Cheap Health Insurance: Health insurance can be a confusing topic sometimes. In health insurance plans, many health services are provided at a reduced price, making these components of the top-rated and economical health insurance companies similar to a service plan that you generally buy for a gadget or an appliance or a car.

Expenses of critical illnesses are handled very smartly by these insurers and can leave you with huge medical bills as coinsurance fees, deductibles, copays, and exclusions reduce coverage benefits. The risk of a critical illness or major injury is the reason why many people think of getting an affordable health care coverage solution.

Know About Cheapest Health Insurance:

Health insurance has become a must-to-have and it is important that we pick the one which suits our requirements the best. Along with this comes the cost of the insurance which plays a very big role in deciding the plan you go for. In the United States in 2017, the average of an individual health insurance premium comes to almost $393 per month.

With such a figure, many people wonder if there are any cheap long term care insurance. Right now, Medicaid is the cheapest plan you can opt for, it provides low-cost or free coverage to those who are eligible.

If you are looking for medical coverage and do not qualify for Medicaid, you can go for other options of cheap health insurance. It is highly recommended to read and understand carefully what you are signing up for. These plans use many complex rules, exclusions and jargons which can create misunderstanding.

Cheapest Health Insurance Providers:

1) UnitedHealth Group:

UnitedHealthcare is the largest health insurance company in the country which captures almost 13% of the health care market. It has almost 900,00 health care professionals in its network. this increases the chance that your preferred provider is already a member and can be used with HMO or EPO plans.

With time, UnitedHealthcare has earned many health care surveys’ awards like J.D. Power awards, including awards for health care experience in Arizona and for provider choice in Texas.

2) Kaiser Permanente:

Kaiser Permanente has a much smaller network than UnitedHealth Group but it has a network of hospitals and medical centers in many states.

All of its plans come with an HSA option, it means that its deductibles are generally higher and as a result, premiums are often lower. If you live in an area covered by Kaiser Permanente’s 22,000 participating physicians and are in good health.

You should think of getting a Kaiser Permanente plan which combines with an HSA. It could be an effective measure to keep your health insurance costs inexpensive.

3) Blue Cross Blue Shield:

Blue Cross Blue Shield (BCBS) provides health insurance in all states and is made up of many independent companies. BCBS provides better service quality, coverage across bigger geography and its plans differ depending on locations as the insurer operates through small regional companies.

Its coverage options have a wide range, it offers services to individuals, families and group health insurance for employers.

4) Cigna: Cheap Medical Insurance

Cigna offers its services in 12 states, if you reside in one of these states, you can go for ACA-compliant health insurance through Cigna as it ensures coverage for essential medical care. It also provides dental insurance plans as well as health insurance for travel.

It does not provide short-term insurance plans so you might have to find a plan elsewhere outside of enrolment periods.

Cigna has been in the health insurance industry for more than 200 years. It puts a focus on innovations like telehealth. It is an easy way to get medical care through a phone call or video chat.

Is It Possible that You Can Get Health Insurance for Free?

It is necessary to understand what you will pay for your health insurance premium. You might have to pay nothing if you are eligible for the Affordable Care Act’s premium tax credit health insurance subsidy. It is a tax credit that is taken beforehand to decrease the amount you pay for your monthly health insurance premium.

In order to receive this subsidy, you have to apply for it first. Then buy a plan through your state’s health insurance exchange, healthcare.gov. Which is also known as the Health Insurance Marketplace.

Depending on your estimates household income that you show in your Marketplace application, you receive an amount. Generally, to qualify, you should earn between 100 and 400 percent of the federal poverty level.

If your application goes through and you qualify for the subsidy, the Marketplace can send the tax credit directly to your insurance company. Which will apply to your monthly plan premium? There are some cases where might not have to pay from your bank account at all for your health care costs. Every state has different costs and rules for this.

Factors of Health Insurance Costs:

Lately, the costs for health insurance have risen at a greater speed than the rate of inflation, becoming almost 18% of GDP in 2017. Due to many changes in legislation, it becomes quite difficult to find the specific reason behind the increasing costs. It is quite a possibility that the higher costs of health care drive by many factors.

The predominant factors which affect health insurance costs on an individual level are:

- Location: The state in which you live or even your zip code can change health insurance costs for you.

- Age: As you get older, health insurance gets costlier.

- Smoking: The ACA allows insurers to impose smokers a higher fee for health insurance. Between a smoker and non-smoker, the difference in cost could be as high as 50%. This amount generally is different for different states and some states even forbid this practice.

Availability Of Health Insurers in all States:

As every state comes with its own rules and regulations for insurers, many insurers do not provide health care plans in all states. Coverage is available in all states but the kind of coverage that is available varies. Wherever you travel within the country, your health insurance generally covers you.

If you are planning to shift to a new state then you will have to look for a new plan. It is said, the travel coverage with the United States remains ineffective when you have a plan.

Many health insurers offer their plans through the Marketplace at healthcare.gov. Basis where you reside, you might find many other private health insurance options available in your state or you might find none.

What are out-of-pocket Limits?

When you are consider to buy cheap health insurance of any type, you should think about your estimated out-of-pocket limits. ACA Marketplace plans come with an out-of-pocket limit that limits your exposure. But the plans that have the lowest out-of-pocket limits usually have higher premiums.

Out-of-pocket costs consist of your deductible and your copays along with any coinsurance overheads. That might be applicable to your health care plan and are calculated on an annual basis.

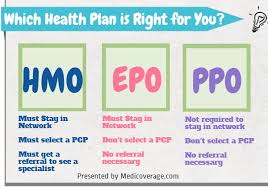

Understand and Select Between an EPO, HMO, and PPO:

If you have the choice and prefer to choose a particular doctor or hospital for your treatment. The type of health insurance plan you choose can make a difference.

- Preferred provider networks (PPOs): They give you the most liberty to choose health care from any provider and that includes providers outside their network, you might have to pay a little more to choose the health care provider of your own choice.

- Exclusive Provider Organizations (EPOs): Quite similar to an HMO, they generally do not need a referral to consult a specialist.

- Health maintenance organizations (HMOs): They use their own network of hospitals and doctors which lets the HMO to negotiate fixed prices for services. Generally, they do not cover (except for emergencies) out-of-network care. Their premium cost usually is lower for HMOs and referrals. It mostly require before the plan will pay for a specialist.

Conclusion:

Choosing health insurance depends on your priorities and concerns. Pay attention to deductibles, copays, coinsurance percentages, and out-of-pocket limits. When you find a good company, check their plans in your state. After that accordingly, select the one after doing proper research on them.

people also search for like: Which is the No 1 health insurance in India? , Which health insurance company has best claim settlement ratio 2023?, Why is ACKO health insurance so cheap?, What are the top 3 health insurances?. Who are the top 5 health insurance companies?

Read More:

As per my suggestion, Kaiser Permanente is the best Cheap Health Insurance Company.

Hello everyone, it’s my first visit at this website, and piece of writing is genuinely fruitful

designed for me (Best Cheap Health Insurance of 2021), keep up posting such articles or reviews.

I believe this website has got some real great info for everyone. This blog includes the best Cheap Health Insurance companies and it will be very helpful to your readers. Keep sharing!

I have found very interesting your article. It’s pretty worth enough for me. Excellent Piece of Information, Thanks a lot for sharing.

Nice post. I was checking continuously this blog and I’m impressed!

Very useful information specially the last part 🙂 I care for such info a lot.

I wwas looking for this particular information for a long time.

Thabk you and best of luck.

Hello there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really appreciate

your content.Please let mme know. Thanks!