If you want to manage your investments, the best way to do that in this digital space is by using an online investment trader or stock trader. There are a handful of very good Online Brokers to choose from. It can be hard to figure out which one works best for you.

Your online broker should provide you with a reasonable minimum investment, high-quality trading tools, reliable customer service access with no hidden account fees.

Online Brokers For Stock Trading

1. TD Ameritrade

TD Ameritrade offers the one in the class package, which includes 0 dollar trade fees, fantastic trading platforms, market research platforms, mobile applications, training, and customer service. This excellent and comprehensive experience makes TD Ameritrade the best online stock broker of 2019.

Commissions And Fees

Effective from October 3, 2019, TD Ameritrade lowered the stock market price from $ 6.95 to $ 0 thanks to a price war, with options trading cost reduced to $ 0.65 per contract. Best of all, there are no additional fees for trading with penny stocks.

Platforms And Tools By TD Ameritrade

TD Ameritrade is the number one trading platform and tool number brought to you by thinkorswim’s office. Whether for a trading day, options or just a casual investor, thinkorswim is a winner.

Graphics:

In terms of graphics, thinkorswim has progressed so far that it’s just a rival to TradeStation. A few mouse clicks generate dozens of graphics that transfer data in real-time. Even the most demanding users will be satisfied with the more than 400 technical studies available for each chart, not to mention the fact that each study can be customized with thinkscript, thinkorswim’s patented programming language.

Business Tools For TD Ameritrade:

TD Ameritrade thinkers have an impressive array of tools. These include company profiles, advanced performance analysis, FRED data for charts, social charting, new analysis and replication of historical markets, and visualization of business and market plans. With a brokerage, traders can also create and run inventory analyzes in real-time, share charts and workspace designs, and analyze advanced options.

The rabbit terrier goes as far as a merchant can imagine. It’s a stunning range of options that will change your mind in a good way.

Profit Analysis:

The profit analysis tool from thinkorswim is our favorite tool for planning results publishing and later evaluating each company’s results. This tool tracks price changes and volatility before and after previous versions.

In addition, data from Wall Street analysts and estimates from public sources are extracted by Estimize to show the EPS estimates and actual results. The whole experience brings clarity with much less noise. It is impressive.

Comes Without a Web Platform:

TD Ameritrade previously offered with Trade Architect a browser-based trading platform that was ideal for casual investors due to its simplicity concerns. It was finally closed in 2018 because it was based on Flash technology and was not compatible with modern browsers. In September 2019, no new platform was launched that could take its place.

TD Ameritrade Research Tools

Like its main competitors, TD Ameritrade offers a great deal of research. Traders will feel right at home with the TD Ameritrade Network and its unique tool suite.

Television Network: TD Ameritrade’s TD Ameritrade network is broadcast live every day from 8:00 am to 5:00 pm CET, providing an excellent combination of market analysis and merchant training.TD Ameritrade network is in direct competition with traditional networks like CNBC, Fox Business and Bloomberg which comes with an excellent base and there’s an infinite stream of ads.

Market Commentary: TD Ameritrade also offers daily commentary and market analysis on the ticker tape. The content is widely used and covers daily markets as well as general finance, savings, retirement, and business education. In partnership with The Ticker Tape, the broker publishes thinkMoney, TD Ameritrade’s quarterly and digital and print magazine, which focuses exclusively on education. TD Ameritrade is great for stock and options trading. For content related to long-term investment and retirement, I prefer the views of Fidelity and Schwab Insights.

Social Commerce: The TD Ameritrade website contains a handful of unique tools. For example, social signal tools show both the real-time transmission of tweets of relevant brands that have been algorithmically filtered, which I find much better than displaying a list of current StockTwits tweets, as well as a summary table of mostly tweeted brands.

Mobile Commerce

TD Ameritrade offers the most technology-oriented mobile phone offering. With artificial intelligence at the core of its long-term strategy, TD Ameritrade is literally everywhere. In terms of applications, TD Ameritrade is my best option for dealers in 2019.

Comes With Two applications: For mobile devices, TD Ameritrade took a different approach, offering not just one, but two apps for smartphones: TD Ameritrade Mobile and TD Ameritrade Mobile Trader. TD Ameritrade Mobile is designed for casual investors, while TD Ameritrade Mobile Trader is designed for active traders with many functions.

