Technology seems to be a mandatory solution for our day-to-day activities. Budget spending is a complex process if not managed properly. Then why not tackle this complex process via modern technology budgeting apps?

Budgeting apps are a convenient way to keep a record of one’s expenses. They are extremely handy and efficient without needing to have a paper and pen or even maintaining an Excel spreadsheet.

What Are the Best Free Budgeting Apps?

A mobile phone budgeting app, developed by top finance app development companies can track one’s expenditure, maintaining a record of personal debts and payments, or for saving money for any big event! Just download budgeting apps or money management apps and allow it to handle the rest.

As mentioned before, with technology ever-evolving mobile budgeting apps have gained huge popularity for their efficiency in maintaining the personal budgets of users. Due to these apps, spending money and keeping a record has facilitated a lot. The saviors for one’s finances, budgeting apps, and finance tools have gained more popularity in 2018. With these apps, one can keep an eye on their financial situations in a better way.

Top Budget Apps and Personal Finance Tools:

The utility of mobile budgeting apps lies in catering to the complexities behind maintaining one’s financial life. With a unique feature of highlighting the extra expenses on credit card, lack of future savings, or unnecessary money spending, these apps are meant to lighten the financial load off one’s shoulder. A budgeting app is a one-stop solution for regulating the incoming and outgoing of your money.

If all these features of the budgeting app seem an interesting piece of knowledge and you wish to download one for yourself, then don’t worry we have done this work for you. We have compiled a list of the top 11 budgeting apps popular in the market for their distinctive features. All you need to do is scroll through this list of apps and pick the right one for yourself.

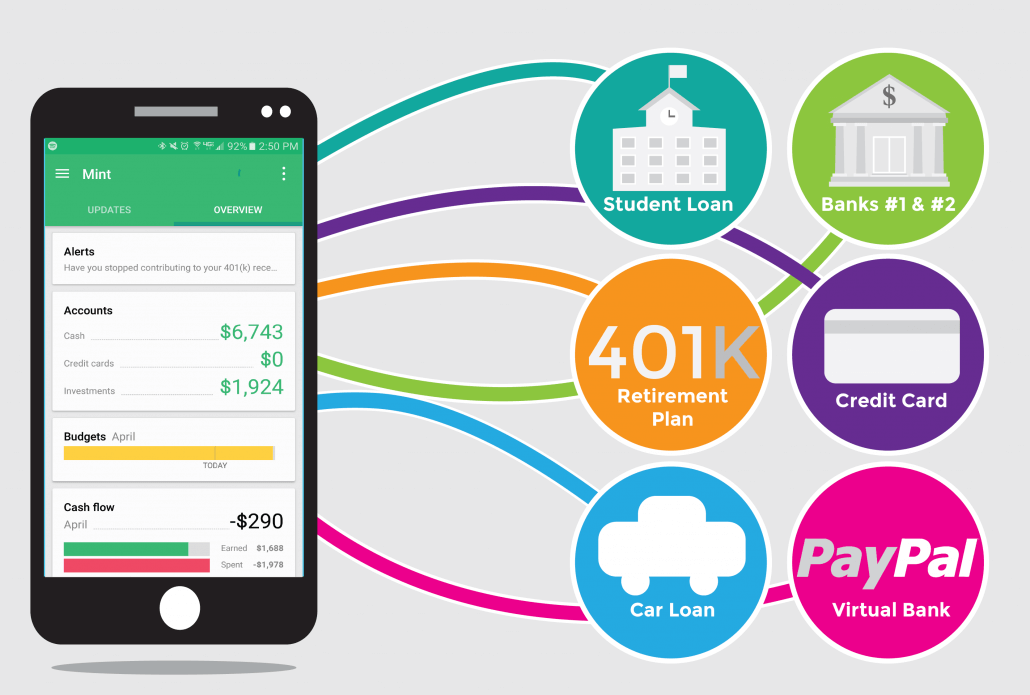

1) Mint App: Best App for Credit Monitoring – Free

Mint is one of the most popular and oldest applications in this segment. It comes with a set of features, which help you in keeping track & managing your online bank money transactions, credit card issuers, brokerage firms, lenders, and other financial institutions.

Owned by Intuit, this app automatically updates and categorizes all your transactions. Hence, it provides a real-time picture of all your expenditures and also sends you push notifications for all your due payments, along with warning messages on crossing your set budget limit.

