’s functioning from the previous 10 years. Without a doubt, this application is perfect and complete with its features, but the most valuable part of the app is “brokerage connect”. Thus simply, it gives you the collection of investments holdings.

Precisely, it provides a scenario of portfolios, either in a single brokerage account or a separate investment account. Hence this view takes the stock rover first place in the ratings of portfolio management acts. After that, the sinking of funds with these applications will provide you with a venture of a famous stock rover panel for tracking and analyzing. The subscriber can access the stock rover as a trial for 14 days for free of cost.

Starting price:- 14 days- free trial, $7.99-$27.99/mo.

7. Trade Station Analytics

It is a strong trading stage that arrives along with the analysing tools for professionals and beginners. This platform contains the education of trading and brokerage assistance given by various industrial analysts. While commencing a trade station, subscribers can utilise the company’s strong analytics stage for free.

Thus it will help in analysing stock for casting and knowing the crypto markets. Along with this, there will be access to precedent trading data, charting abilities and backtesting. If the user takes interest in purchasing the software without using the stage of making trades, in the first place then, they can buy it.

Starting price:- $99 for beginners, $199 for experts.

8. AAII(American Association of Individual Investors)

It is a bank of monetary services with a number of articles owning finance behaviour to financing plans, monthly journals and collection of shadow stocks. The previous product has crashed the market by the margin of 4:1 since its establishment.

All the products came along with AAII’s preliminary plan, but if the user wants to choose advanced research, they can assist the AAII’s premium subscription. However, collaboration advantages inculcate AAII’s entire program, including the ingress to robust data suite for screening various talks and mutual funds for portfolio.

Starting price: 30 days demo for $1, premium subscription for $29 yearly.

9. Trading View

The trading view is a beneficial investing software for traders who are not independent and depends on hi-tech analysis.

This application avails the stock charts with the operational data and the particular indicators like fluctuating averages, RSI etc.

However, this research of investment shows better results for traders. So that they can look towards the game from the market by using more than 50 trading offers plus data feeds on the same platform. These services also provide custom hi-tech analysis along with backtesting, volume indicators, MACD etc…

Starting price:- 30 day trial for free, PRO $14.95 monthly or $155 yearly.

