Did you know that every year more than 500,000 Americans file for bankruptcy? While this is unfortunate, it is useful to know that you are not alone in the face of bankruptcy. Even after bankruptcy, you have to deal with the consequences on a regular basis to repair your credit.

Types of Bankruptcy And Credit Report

1. Chapter 7 bankruptcy

2. Chapter 13 bankruptcy

With so many insolvency administrators & a lot of financial data being transmitted by credit bureaus, the possibility of errors is high. It is imperative that you verify all the information in your credit report, especially the details of your bankruptcy.

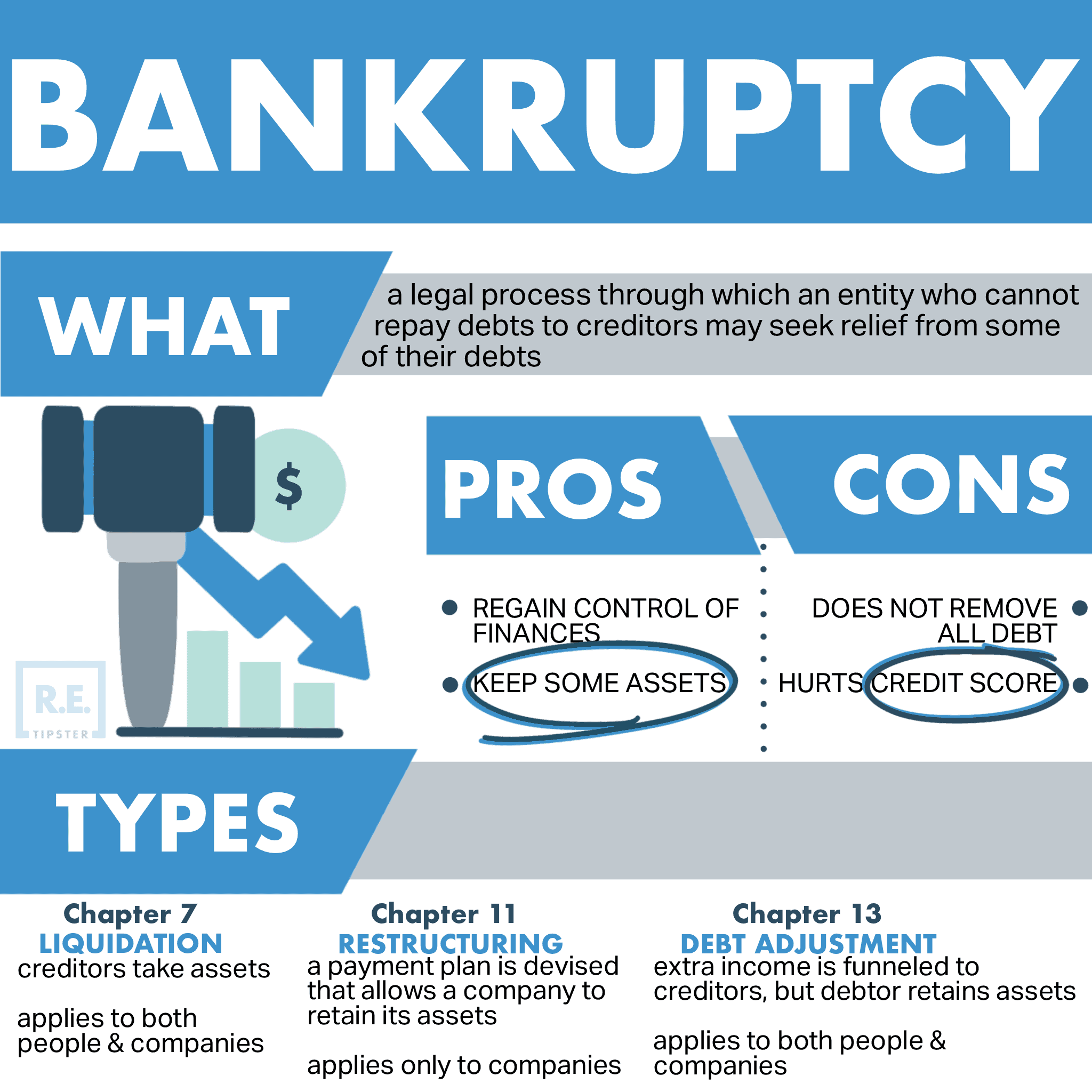

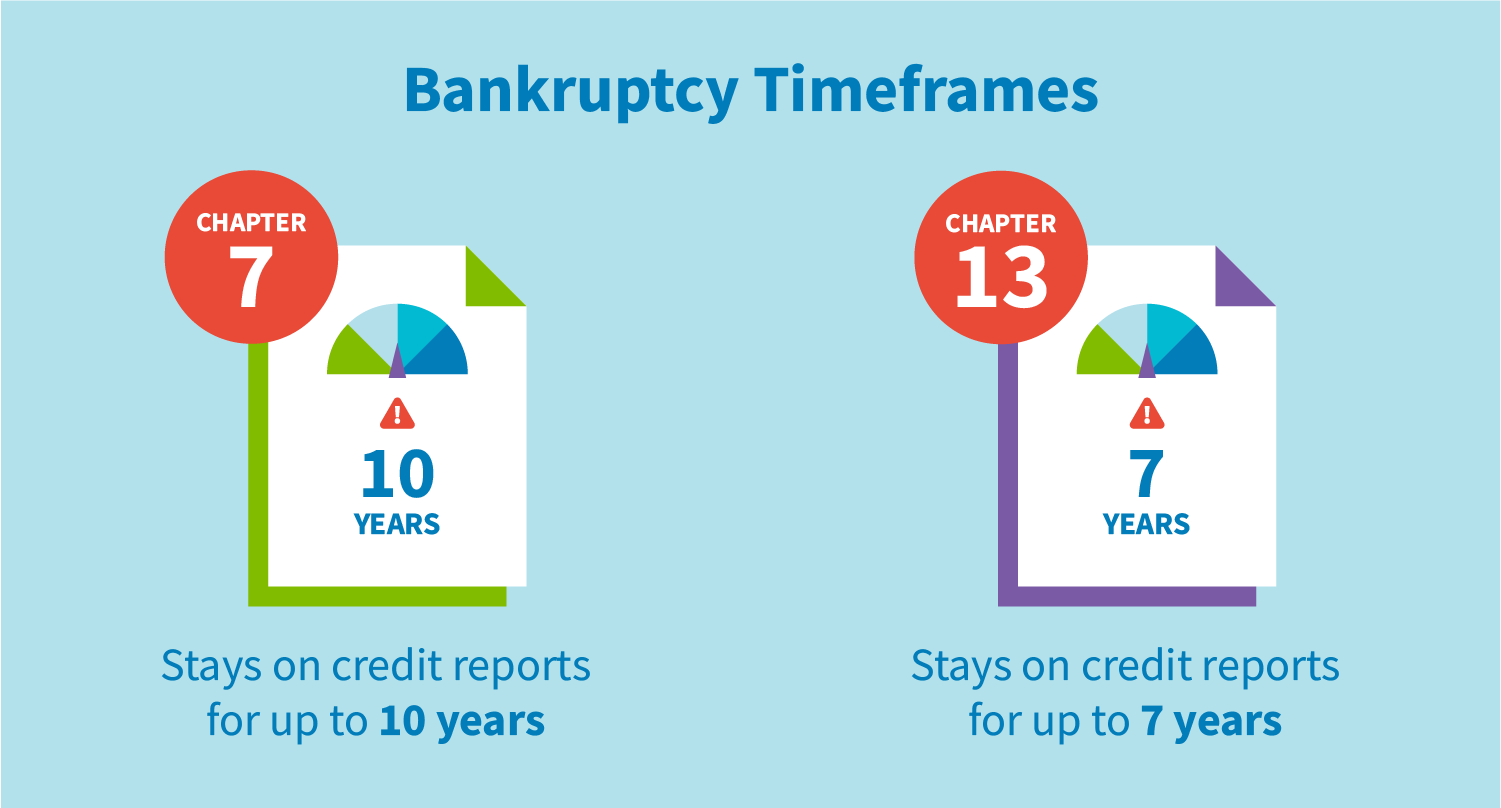

Bankruptcy is a legal process that lasts up to 10 years in your credit report and is also reported after your debt expires and the bankruptcy is closed. However, the exact length of your messages will depend in part on the type of bankruptcy you have reported. Among the different types of bankruptcies are two of the most common bankruptcy- chapters 7 and 13.

Although the bankruptcy of Chapter 7 is recorded in your credit report (at the filing date) for 10 years, Chapter 13 remains valid for 7 years. Although a bankruptcy remains on your credit report for a decade, its impact on your credit may decline over time before you leave your reports. And there are things you can do to mitigate the effects.