It intelligently uses information from the listed accounts to suggest budgets for you based on your spending pattern, and further classifying them into categories such as entertainment, shopping, investment, etc. It also provides a free credit score to its users.

This is the best free budgeting app and its USP lies in its seriousness towards the user’s data and its “alert giving feature” on your money spending and it is the best budgeting app for couples.

This must-have financial application and is the best budget app on iPhone as well as on android and available on iTunes and google play services.

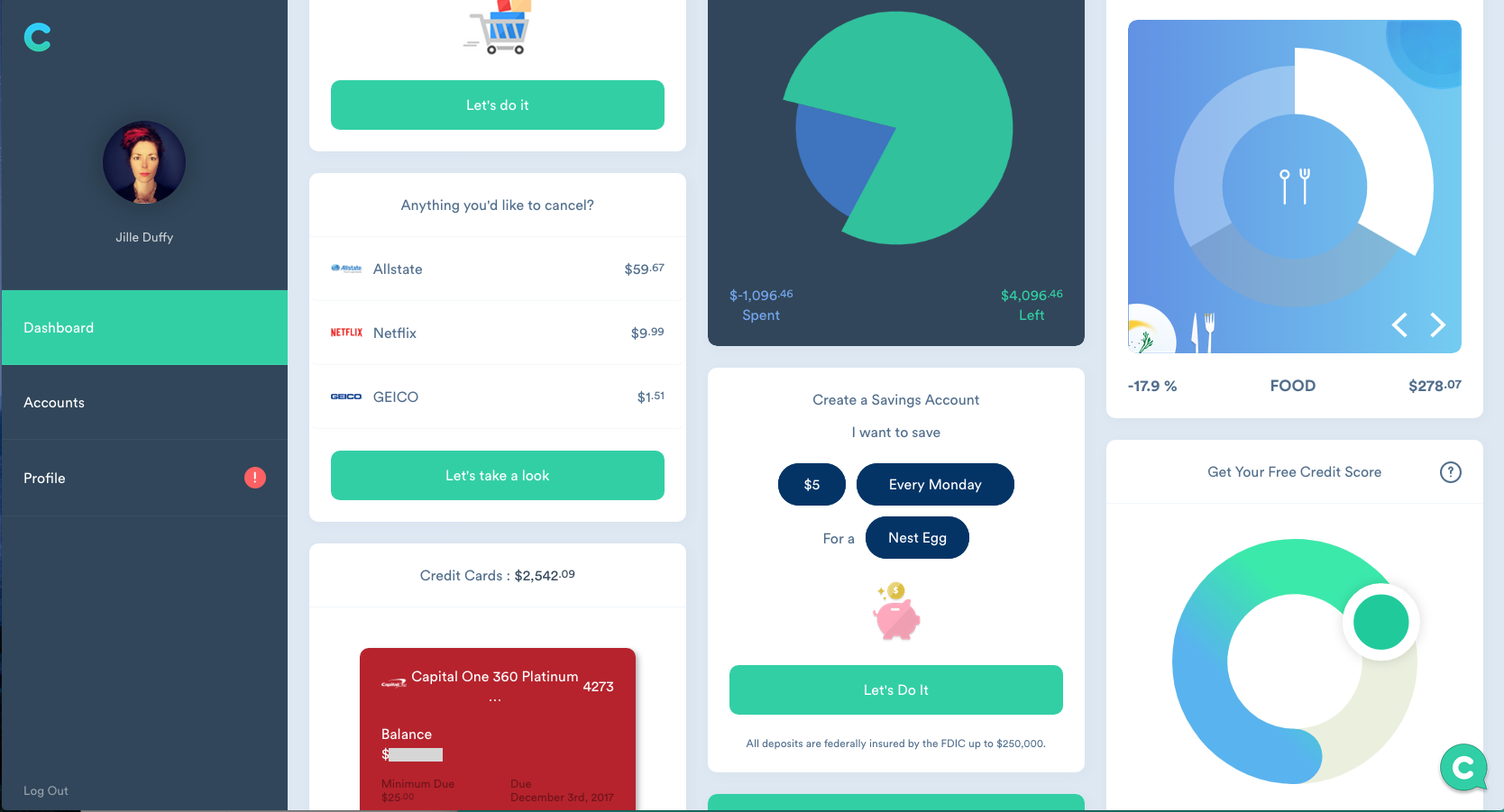

2) Clarity Money App – Free

As the name suggests, it provides you an acute clarity on your money. The Clarity money app is equipped with several features that give you a clearer financial picture of your money.

