Find Best Mortgage Rates: Buying a home is one of the biggest and one of the most important financial decisions of your life. In most cases it will likely require a mortgage to fund the purchase of the home of your dreams.

As technology has progressed by leaps and bounds, the process of searching for the best mortgage rates can all be done online. There are handy instruments which help you to find the best option for you.

Find The Best Mortgage Rates

Knowing the numbers is just the first step. You should also know about what influences the numbers and whether it is a good deal for you, or not. So after you have calculated the right numbers for you, you should also know about the different categories of mortgages.

Terminologies To Use Mortgage Calculator:

Below is a list of terminologies you are likely to come across as you use the mortgage calculator:

Credit Score:

The credit score is basically the numeric parameter of a person’s creditworthiness.

Location:

You must check out the state in which the mortgage will be carried out, then narrow down on the location either through the closest city or ZIP code.

Loan Amount:

This is almost equivalent to the estimated value of the home (minus the down payment to be paid) or basically the remaining balance of your incumbent mortgage that you would like to refinance.

Mortgage Points:

A mortgage point is one percent of the total amount of the mortgage. There are basically two types of mortgage points. The first are discount points, which represent prepaid interest on a mortgage while the second is origination points, which are the amount of fee the mortgage lender may charge from a borrower.

Percent Down:

This is also known as a down payment and it is an initial payment made when something is bought on credit.

Products:

This is actually the type of mortgage you may be interested in, such as a traditional fixed-rate mortgage, an ARM, or an I-O mortgage.

Purchase or Refinance:

Purchase mortgages come into the picture when you want to finance the purchase of a home. Refinance mortgages are used to replace an older loan with a new loan which offers better terms for a fee.

Types Of Mortgages:

It’s important to know about the types of mortgages to find the best mortgage rates. Depending on certain factors such as credit score, your employment history and also the debt-to-income ratio, a lender may offer you a prime rate mortgage, a subprime mortgage or a hybrid product called an “Alt-A” mortgage.

Let’s have a quick discussion about the different mortgage categories and see the factors which affect which one you qualify for.

Prime Mortgages:

Prime mortgages stand by the quality standards set forth by Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation). These two government-sponsored enterprises provide a secondary market in home mortgages through the process of purchasing loans from originating lenders.

According to the definition given by the Federal Reserve, a prime residential mortgage is basically “A mortgage for a borrower whose credit score is 740 or higher, whose debt-to-income ratio is lower than average and also whose mortgage features a standard amortization schedule which is common to a fixed-rate or an adjustable-rate mortgage.”

People opting for prime mortgages also have to put up a considerable down payment on the residence which is typically 10% to 20%. The idea is to make sure that you’ve got skin in the game and consequently you’re less likely to default.

Since borrowers with better credit scores and debt-to-income ratios are customers with lower risk, they are offered with the lowest interest rates which currently range around an average of 4.6% on a 30-year fixed rate mortgage. This save money fast over the life of the loan.

Subprime Mortgages:

Subprime mortgages, as the name suggests, are offered to customers with lower credit ratings and whose FICO credit scores are below 640. However, the exact cutoff depends on the lender. Since there is an increased risk to lenders, these loans are offered at higher interest rates which are somewhere between 8 to 10 percentage.

There are various kinds of subprime mortgage plans available. The most common of them is the adjustable-rate mortgage (ARM), which carries a fixed-rate “teaser rate” at first and then switches to a floating rate and an extra margin, for the remainder of the loan.

These loans generally start with a very reasonable interest rate but once they switch to a higher variable rate, the mortgage payments start increasing substantially.

Alt-A Mortgages:

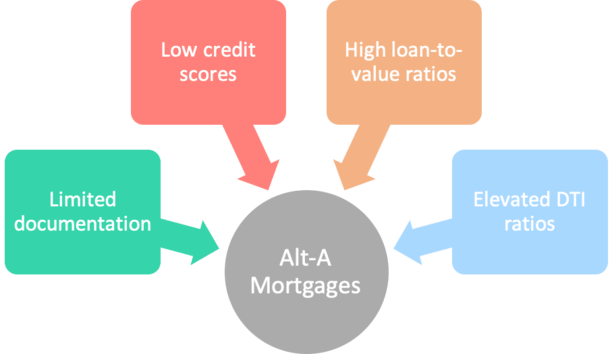

These mortgages fall somewhere in between the aforementioned categories of prime and subprime mortgages. One of the defining features of an Alt-A mortgage is that it typically is too low on documentation as the lender doesn’t require much of the documentation to prove a borrower’s income, assets or expenses.