Below is some information on the different types of bankruptcies and how they affect your balance, as well as tips to help you manage the process.

Individual consumers can submit two major types of bankruptcy. This is what you need to know about the impact anyone can have on your balance.

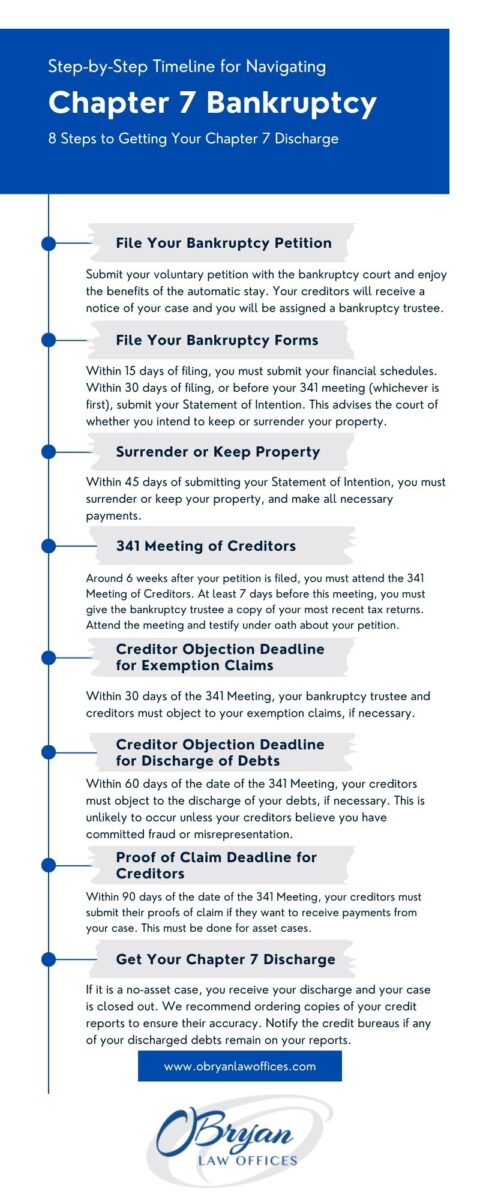

Chapter 7 Bankruptcy

If you file for bankruptcy under Chapter 7, you will probably have to wait a full 10 years for the deregistered mark to leave your credit report.

The debt involved in your bankruptcy may also affect your credit reports. It is likely that the canceled debts are listed as “bankrupt” or “paid” with a balance of $ 0. For Chapter 7 bankruptcy, these accounts must be removed from your reports seven years after the date of your deposit. unless the accounts were in default before the bankruptcy filing date.

When Should We File For Chapter 7 Bankruptcy?

If you’ve tried to negotiate with your creditors, work with a credit counselor, or consolidate your debts, but still have trouble managing your debts, the bankruptcy of Chapter 7 may be your last resort.

Chapter 7 Bankruptcy can help by acting as a “break” button on some of your debts. Once you have submitted your application, some of your creditors may be temporarily excluded from most of your recovery measures against you or your property.

However, the introduction of Chapter 7 may ultimately result in the loss of some assets. The law varies from state to state and each state may classify the property as liberated (can not be taken) or liberated. Depending on your place of residence, your home, your shares, your other investments, and your other non-exempt assets, these may then be at stake. You can exempt some of these assets like 401 (k) s and pensions.

How Can The Bankruptcy Of Chapter 7 Affect Your Credit?

One of the main consequences of bankruptcy is the risk that your loan will be borne. Bankruptcy is a major concern that can affect your credit rating far more than any other financial events.

How Many Credit Points You Lose After Bankruptcy?

It totally depends on your current results and other factors related to your financial situation. Although the impact on your balance may decrease over time, your results are likely to be most successful in advance.

Chapter 7 Bankruptcy will remain on your credit report for up to 10 years. Insolvency does not necessarily prevent you from qualifying for a new loan or even being approved for a mortgage. However, this can lead to higher interest rates and fees.

Remember that your credit can be improved with the required time and effort, regardless of the impact. By introducing sound financial habits, such as For example, to pay your bills on time, keep your credit card balance low, and not apply for multiple loans or new loans in a short time, you can restore your balance.