- It has a dashboard to remind you of your present financial status

- An account screen with a list of all your accounts linked to Clarity money app

- And a screen that tracks and monitors your overall money spending.

With the free of cost Clarity money app, everything is in front of the user. This also becomes its USP and the reason for its huge popularity giving it a tag of “the best app in the market!”

3) Good Budget App – Paid

If you’re a couple, not yet married, or living together, the Good Budget app is tailor-made for you! It’s the best option to manage your budgets.

Used to be called ‘Easy Envelope Budget Aid’ earlier, this allows a couple to work together on a household budget and simultaneously work on paying the household debts. Though the app focuses on merging two different personal financial accounts, it works pretty well for the singletons also. You can take this app as your personal ‘piggy bank’ for its ‘envelopes’ feature – putting money in and taking money out of the envelope when required!

The Good Budget has two versions. A basic one for free of cost and an advanced one for a monthly $5.

The USP of Good Budget lies in its ‘envelope model’. It works like a piggy bank in which you can put your money and later take the money out for doing your monthly transactions like eating with friends or for making any big purchase! This is the best budget app on android as well as on iPhone and available on iTunes and Google play services.

4) Wally App: Best App for Budgeting- Free

One of the easiest apps to navigate, Wally is meant for those who like their monetary transactions systematic and organized. Through the Wally app, one can track all their personal expenses and access reports of the same.

The app also lets you upload pics of receipts and thereby cutting short the time of filling up forms. One can also activate the geo-location on their phone, and it will automatically take up data to fill up the forms for them. Favorite among millennials, the best budget app on iPhone as well as on android and available on both the platforms, viz. iTunes & Google Playstore for free.

Wally supports almost all foreign currencies. Hence, is the favorite one amongst users outside the United States.

Read Also: Best Money Sending Apps

5) Acorns – Paid

Built on a single premise, Acorns is your investment buddy! It takes into account every single dollar of your money even the spare change to improve your financial situation. It invests every spare dollar of your money in a portfolio developed and operated by the investment experts. For example, you buy groceries online for an amount of $69.30, it puts your spare 70 cents on your work. Isn’t it great!

The cost funda of Acorns is $1 per month but as soon as your Acorns account hit $5000, the charge reduces to 0.25% of the app balance.

The USP of Acorns is its debit card which apart from preserving your spare change from your every online purchase, it also gives you accessibility to use your ATM across the U.S

This is the best budget app on iPhone as well as on android and available on iTunes and Google play services.

6) Pocket Guard App: The Safest Budgeting App – Paid

One of the best app to keep you from overspending! PocketGuard links all your financial accounts and tracks your expenditures vis-à-vis your monthly budget. One can also link their savings bank account to track their daily expenses in regard to their income.

It sends-off the notifications on the money left ‘In the Pocket’ for the respective day/week/month. One can deep dive by categorizing their expenses like groceries, clothing, bills, eating out, etc, for a better understanding of their expenses.

This easy-to-use and futuristic application and the best budget app on iPhone as well as on android and available on iTunes and Google play services.

