If you want to invest by starting your own business, you will always find it intimidating. The first and foremost reason is your inexperience about business and any investment regarding it. However, thanks to online business and the plethora of opportunities that investment accounts for young people is not a hassle anymore.

There are new brokers and Robo-advisors are making it quite simpler for young adults to investment with the smallest amount.

Whether you want to start it with $50 a month or manage a good amount of money, the right companies to help you are just a few clicks away. Here is a quick guide about your best picks of best investment accounts.

Top 7 Investment Accounts For Young Investors

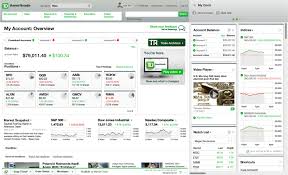

1. TD Ameritrade Accounts

This one is one of the best favorite brokers for young investors right now in the world of the internet. In TD, there is no minimum amount needed to open an account. This is indeed a big opportunity of investors who really struggle to manage their budgets. There are many amazing features of TD you need to know. Take a look at the standout features:

- Amazing Web Platform

- Think or Swim feature (This is a special tool to perform stock analysis and trading strategies)

- Mobile trading with the super-fast app

- Heat Maps

- Live-streaming media

This platform is the best for investors who always fear to invest money.

2. WealthFront Accounts

With Wealthfront, you only need $500 to open an account. However, after that your first $10,000 will be managed and protected for free. You will never have to pay any charge for maintaining your account. By combining to offer with brilliant features, WeathFront will leave you awestruck. Have a look

- Free financial management planning

- Initiating a 529 college savings plan

- Line of credit for free in every $10,000 investment

Get ready to open an account today.

3. Betterment Accounts

Betterment is a Robo-advisor. It is an algorithm used by various companies to manage a diversified portfolio for you. Betterment charges 0.25 perfect a month for maintaining your finances. This is unimaginably cheap. Betterment provides you with an opportunity of premium finance plans that include online consultations for free.

You can go for this and make the best plan if you are too scared to decide it on your own. You can also opt for advanced account monitoring. The premium account for maintaining a premium plan account is $100,000. However, it increases your total annual fees by 40%. That is not a small amount, isn’t it?

4. Acorns Accounts

This investing account can be managed from your phone. This is a Robo-advisor which is free for students up to 24 years. No student has to pay the account maintenance charge as well. You can connect it to any debit or credit card you wish and Acorns will automatically round up every update.

If you are above the age of 25, you will only have to pay $1 per month for account maintenance. So, do not delay as this is the best deal you can get today.

Read More: Roth IRA Investment Accounts Of 2020

5. Ally Invest Accounts

If you aim to trade with your investment, do not delay and open an account in Ally Invest. You can build your own portfolio here and go for proper planning for trading. Ally is worldwide praised for its flawless customer service and online trading tools.

There are millions of investors who hold accounts with Ally and are benefitted in various ways. Therefore, place your trust in Ally and you will never be disappointed.

6. Fidelity Accounts

It is one of the largest investment companies in the world. There are a plethora of beneficial features that you can enjoy if you open an account with Fidelity. You can also get thousands of direct mutual funds offers when you opt for fidelity. This is also one of the most reliable ones in the market now.

7. Vanguard Accounts

If you want to get the best hands of investors, try Vanguard blindly. It has good mutual funds deals which can be very beneficial for you. Open an account and start off with small investments. You can also activate the notification from the settings. Whenever you need updates about mutual funds, you can get direct notifications from the app.

Conclusion:

These 7 investment accounts can save you big and also provide you with the best lot of benefits. Do not forget to check every detail on their website whenever you plan to open an account. Stop worrying about the investment when you are just starting with it. These awesome platforms are built exceptionally for young investors with less experience. So, are you ready to go for one?

People also search for like: What kind of investment is best suited to younger investors? , What is the best investment for youth?, What should a 19 year old invest in?, How should an 18 year old invest?, Which investment gives highest ROI?, What stocks to buy at 18?

Read More:

1.PayPal Alternatives: 10 Best Online Payment Apps

2.10+ Best Budgeting Apps For 2020

3. Things You Should Know About Balance Transfer

Nowadays, everyone is finding the investment tricks and after reading this blog, I think this blog will be very helpful to all your readers. Really appreciate your thoughts on this blog! Keep writing.

Unquestionably consider that which you said. Your favourite justification appeared to be on the internet

the easiest factor to take note of. I say to you, I certainly get annoyed at the same time as people think about worries that they just do not know about.

You managed to hit the nail upon the top as smartly as defined out the entire thing without having side effect

, folks could take a signal. Will probably be again to get more.

Thanks

We’re a bunch of volunteers and opening a new scheme in our community.

Your site offered us with useful info to work

on. You have done an impressive process and our whole community might be thankful to you.