Impact Assessment and Technological Innovation: TD Ameritrade was one of the first Online Brokers to offer an Alexa skill, and on August 2017, it was the first broker to integrate Facebook Messenger for the Future of Artificial Intelligence (IA) with its own chatbot in 2018 was Apple Business Chat, which I use more and more often to get quick quotes. In simple terms, if you appreciate technology and artificial intelligence, you will enjoy TD Ameritrade.

2. TradeStation : Online Trading And Brokerage Services

TradeStation is an active, operator focused broker, best known for its superb computerized trading platform, which has limited trading tools and market research results. For occasional investors, TradeStation also offers TSgo, a free trade plan (0 USD), which is the only warning that allows trading only with the web platform and the mobile application.

Commissions And Fees

TradeStation offers various commission structures that can be confusing. Fortunately, the broker’s most widely used pricing structure, flat rate trading, is easy to understand, contains free market data and leads to monthly platform fees.

Fixed-Rate: TradeStation’s most used pricing structure includes access to the three TradeStation platforms. For fixed-rate transactions, stock deals cost $ 5 and options $ 5 + $ 0.50 per contract.

TSgo Free Trade: In early October 2019, TradeStation launched TSgo, a free-to-trade program that allows unlimited trading in stocks and ETFs with options for just $ 0.50 per contract. The only limitation with using TSgo is that TradeStation Desktop is not available. Instead, all transactions must be executed with TradeStation Web Trading or the TradeStation Mobile application.

Platforms And Tools Offered By TradeStation

TradeStation offers two trading platforms: Web Trading, a browser-based platform for simplicity-seeking marketers, and TradeStation Desktop, the company’s flagship. Both are outstanding

TradeStation Web Trading: Easy to use, TradeStation Web Trading offers traders the ability to manage active positions, open orders, tracklists, analyze stock charts, and easily trade and measure scales through the matrix. The card trading feature is superior to many flagship platforms.

TradeStation Office: The tools provided on the TradeStation desktop are complete and truly professional. For example, more than 40 years of historical data are available to share actions related to graphics and studies. In addition, there are 274 indicators/studies available, each of which can be customized to the merchant’s specifications using TradeStation’s proprietary EasyLanguage encoding language.

Options Trading: In addition to the strong TradeStation desktop graphics, stockbrokers should not forget OptionStation Pro, a cross-platform tool to streamline transactions. Optional features include user-defined grouping for current positions, Greek real-time transmission, and advanced position analysis.

Other tools: Other tools in the TradeStation arsenal include the radar screen (329 customizable columns for real-time monitoring), the scanner (custom filtering), the matrix (scale trading), and the walk-forward optimizer (Advanced Strategy Test) amongst other things.

Some Disadvantages: With TradeStation Web Trading, watch lists are not synchronized with the TradeStation office, which is a bit of a hassle for operators using both platforms. I also found two graphics errors on the TradeStation desktop.

The first is that there is no way to draw the axis’s baseline markers and corporate events such as dividends, divisions, and profits. Second, there is a lack of automated technical analysis.

Research Option With TradeStation

Like its close competitors, TradeStation is not recommended for search. Professionals include stock and option selection as well as futures and currency data. Among the disadvantages, there it comes with no traditional fundamental research on equities, no research on mutual funds or fixed income securities, and almost nonexistent research experience with the ETF.

Mobile Commerce

TradeStation’s mobile commerce offering is clean, efficient and offers the features that active merchants need to succeed. The day-trading function is integrated thanks to matrix or ladder trading and support for complex trading options.

Note: Matrix requires Level II market data, which is available for an additional $ 11 per month.

Graphics: TradeStation mobile graphics are robust, clear and contain almost everything a demanding operator desires such as full flexibility in chart type and date range, out of hours visibility, visibility of active and completed jobs and 43 optional indicators. There are even drawing tools that let you draw everything from trendlines to Fibonacci retracements in graphics. However, in my recommendation, you can use a cell phone with a large screen or an iPad because my iPhone XS is too small.

Synchronization of watch lists: Although mobile watch lists are automatically synchronized with the web trading platform, they are not synchronized with the TradeStation desktop platform.

Investment Offers By TradeStation

TradeStation offers its customers an almost complete range of commercial products. Full access to stock and options trading, including full direct market routes, many types of orders and more. In addition, an account that is unusual in the online brokerage industry generates an annual interest rate of 0.55% by the client (depending on the size of the federal funds).