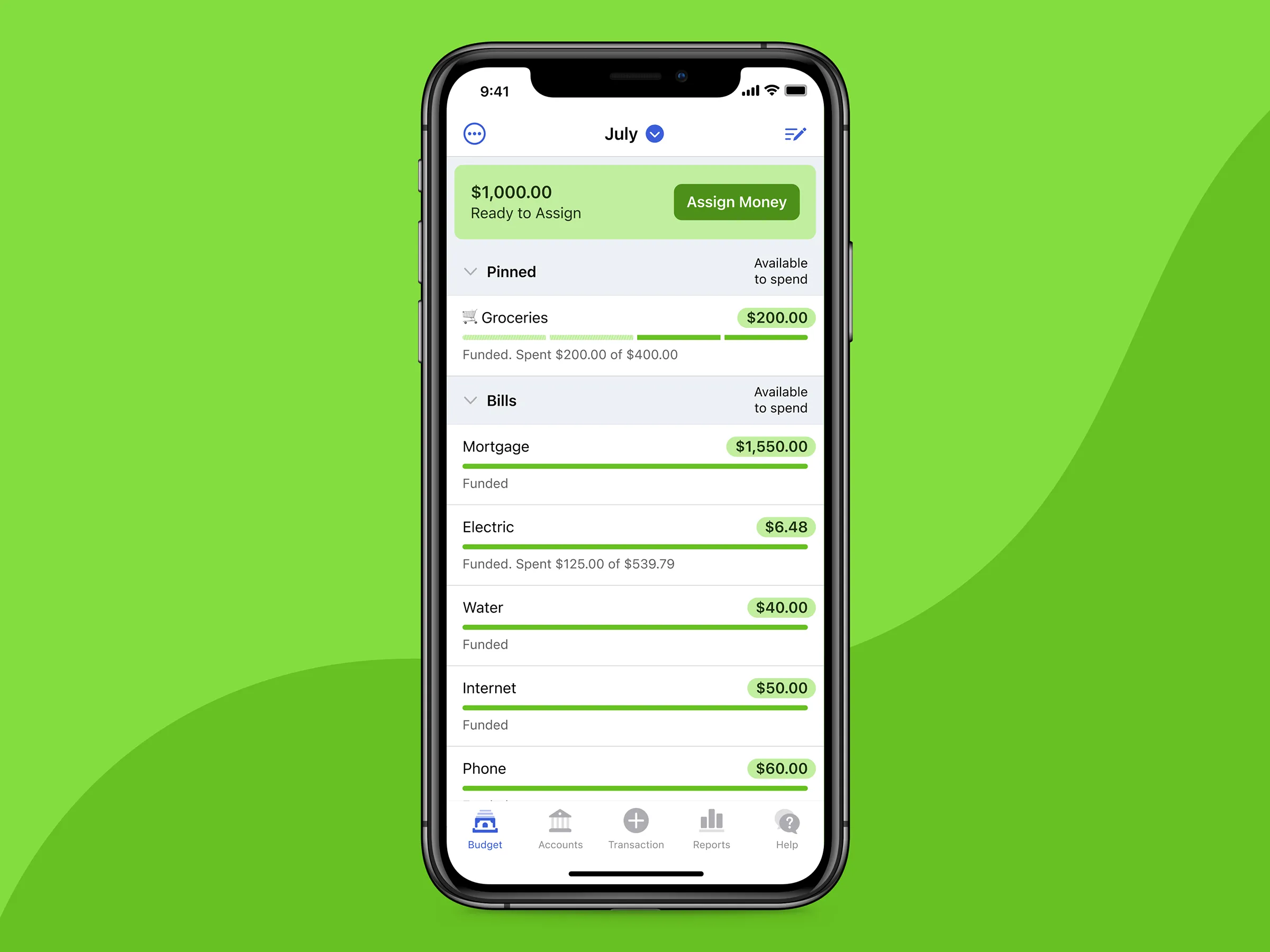

7) YNAB – Paid

‘You Need A Budget’ or ‘YNAB’, as it is popularly known as, is a robust app for some serious budgeting and financial planning. One can either manually enter their expenses on the app or just sync it with your bank accounts for automatic updates. One can also categorize the expenses on YNAB and allocate your funds, accordingly.

Apart from being available on both the platforms, viz. iTunes & Google Playstore, YNAB is also available on Amazon Alexa. One can also access it on a web browser. A 30-day free trial of the same is available on iTunes and a 34-day one on Google Playstore.

8) Count About – Paid

It seems mandatory for the phone users to link their bank account to the budget app and the Count About app does just the same.

It provides you a lot of deals with thousands of financial institutions and tempts you to sync your bank account with the app but all for good! lets you track your transactions, your spending, and also initiates personal budget building for you.

The Count About costs $10 for every year (not per month) while its advanced version is accessible in $40 annually.

The USP of Count is it’s being the only financial app that lets you sync and manages your financial needs. This is the best budget app on iPhone as well as on android and available on iTunes and Google play services.