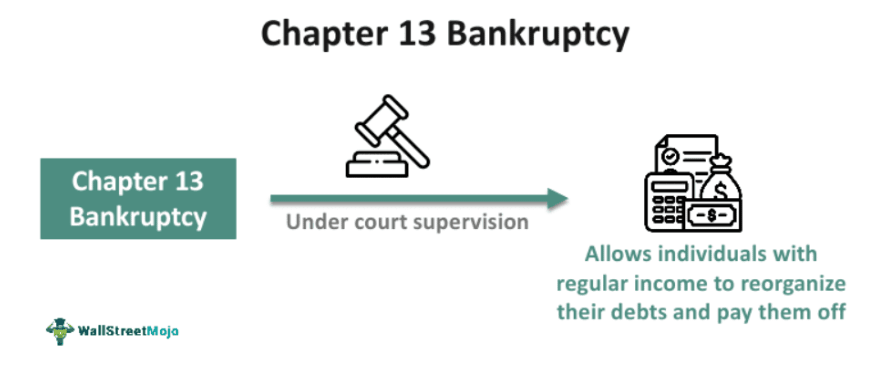

Chapter 13 Bankruptcy

The bankruptcy of Chapter 13 is a little different. In Chapter 13 bankruptcy, you agree to a payment plan, which is usually implemented for a period of three to five years. Once you have completed the payment plan, the debts contained in the plan can be canceled.

A complete bankruptcy in accordance with Chapter 13 and the accounts contained therein must disappear from your credit report seven years after the date of your deposit. Accounts that were in default of bankruptcy can be deleted from your reports beforehand.

Another thing you should know is that lenders can see chapter 13’s bankruptcy somewhat more favorably than Chapter 7 since in a Chapter 13 bankruptcy you generally agree to pay at least part of your debt.

Chapter 13 Bankruptcy Filing Requirements:

In your application for bankruptcy, you must provide a list of all late or late debts and your income, assets, and living expenses. You also need to create and submit a repayment plan for your debt for a specific period of time. You must have a steady income and also record this income in recent years to strengthen your ability to repay your debts.

While there is no limit to the amount of debt that you may need to report for Chapter 7 bankruptcy, there are limits to bankruptcy under Chapter 13 for secured and unsecured debt. These limits increase every year due to inflation. Check the current values before submitting your request. They are introduced to increase the likelihood that debts will be paid through a payment plan, rather than letting them loose.

In addition, you must complete a financial advisory course to prepare for your bankruptcy petition and to examine bankruptcy alternatives. The board should also help you to understand what behavior has caused your difficult situation in the first place and how you can change your behavior in the future.

Filing Chapter 13 Bankruptcy Involves Trustee’s Commission

If you file for bankruptcy, your liquidator will handle a large number of documents, legal issues, and negotiations with creditors. The liquidator is an independent, government-appointed contractor and not an employee of the government. They also have an office and usually staff to help them.

By paying these benefits, the administrator can charge a commission to the bankruptcy court, which is calculated as a percentage of your disposable income. The trustee’s commission is considered a “senior debt” and must be paid for the bankruptcy to be completed. This commission increases the required registration fees or legal fees.

The administrative fee varies from 3% to 11%, depending on your jurisdiction, the individual administrator, and the calculation method for the commission. The administrator receives his monthly commission. You simply send the administrator the total amount of your disposable income, deduct the commission, and send the payments to the lenders along with your payment plan, along with the rest.

How to Improve your Credit Rating After Bankruptcy

1. Monitor your Credit score

It is important for everyone to check your credit report on a regular basis. But it is more important for those who have recently filed for bankruptcy. Keep a list of debts contained in your bankruptcy and check your status several months after the cancellation of your debt. If you have submitted Chapter 7, these debts must have a balance of $ 0 and are no longer considered overdue. If something is not reported correctly, ask the issuer of the credit report to make the change and contact the original lender.

2. Repay your Credits as soon as Possible

Depending on whether you file Chapter 7 or Chapter 13, bankruptcy will expire in ten or seven years from your report. However, if none of your accounts is more than ten years old, you may be in the same place as an 18-year-old without a credit rating through bankruptcy. Otherwise, you could create a virtual “hole” in your report or a long period of time in which you do not seem to have a credit.

Therefore, it is important to apply for a loan shortly after the bankruptcy in order to restore credit history and rebuild your score. Despite a bad credit report, there are several ways to start this process:

3. Secured Credit Cards for a secured credit:

you must give the credit card company a lump sum as collateral. You will then receive a credit card, the maximum amount of which corresponds to the warranty granted. These cards often pay. Therefore, carefully check the information provided and the application to make sure that you do not spend more than the value of the card. These cards are much easier to get than other credit cards because the lender takes no chances in extending your loan.