In the case of TradeStation, the only downside is that a minimum balance of $ 500,000 is required for the equity accounts and $ 250,000 for the term accounts.

3. Charles Schwab

Established in 1973, Charles Schwab is a full-service broker with over $ 3 billion in assets. Charles Schwab is a leading provider of $ 0 worth of penny stocks, offering investors excellent stock analysis, high-quality professional tools, and professional planning for the future.

Commissions And Fees

For stock or option trading Charles Schwab uses a flat rate for his closest competitors. Transactions in equities and ETFs cost $ 0, options cost only $ 0.65 per contract, and the broker offers mutual funds of $ 3,422 (no transaction fees). Charles Schwab is the only broker to use Fidelity to list the price improvement on eligible orders, which is important transparency in order to execution quality.

Other Trading Fees: All online transactions cost $ 0. As per our investigation, we did not find any additional fees or costs for stock deals of less than $ 1 (sub-penny transactions) completed in the hours before or after the deal. Market. If you use the Schwab automated phone system to complete a transaction, a $ 5 fee will be added to the order. For broker-based transactions, an additional fee of $ 25 will be charged.

Investment fund commissions: All trading fees for investment funds are $ 49.95 per transaction. Note that unlike most brokers, Charles Schwab and Fidelity only charge a fee for the initial purchase. There are no additional costs for the sale. For investors seeking Transaction Free Funds (NTF), Schwab offers customers access to their OneSource funds. OneSource funds are NTF (No Load) funds (NL), selected on the basis of several factors and with the highest performance in the past.

Platforms And Tools Offered By Charles Schwab

Charles Schwab currently offers clients access to three platforms: StreetSmart.com (on the internet, daily investors), StreetSmart Edge (on desktop, online assets) and StreetSmart Central (on the Internet).

Although each platform has its strengths and weaknesses, Schwab generally does a good job and will satisfy most customers. For example, the StreetSmart.com platform is too late for a review of the design and features.

Trading Platforms: Charles Schwab bases are included in the valuation of the trading platforms proposed by Charles Schwab, less paper-trading for beginners. Use paper trading virtual funds to trade stocks, stocks, and options. Despite these inconveniences, Schwab offers new investors an excellent education.

Stock charts: Charles Schwab does a good job on stock charts, although there is little room for improvement. While ordinary investors will find everything they need for basic technical analysis, experienced traders see the lack of technical indicators as a disadvantage, for example. If I like an aspect of Schwab graphics that I love, it’s an intuitive design that’s really easy to learn.

Daily Trading: StreetSmart Edge offers the most options that active traders and daily traders need to succeed. I think the platform is easier to learn than TD Ameritrade and TradeStation, although the latter two generally offer a broader experience.

On the other hand, the StreetSmart Edge platform is not the fastest and not ideal for traders who want to hold 10 stock charts on multiple monitors at the same time, for example. See also: Best Online Brokers for daily trading.

Options Trading: Finally, look at the option trading features offered by Charles Schwab and the many innovative features Schwab offers to traders until the optionsXpress broker is acquired in 2011. The patented order limit is ideal for option providers. Overall, Schwab offers option traders a great experience.

Mobile Trading

Charles Schwab provides a consistent and generally enjoyable mobile trading experience, regardless of the device. However, your mobile apps lack key features in two key areas: alerts and offers.

Business Support: Schwab’s mobile applications provide comprehensive support for trading in stocks, mutual funds, and complex options. In particular, for equities trading, clients can process essentially all types of orders, including over-the-counter transactions.

Conditional commands are missing in the list of functions. However, this is very little, as conditional orders are almost always used by active traders.

Market Research By Charles Schwab

Charles Schwab does a good job of thorough market research. Option providers, for example, will appreciate the Idea Hub tool, which is available exclusively to Schwab Mobile and makes it easier to identify and filter through the exchange of ideas options.

In addition to the experts in mobile applications, Schwab must above all improve the use of market data. Basic stock price alerts can not be set. Courses are real-time but must be updated manually. The watchlists are automatically updated every 10 seconds while the closest competitors are updated by Schwab to offer courses of transmission.