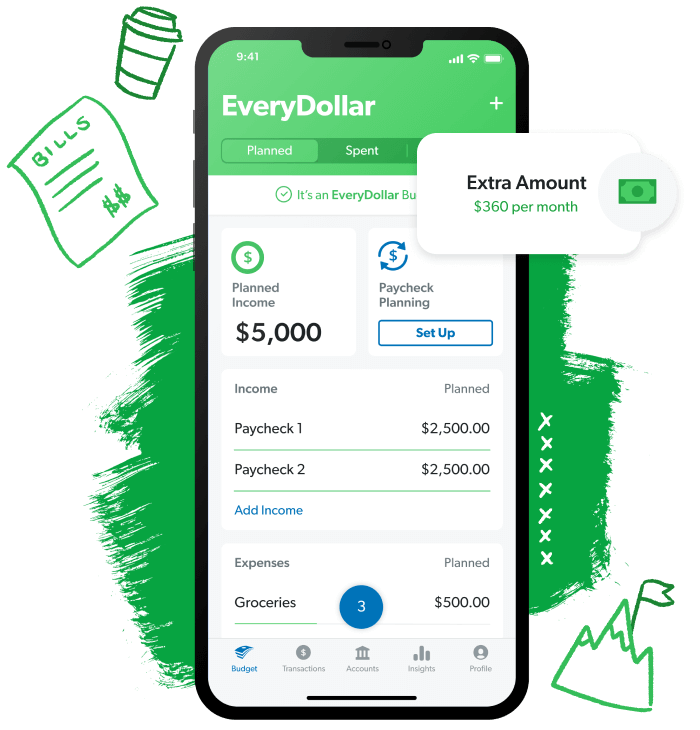

9) Every Dollar – Free

Developed by the financial guru Dave Ramsey, Every Dollar seems like a perfect blend of budgeting app and financial accounts to remind you of your financial status! It gives you access to multiple devices to create infinite budgets along with transaction alerts if the spending does not come into your budget. It provides you bank-level security and fast expense monitoring by connecting to your bank accounts.

Every Dollar is free of cost! Its USP lies in Ramsey’s concept of “Baby Steps to Wealth” for beginners in terms of budgeting. This is the best budget app on android as well as on iPhone and available on iTunes and Google play services.

10) Albert – Paid

One’s finances maintenance along with suggesting tips on how to optimize your financial profile is what Albert does for you! Albert keeps all the records of your bank accounts and gives an active insight into improving one’s financial records.

Albert app acts as a personal assistant for money management. It’s an all-purpose app with a multitude of features for budgeting, savings, and debt reduction. It’s backed with a specific algorithm, which decides how much you can safely save on a monthly basis.

And then, automatically transfers the respective amount into the ‘Albert Savings’ – a feature of the app. The funds accumulated in this Albert Savings can be withdrawn at any time without any fees. Moreover, the account is FDIC insured up to a balance of $250,000.

Though this app is available for free, a paid premium service named ‘Albert Genius’ is out for a subscription fee of $4 monthly. The paid app allows subscribers to seek guidance from the financial experts for their money-related concerns. ‘Albert Genius’ also rewards users for saving money. This is the best budget app on iPhone as well as on android and available on iTunes and Google play services.