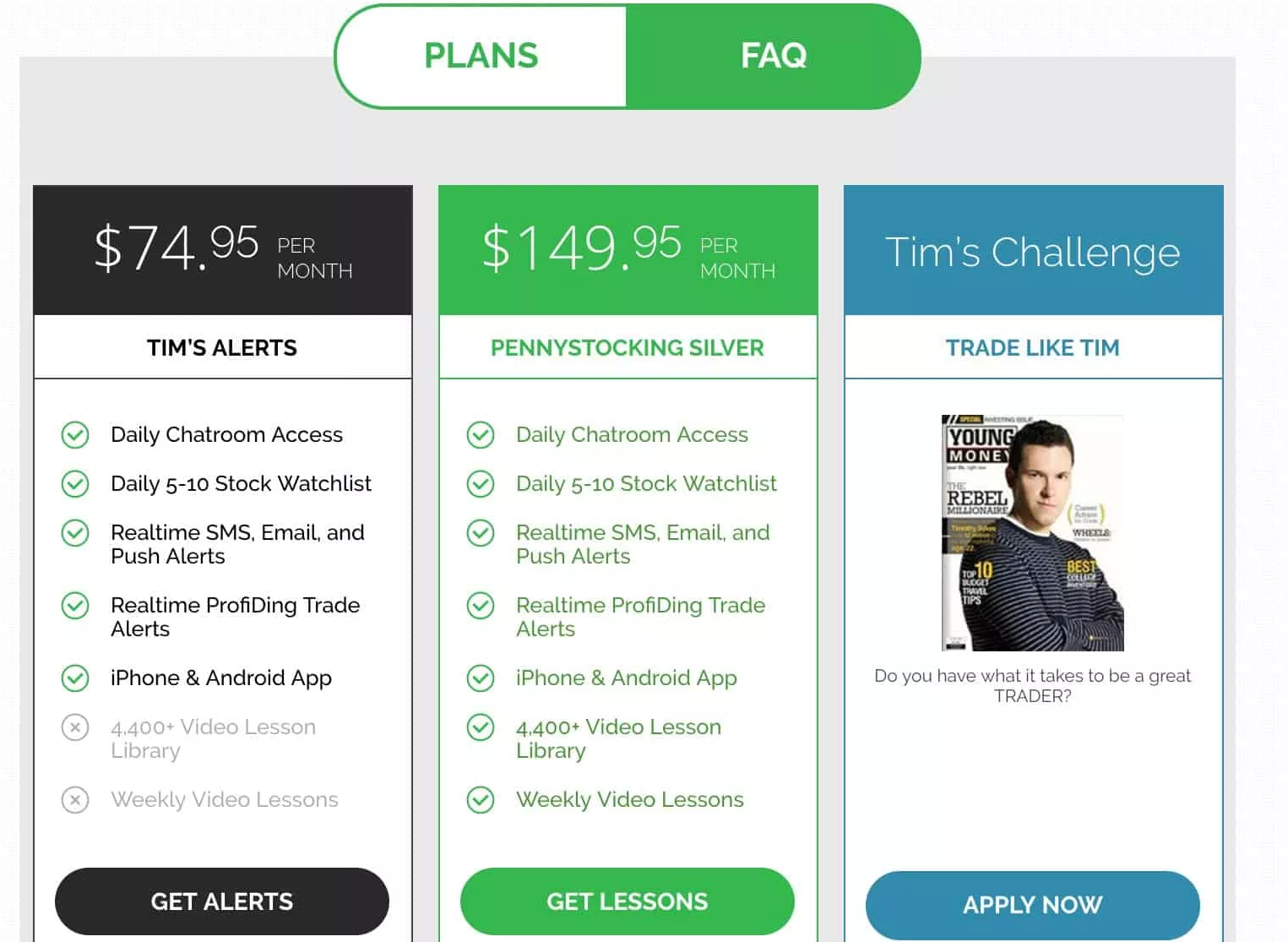

10. Tim Alerts

It is the foremost option for penny stocks day traders. Penny stocks account for buyers when the stock traders expect to make instant money on a particular period.

For example:-

Tim Sykes Rose has taken $ 12000 in the bar and made a day trading on the penny stocks.

When he graduated from college, he became the king of a million dollars by teaching others how they can repeat his success in their own way. He brings stock picking services in inclusion to knowledgeable content, monitoring services, and training the investors. However, services provide access to a library of 7000 videos to train the traders and effectively replicate the success of Tim.

Starting price:-

$697 yearly and for a premium $1297.

Read Also: Online Brokers For Stock Trading

11. Ask Finny

finny vails proprietary investment tools, X-ray analysis and perception to investment theses. It gives target points of the outlook for research by implementing a research analysis to mutual funds or stocks. While seeking the cases of purchasing a stock, the company provides the subscriber known as the finny score to maintain the steadiness of groundwork and arguments.

Also, the user can equate a sequence of investments to escort decision making. Further, users can utilize the company’s stock screener to expose the fair chance and come across the market’s active news. It also provides a newsletter “THE GIST”, with precious details and information regarding the construction of the market, economic activity etc. However, it is useful for financial lessons along with quizzes to construct a mountain of knowledge.

Starting price- a free trial for 7 days, after that $8.33/mo.

12. Sec Edgar

The services came up with free of cost features for the American taxpayer and civility of public companies. EDGAR gets the securities and exchange commission (SEC) assistance and brings Out portfolios built by public companies. However, The user can access tons of information hidden in yearly form 10- Ks, form 8 Ks, and many more.

Warren Buffett popularly covers yearly reposts and makes the special awareness to management’s discussion analysis (MDA) to know the management’s views on the companies part. uses

Starting price-free of cost

13. Zack Investment Research

It is an innovative platform built for active traders to avail themselves of expert support. Though, it offers the bundle of information of more than 6,000 companies trading in the public market. This information teaches valuable analysis for general opinion, earnings and many other factors.

The user can get the services of a trading broker at a nominal trading commission along with margin loan rates. Zack investment research provides the computational margin rates with the help of research and trading tools.

Starting price- $249 yearly for premium

14. Webull

There is no commission taken from the users—Webull uses this application; there is a target trader who uses hi-tech reviews. The free commission grants the specific account of technical resources to those seeking investments in stock cryptocurrencies, bonds, etc. However, it showcases the idea of the trading market on different bids and knowing monetary market fluctuation.

Either it may shift in favour of lower or higher prices in security. These services provide a smartphone application with a desktop for locating trades, whether it entails tracking, selling, buying, etc. After that, this application also offers free stocks while signing up for a nominal deposit. The subscriber can open a free stock account worth $3-$300, a minimum deposit of $5 to get another free stock at the value of $8-$200 and assemble crypto trade for $5.

Starting price – free stocks worth $5 deposit, $0 trades and minimum account.