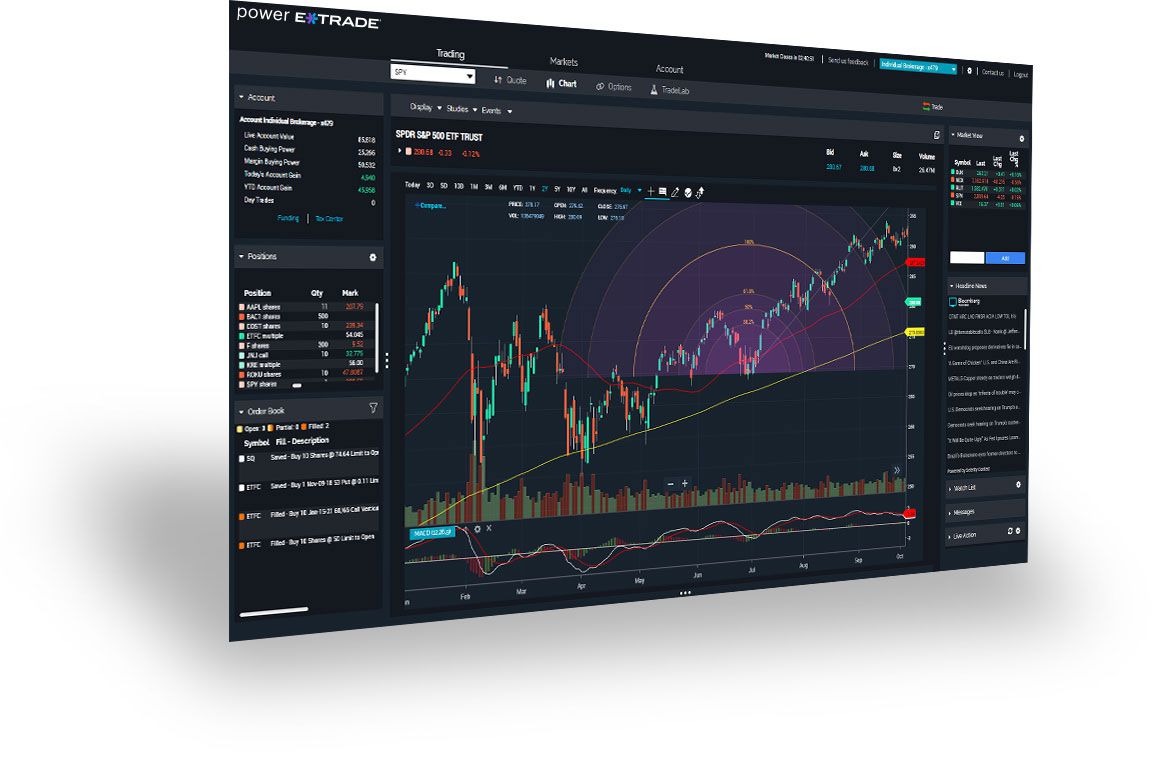

4. ETRADE

ETRADE is a full-service Online Brokers. Stock trading costs $ 0 and options trading $ 0.65 per contract (no base rate). ETRADE’s strengths include the Power ETRADE platform, which is ideal for options trading, as well as Corridor’s two great mobile applications.

Commissions And Fees

Due to a price war in early October 2019, the transactions in common stock are now $ 0 (formerly $ 6.95), and options cost $ 0 + $ 0.65 per contract (formerly $ 6.95). + 0.75 USD per contract. During trading hours before and after the market, however, a rate of 0.005 ECN per share is added to the usual commission rate.

Active traders who make at least 30 trades per quarter receive a reduced option fee of $ 0.50 per contract.

Platforms And Tools Offered By Charles Schwab

Designed as a web platform, Power ETRADE is innovative and delivers the speed, ease of use, and tools necessary for successful option providers. Apart from options traders, active traders, especially day traders may want more.

Graphics: The Power ETRADE graphics engine works with ChartIQ, an excellent external HTML 5 graphics provider. The downside is that the graphics do not support saving custom tutorials. You also can not save custom graph profiles if you think of preset time periods and beam types, among other things.

Options Trading: For new investors, there is no better platform than Power E * TRADE to learn options trading. For example, if you use the Snapshot Analyst tool, the risk/reward report is not only fully broken up into smiling faces to reflect the risks and benefits, but the key events to consider are listed below.

ETRADE Pro: ETRADE Pro, the former downloadable desktop operator platform for the Corridor, is slowly retiring in favor of Power ETRADE. Although still technically available, the platform is invisible to new customers.

In order to gain access, customers must write to support in writing and meet stringent requirements, including placement of at least 30 stock or option transactions per quarter or a portfolio balance of $ 250,000.