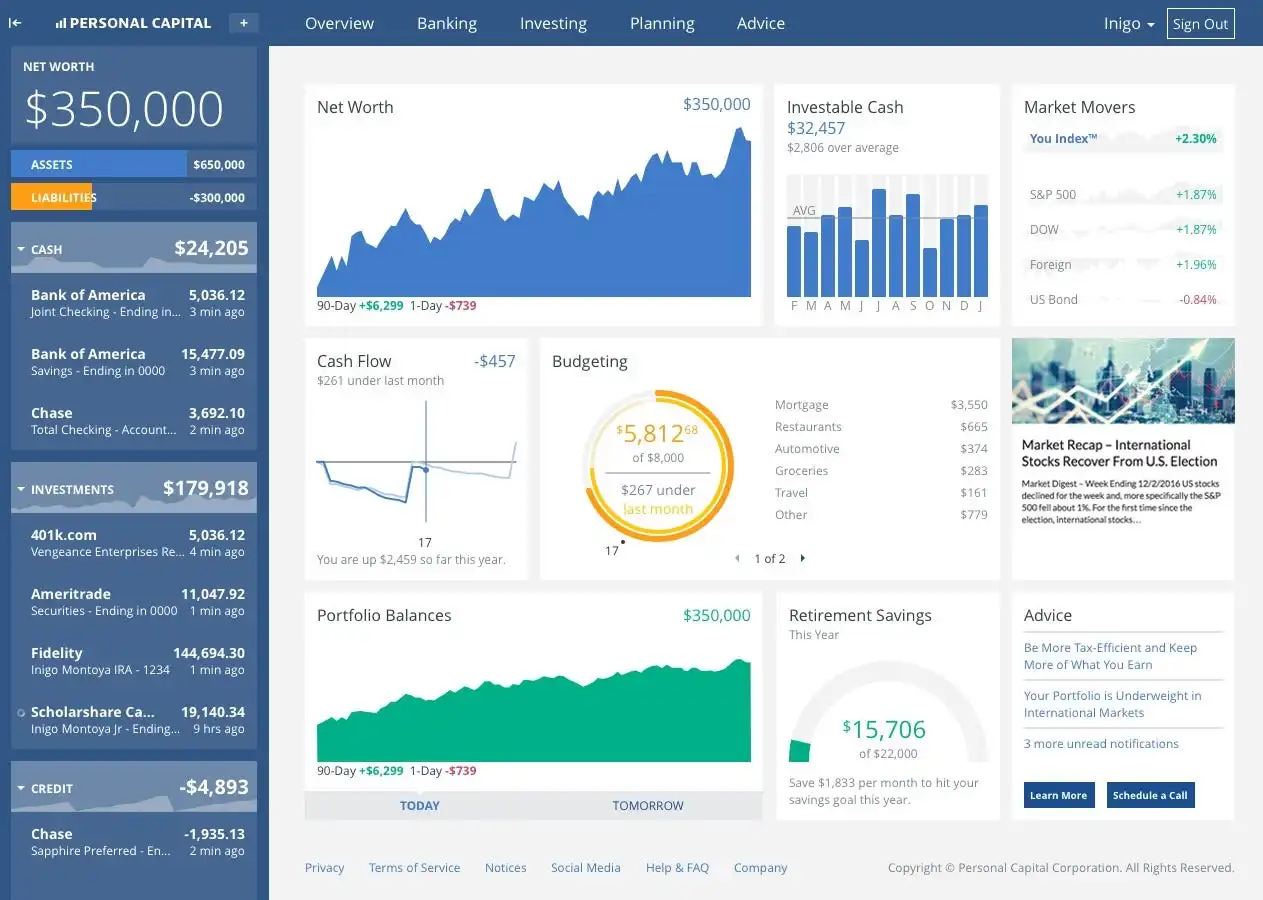

11) Personal Capital: Best Budget App for Investors – Free

Quite popular as an investor-friendly app, Personal Capital is a smart way of tracking and managing all your financial activities. It comes with an award-winning financial tool that gives a dynamic view of your net worth. The app also has a money tracking dashboard, along with some great & the best free budgeting app features.

The app is known for optimizing the users’ investment strategies. The investment checkup tool of this app analyses the asset allocation in a user’s investment account and recommends a target allocation, accordingly. It also offers a retirement planner.

Apart from being available on both the platforms, viz. iTunes & Google Playstore, Personal Captial can also be accessed through a web browser on your mobile/desktop.

Conclusion

Isn’t it great to just hand over the responsibility of your budget and money spending on technology? You just have to spend your money and let the budgeting app do its job! This list has all the popular budget apps and the finance tools that would take care of your money spending and savings to let you breeze through your money!!

People also search for like: What is the number 1 free budget app? ,Which is the best expense tracker app in India 2023?, Which is better Mint or rocket money?, Is Rocket money free?, Is Zeta app safe?, Are budgeting apps safe?

Read More:

1. Things You Should Know About Balance Transfer

2. Renting A Car? Know Your Coverage At Home And Abroad

3. Review Of Victoria’s Secret Angel Card

Hi –

I noticed you have a great article about saving apps. I appreciate your ideas.

Nice collection of Budgeting Apps! Thank you for publishing this awesome article. I like your ideas on this topic.

Very well written & done.

I began bloggibg very recently and observed that many blogs merely rework old ideas but add very littlke of value.

It’s great to see a beneficial write-up of some real

value tto mme and your readers.

It is actually going on the list of things I need too emulate

being a new blogger. Audience engagement and material value are king.

Some awesome ideas; you’ve unquestionably got on my list of sites to watch!

Continue the great work!

Congratulations,

Kelwin