In-Store Credit Cards:

Qualification requirements for in-store credit cards are often lower, although interest rates and fees are generally high. As always, it is worthwhile to carefully read the information and the application.

Car Loans:

Car loans are usually easier to obtain than other types of loans, especially if you offer a large down payment. If you need to buy a car and save money on the down payment, you can start shopping within six months of the bankruptcy.

Keep your eye On Credit Card Offers

One thing that baffles many liquidators is that they receive multiple credit card offers as soon as their bankruptcy ends. You might think that a new bankruptcy would be a strong deterrent for lenders.

The banks know, however, that they can not submit the application for several years. The risk is better than before. Be sure to read the fine print of all the new debt you demand. Many companies purposely use the benefits of new bankrupt individuals by offering new lines of credit with fees, minimum payments, and extremely high-interest rates.

Over time, reporting on these debts will increase your credit rating, provided you use credit cards and rewards, paying wisely each month on the due date. Initially, only small banks and credit unions will probably forgive your loans. However, in a few years, you may be able to obtain approval from domestic banks. This is important because the big names in a credit report can potentially influence future credit decisions, eg. B. Mortgage Loans. Your favor.

The passage of time only increases your score. In addition, every time your report is filled with A + Ratings. you should get a decent credit rating. And a good rating in a few years if the bankruptcy leaves your report.

4. Keep your Oldest Accounts in Use

Since many people who have previously filed for bankruptcy have a good credit rating, the oldest items in their report can improve their creditworthiness, even if they then file for bankruptcy. The credit term factor, which accounts for approximately 15% of your score, is generally unaffected by the bankruptcy filing. Keep these old accounts active and in contact whenever possible to maintain the duration of your credit history.

5. Do Not Create Multiple Accounts

About 10% of your credit rating is determined by the fact that you recently applied for new accounts. Although you must apply for a new loan to begin rebuilding your score. You should keep the accounts to a minimum and distribute your requests over time.

This is especially true if you apply for a large loan, eg. For example, a mortgage or a car loan. Credit bureaus consider it a bad sign to apply for multiple new loans at the same time. Another reason to limit the number of credit accounts you request is to manage your accounts efficiently and responsibly.

What if you Have a Fraudulent Bankruptcy on your Credit Report?

The court’s public records are accessible through the Public Electronic Records System (PACER). If your registry contains a fraudulent bankruptcy due to identity theft it should not be difficult to locate.

If you notice a false bankruptcy in your report, you must appeal it to each credit bureau. This can be done with a protest letter. The letter must contain a statement from the registry court.

You must contact the court and request a written statement that you have not filed for bankruptcy. If the court files for bankruptcy, you must work with them to solve the problem. You may be required to provide ID and other documents. That way you can prove that there was some kind of confusion.

Initially, you need to get everything you need from the court. Then send it with copies of your ID card & your certified protest letter to each of the major credit bureaus. It usually takes a few weeks for the changes to be recorded in your credit report. This applies whenever everything you have submitted has been checked.

Conclusion:

As we know, bankruptcy in your credit report drastically reduces your starting score. But over time it will become less important as you build new credit and good financial habits. In fact, those who are responsible for their debts and actively monitor their creditworthiness. They can claim the most debt and qualify for them within two to four years of going bankrupt.

You can apply for mortgages, car loans, and new credit cards in the same way as anyone else who has a similar credit rating, regardless of the bankruptcy. Let me know in the comments section below if you have any queries regarding bankruptcy. We’ll be happy to help you out.

People also search for like : Does bankruptcy stay on your credit report permanently?, Is it true that after 7 years your credit is clear?, Can I have a bankruptcy removed from my credit report?, How long until bankruptcy is cleared?, How do I delete a bankruptcy?

Read More:

1. Amazon Prime Rewards Visa Signature Card Review

2. Best Prepaid Credit Cards: List Of 2020

3. Credit Card Security: 9 Do’s And Don’ts For Avoiding Identity Theft\

Very useful information is given that how Long does a bankruptcy stay on your credit Report. It is really very helpful.

Pretty nice post. I just stumbled upon your blog and wanted to say that I’ve truly enjoyed browsing your blog posts.

After all I’ll be subscribing to your feed and I hope you write again soon!