Mobile Commerce

ETRADE Mobile and Power ETRADE Mobile are easy to use and offer many features. You can use ETRADE Mobile for stock trading and Power ETRADE Mobile for options trading.

Mobile features: Both apps are compatible with iOS and Android, while ETRADE Mobile is also compatible with Apple Watch. In addition, ETRADE Mobile offers a range of features that few other brokers offer: Bloomberg TV live streaming, Level II courses, custom action analysis, third-party search ratings, and customizable dashboards. amongst other things.

Mobile Graphics: Graphics are an elegant experience in Power ETRADE, using ChartIQ, the same engine that leverages the web-based graphical experience of Power ETRADE. However, the diagrams are still below the industry standards for the availability of engineering studies. Only 11 ads are compatible with Power ETRADE Mobile (10 with ETRADE Mobile), well below the industry average of more than 30.

5. Fidelity

Fidelity is a value-based online broker with over $ 2 billion in client assets, offering $ 0 trading, cutting-edge research, powerful trading tools, a user-friendly mobile app, and easy-to-use online trading with full benefits and a pension plan for investors. Overall, Fidelity is a winner for investors.

Commissions And Fees

Considering the quality of the order execution, where Fidelity is the top priority, Fidelity’s $ 0 stock and ETF transactions consistently add value to clients and make them a winner for the trade. with a discount.

No PFOF: A rarity in the industry, Fidelity does not accept Order Flow Payments (PFOF), resulting in lower costs for clients trading inequities. In fact, Fidelity is the only broker with Charles Schwab to show its clients the price improvement on qualified orders.

Cash Management: Fidelity automatically transfers the available cash in your portfolio into high-yield assets. In other words, instead of earning free cash interest from TD01 Ameritrade and ETRADE or 12% cash from Charles Schwab, Fidelity earns 1.58% interest after 10 years. October 2019. Actual performance is governed by prevailing interest rates.

Platforms And Tools Offered By Fidelity

Every day, the Fidelity website offers everything an investor needs to manage a portfolio. For active operators, Active Trader Pro is Fidelity’s flagship desktop platform packed with tools.

Website Checklists: The Fidelity Website Checklists Tool is my favorite among all brokers I tested in our annual review. There are transfer quotes and a total of 48 columns of data. In addition, the workflow is continuous, which facilitates the transition to finding the variable sales or tickets of the attached order to perform an operation.

Charts: In Active Trader Pro, graphics are presented in a straightforward way and cover almost everything a trader wants such as 22 different drawing tools, 166 optional studies, overlays, custom profiles, off-chart trading, alerts, notes, and more. In addition, Plus Recognia is integrated to automate the identification of common technical standards.

Active Trading Features: Active Trader Pro includes several proprietary tools, including real-time analysis (commercial signal transmission) and Trade Armor (real-time position analysis). Trading options with Active Trader Pro are just as impressive as stock trading and include various analysis tools.

Mobile Commerce

The mobile experience of Fidelity is characterized by a clear, flawless design and a phenomenal experience for investors. While active traders want more, Fidelity offers the first bid in 2019 by winning our award.

Customizable Control Panel: When you log in, you will be greeted by a unique and customizable control panel that will be displayed as a custom feed. In their personalized river, market cards float on different scenario images, which alternate after each connection to create a unique experience. The cards cover everything from market news to portfolio information and watchlists. With the customizable panels, Fidelity is my favorite.

Other unique features: The search is strong and exactly what you expect after using the site. Other highlights of the mobile app are the note function, which is synchronized with the notebook tool on the main page, and Active Trader Pro. Using notes, you can record personal reflections of individual stocks and in larger markets. Then sync everything in one easy-to-access location.

Research Option By Fidelity

The shining star of fidelity is the research. The entire experience of the website is meticulously presented, the broker gives an excellent commentary on the domestic market and every tool is rich in information.

Research tools: Fidelity, ETF and mutual fund evaluators are easy to use, data-rich and the industry benchmark. Fidelity also provides 12 independent equity research reports and five for the ETF, the largest broker. Surprisingly, however, no third-party research report is proposed for investment funds.

Market Commentary: Fidelity’s market leadership extends to general market research with Fidelity Viewpoints. Only Schwab with its Insights articles can handle the market analysis of Fidelity. My favorite research is the annual sector outlook. Which highlights the main trends and provides a detailed analysis of each sector.

