Debit Card Spending Limit: Performing any transaction via a debit card has become widely popular these days because of the flexibility it provides to its bearer. However, it’s a must to have proper information on how to access a debit card and its fundamental rules and guidelines.

Having money in your account is not enough to buy your favorite things. It’s forever advisable to be aware of the spending limit of one’s debit card. It seems must, especially in those cases of newcomers who have very little or no knowledge of spending money via debit cards and the transactions performed by them.

How To Increase Debit Card Spending Limit?

Does a debit card come with a spending limit on it? Well, I would say yes. And is it something to be taken care of? Indeed, yes!!

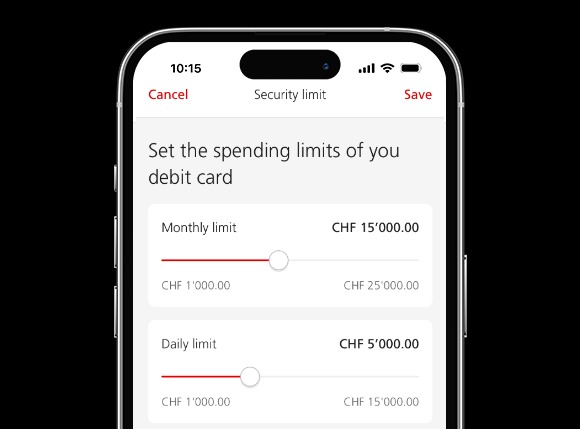

The spending limit on a debit card is finalized by an individual’s bank itself. It varies from bank to bank and falls somewhere within the range of $1000, $2000, or $3000. Exceeding this limit may put you in an embarrassing situation because even if you’re having enough money in your account, your card will be declined.

Related Post: Best Prepaid Debit Cards

Now, you might ask why is it necessary to worry about the spending limit on debit cards.

We don’t usually make huge transactions every day but more often than not we likely need to do a large purchase in a single day from our debit card. This can be booking a flight, giving down-payments, paying huge fees for your car servicing, booking a week-long vacation, etc.

Making payment in such cases may take you beyond the daily spending limit on your debit card. The reason behind putting a daily limit on debit cards us directly related to the bearer’s security. It prevents one’s bank account to become deprived of money in case of thefts or frauds!

How To Know About the Daily Debit Card Spending Limits?

After discussing the limits on a debit card, let’s talk about how can you know this daily spending limit. Usually, what happens is that a bank may print this information in the paperwork itself presented at the time when you receive your debit card while some of the banks like to publish this information on their websites.

If neither of these options is provided to you, you may inquire about this from your bank representative. Apart from asking about the daily spending limit on your debit card, it’s always safe to ask the daily withdrawal limit on your ATM card. Consider this information safe for future use.

Generally, the cash withdrawal limit is lower than the daily spending limits again for the bearer’s security reasons. Many banks set ATM withdrawal limits at $500 in a 24 hour period. Sometimes it’s $1,000. It happens in most of the cases that you may ask your bank for increasing the daily spending limits on your debit cards.

However, this raise is temporary and may last for not more than 24 hours. Moreover, the time duration it takes for an increase to occur is also variable. It may take up to 48 hours while sometimes it’s instantaneous.

So be careful to perform your huge transactions accordingly by taking into consideration both these time frames.

Conclusion:

In this article, all we’re saying is that there are daily spending limits on a debit card that needs to be taken care of. We suggest that only after getting clear all your debit card-related doubts by your bank. The representative should move further to perform any transactions from your debit card.

For it’s always better to be late than trapped!!

Read More:

Small Business Ideas for beginners

If you want to know that how much daily spending limit your debit card have then refer this blog and Know About The Daily Spending Limit of your Debit Card.

I like your article on this topic. This blog helped me to solve my confusion. Thanks for sharing!