This also opens the door to some fraudulent mortgage practices because both lender and borrower could exaggerate the numbers in order to secure a larger mortgage.

Apparently, after the infamous subprime mortgage crisis of 2007-08, these mortgage loans have become known as “liar loans” because borrowers and lenders used to exaggerate income and assets to be qualified for a bigger mortgage.

Although the Alt-A borrowers typically have a very good credit score of at least 700. Which is well above the cutoff for subprime loans, these loans still have relatively low down payments, a higher loan-to-value ratio and much more flexibility when it comes to the borrower’s debt-to-income ratio.

Despite the disadvantages, a low-doc and no-doc loan can be helpful if you actually have a good income but can’t convert into justifiable numbers because you earn it sporadically, for example, if you’re self-employed.

Alt-As are perceived as somewhat risky as they fall somewhere between prime and subprime mortgages. Therefore, interest rates are higher than those of prime mortgages and lower than subprime mortgages. The interest rates range somewhere around 5.5% to 8%, depending on the lender and the borrower’s demands.

How To Get the Best Possible Mortgage Deal?

Evidently, the higher the interest rates are, the more you have to pay each month.

The important thing here to realize is that just because a lender offers you a mortgage with an Alt-A or subprime mortgage; it doesn’t mean you don’t qualify for a prime-rate mortgage if you go to a different lender.

Lenders, as well as mortgage brokers, are competitive and they generally are under no obligation. They provide you the best deal available. It’s worth the effort to search around and take the time to find a better interest rate so that you can save money over the course of a loan.

How To Get a Mortgage at a Cheap Rate?

Following are a few tips for finding The Best Mortgage Rates:

Do not let somebody else do the bargaining for you. As we know by now, the rates you get can probably make a substantial difference in what you will have to pay to borrow the same amount of money.

The question is, how do you avoid paying more than you actually need to for your mortgage. Certainly, you will have to compare the offers you get by running them through some of the online mortgage calculators. To see what your payments and interest will eventually turn out to be.

Follow the steps below while you find the best mortgage rates for you:

Start Early:

If you are searching for a home right now, getting your finances in the right shape might be a little tough. So plan ahead; maybe even try to postpone house-hunting until you can sort out your financial hurdles.

In general, you need to have an outstanding credit rating. Even before you are considered for a mortgage, traditional lenders will demand for a credit score of at least 700. As mentioned above, it should be above 740 for a prime-rate mortgage.

FHA loans might come with more relaxed standards but they have more stringent conditions. So do whatever you can to have a high score by paying off your credit card balances and all other personal debts to your best.

Even a 20-point difference in your score can end up affecting the rate up or down more than 0.25%. On a $250,000 home, this difference could mean paying an extra $12,000 or more paid in interest over the entire life span of the loan.

Saving is crucial! The more you can save right now; the lower will be your mortgage payment and the less interest you will have to pay over time. A higher down payment will result in a lower interest rate. Putting up with a 30% down payment, as compared to the conventional 20%, can drop your rate more than 0.5%.

Interest Rate is Not the Only Thing:

The interest rates are important, but there’s more you should compare. You should know if there is a prepayment penalty if you decide to refinance at some point? What will be the total closing costs? Closing costs can usually amount to 2% to 5% of the price of the asset. Learn about PMI

Though they do add up to the overall cost of your mortgage, closing costs are a one-time payment. But there’s something even more serious than that which keeps on biting. If you make a down payment of less than 20%, you’re considered to be a customer with higher risk. And you are required to carry PMI (Private Mortgage Insurance).

This eventually makes you a safer customer for the lender. However, you’re the one paying for it with extra rates to the tune of 0.5% to 1% of the entire loan each year. That can easily add up to thousands of dollars to what it costs to carry the loan. If you have to pay for PMI, make sure it is stopped as soon as you have regained enough equity in your house through your mortgage payments.

Go for the Opportunity:

Let’s say you happen to find the most amazing mortgage deal. Then there is no need to wait and you have to move fast. The interest rate and other conditions are locked in only for a set amount of time. You have to close your deal within the lock period or end up paying more.

Conclusion:

Most of the work required in getting the lowest mortgage rate is done long before you actually apply for the loan. A great credit score and a substantial down payment are the best ways to lower your interest rate.

However, don’t blindly trust your bank, realtor or mortgage broker for the best terms. They may have their own financial motive to steer you in a certain direction. Do your own research, do the required calculations and choose the right product.

Read More:

Things You Should Know About Balance Transfer

Renting A Car? Know Your Coverage At Home And Abroad

Leave a Reply