How You Can Choose Best Brokers For Stock Trading

It is very important for every investor to have the best Online Brokers to meet their individual needs. For example, cheap commerce is often operated at the expense of fewer search tools and a simplified trading platform. Consider these 12 key factors to compare all stockbrokers and ultimately find the best broker that suits your needs.

1. Commercial commissions

How much does the purchase of shares cost? Does the price change depending on the order type or order size?

If you have these questions in your mind, you just simply need to look for Online Brokers who offer flat rate exchanges, ie they charge a flat rate, regardless of the type, the price of the action, or the size of the order.

2. Customer service

If you call a broker or send an email, there must be a trained customer service representative ready to help you. The way an investor is treated as a client is more important to some than to others. But for those who do not trust customer service too often, having an award-winning service is reassuring.

3. Business Tools

Successful action is much easier if investors have excellent tools. Prime Online Brokers should have access to a variety of business tools to get the most out of every transaction. From real-time quotes to best-selling tickers, quality scanners, mobile commerce apps, and Level II quote, just to name a few. Powerful tools are essential for active investors.

4. Minimum Accounts

For some Online Brokers you can open a no deposit account, others may require several thousand dollars. Also note that some brokers have higher minimum requirements for accessing premium platforms, features, and customer support.

5. Market Study

Good online brokers offer a variety of market research tools. The general rule is simple: the more you pay per transaction, the better the market research both fundamental and technical.

6. Investment Options

An online broker not only needs access to commercial stocks. But also a wide range of free investment funds, free ETFs and complex options. Other unique investment opportunities include direct market access, contingent orders, futures, and forex trading.

5. Compare Prices

Non-commission prices include inactivity fees (common to active brokers such as Interactive Brokers, Lightspeed and TradeStation). And IRA fees for maintaining a retirement account. Although most Online Brokers do not charge a levy, it is important to exercise the necessary care. Like a bank account, investment dealers also receive part of their income from various expenses.

6. Investment Options

An online broker not only needs access to commercial stocks. But also a wide range of free investment funds, free ETFs, and complex options. Other unique investment opportunities include direct market access, contingent orders, futures, and forex trading.

5. Compare Prices

Non-commission prices include inactivity fees (common to active brokers such as Interactive Brokers, Lightspeed and TradeStation) and IRA fees for maintaining a retirement account. Although most brokers do not charge a levy, it is important to exercise the necessary care. Like a bank account, investment dealers also receive part of their income from various expenses.

8. Retirement Accounts

Funding an IRA, Roth IRA, or other retirement savings account without a renewal fee is another benefit offered by many online brokers. There is no reason for you to pay an annual pension plan fee. If managing your own portfolio does not matter, all full-service brokers also offer optional advisory services. In addition, Robo consultants are becoming increasingly popular. Again, the experience in the large established corridors will be greater than in the small corridors.

9. Banking

The largest online brokers offer banking and other financial services. This goes beyond money market accounts and CDs. You can also offer to check accounts, mortgages, debit cards, and credit cards. The leader in this field is undoubtedly Bank of America, Merrill Edge.

10. Account Security

Due to the current website, all online brokers invest heavily in account security. Most Online Brokers use SSL websites (look for “https” at the top of each URL). And some even offer two-factor authentication (use your phone to confirm a code before you log in). Just as with buying online and choosing a reliable website. It is a good idea to choose a well-known Online Brokers for your portfolio.

11. Speed And Execution Of Orders

For the active operator, execution speed and fill price are very important. I will not go too far here, but I have tried many of these corridors. And there can be significant differences in the timing and quality of the trade execution.

For most investors, saving a penny a share on the order of 100 shares is not the end of the world. But for active traders, this must be taken into account. Read this guide to understand the execution of jobs.

12. International Trade

For investors in the United States, this is not a problem. But for investors resident outside the United States. It is important to make sure that they offer services in their favor when comparing broker’s countries.

Conclusion:

In this article, we have not only covered best online brokers for Stock Trading also let you know how you can choose the best brokers. If you have any queries or suggestions let me know in the comments section below.

Read More:

H&R Block Vs. Turbo Tax Vs. Jackson Hewitt

Venmo Vs PayPal: What’s The Difference In 2020?

Very interesting information! Perfect just what I was looking for!

I’ve been reading a lot and watching plenty of YouTube video tutorials on this topic. But This blog includes the best content on Stock Trading. It will be very helpful to all your readers.