15. Worden TC 2000

It is a piece of cake to prepare the investment research and analyse the software, which helps construct watchlist scanning, sorting, receiving stock alerts, following stock news, making personal notes, and many other stock privileges. The software avails more than 70 high tech indexes along with over 12 drawing tools for the investment.

The soul and heart of the software is condition Wizzard. However, it permits the construction of any state that might give an idea of indicator stepwise. Precisely, it doesn’t need any written formula. The user can create their flex circumstances over time. These services also provide scanning for millions of data points. Hence Worden TC 2000 is a platform for analysing and identifying chances to catch alpha.

Starting price – $8.32 /MO – $74.98/MO

16. Morning star

This morning tar software comes up with famous sources for traders and investors to evaluate and detect investment ts. The company has given stock research and financial research for almost four decades.

Thus it feels an honour on itself for the reputation and independence of their targets. These services encompass stock screeners detailed analysis, research on reports and determining investing choices. The morning star premium gives expert advice.

Starting price – 14 days free trial then, $199 for 1 year, $339 for two years and $439 for three years.

17. Yahoo! Finance

Yahoo! Finance gives rise to various news markets to retain investors up to date with the active evolution in the market. There is an opportunity for the investors to type in a ticker method to get the recent quotes accessible on needs, use pliable charting for viewing stacks, check the performance of stocks, and read out the current news and stories on particular stocks etc.

Further, it even allows the users to visit inboxes to conversate with many other investors. However, there are more than 17 million people who have faith in Yahoo! Finance. It also provides the feature of dark mode for night use. Hence it is a perfect tool to help in accessing the stock market.

18. CNBC

The monetary network of news helps in operating the broader part of NBC news of a multi-industry company. However, this service is available 24*7 on television and other active websites with opinion pieces, news, analysis, stories and other things.

Various famous financial statistics appear on the shows regularly or the company’s website. CNBC is the perfect platform for breaking stories and news and many other market developments to know more about this market.

19. Robinhood

Robinhood is the best investment application for keeping down the fees for investors who need to fulfil it independently and pay less possible fees. For those, Robinhood is the best application. There is no commission and no account minimum. It cut down the costs relating to the investment. Fortunately, the users need not make any sacrifice due to price.

Robinhood does Not provide any seclusion accounts or any stack of portfolios. All the investments put together with the help of the application get proper management and are taxable. Quietly it is essential for the application parallelly; it is also the perfect method to trade solely for free of costs.

20. E-trade

E-trade is the best application for investors for doing data dissectors. With the help of E-trade applications, investors can purchase a variety of assets. However, in the research library, all the E-trade stocks like ETFs, mutual funds have the best class. In other words, these are the backbone of the research library.

Here E-trade avails interesting charts and professional studies. Subscribers of the E-trade investment application can turn over into great earnings, company news, matrix, dividends and equity ratio. In trading this data, the E-trade app asks for a commission of $6.95 per trade.

With the help of its educational tools, the application provides the best smart picks for trading. The intermediate traders appreciate the reducing risk portfolio while experts like its white-collar investment system. Apart from this, E-trade is known for its innovative platform, easy tools, instinctive capability, and future forecasting of trade. The best part is it effortlessly understands the probable events and possibilities of business at a glimpse.

21. Betterment

The new investors like to help the companies at the social level. For this, the betterment app provides a best-of-breed SRI- a collection of investments. This application has a higher lid SRI possession score of 42% more than its public duty index compared to its portfolio. However, the alternative assets of betterment investment application are most of the broad trading ETFs.

Along with billions of assets under their management, this app not long ago broke apart from its serving with a $0 account minimum and management fee @0.25% at a premium. Further, with a $100000 minimum and a 0.40% fee, it gives unlimited handset sessions with monetary certification planners.

Conclusion

After studying the best software written above, they can provide us with the best results when employed efficiently. They also put you on a path that is sustainable to wealth development. When we start with the free versions of research services and demonstrate their products, users can use charting tools, reports, screeners to screen various investments and make a watch list to follow. These tools will greatly help to create and manage the portfolios of the individuals.

The investors who do not have reliable time to manage their portfolio on investment or can not pay enough attention to news across the globe can be geared up by these research software as it will efficiently decrease their time investment.

A full day service advisor daily can also stay informed about the deviating trends in the stock market. Knowledge is power even if you are not driving the car. So, it is always important to update the knowledge in the finance and economy so that one can contribute to the greater cause except for only individuals business or finances.

Leave a Reply