Best Personal Loans: A personal loan is basically a loan taken for a short period of time ranging anywhere between two and five years. Unlike a credit card or line of credit, the length of time is fixed and does not fluctuate.

The amount of loan taken usually varies between $1,000 and $100,000 and depends on the customer’s needs and creditworthiness. Each bank has its own set of rules and conditions on how much and for how long one can take a personal loan.

Personal loans are usually unsecured i.e. there is absolutely no collateral you have to put up with, such as a car or house which will the loan. Many lenders offer personal loans, including the traditional brick-and-mortar banks and also the new online-only lenders.

They cater to borrowers with acceptable credit scores, a good income and various other qualifying requirements.

This article explains how you can find the best lenders for personal loans. This is basic guidance for finding the right lender based on your credit history and income and also talks about the interest rates being offered.

The article also talks about how much you can borrow and what you can and can’t use the loan for. Going for the right lender and compatible terms can save a lot of money.

Top 7 Personal Loans Companies:

Following are the companies providing the best personal loans:

- Lending Club: Best for Fair Credit

- SoFi: Best for Co-Borrower Options

- Discover: Best for Minimum Fees

- Light Stream: Best for Funds Same-Day Availability

- Marcus by Goldman Sachs: Best known for great Customer Service

- Prosper: Best for Small Loan Amount

- Upstart: Best for Borrowers with Low FICO Scores

Each consumer has different requirements and demands, and they need to find lenders who specialize in specific areas designed to meet them. No lender is perfect for every consumer and recommendations are based on eligibility requirements. Customers should look for interest rates and features that make them good matches for their requirements.

Looking For Fair Credit:

LendingClub:

LendingClub has been in the lending business since 2007 and has loaned more than $44 billion to its customers. They may even approve borrowers with FICO credit scores as low as 600 while some borrowers can also be eligible for a joint application.

- Minimum FICO score required: 600

- Maximum debt-to-income ratio required: 40%

- Co-signer option available: Yes

- Preapproval on rate quotes available: Yes

- Loan amounts available: $1,000 to $40,000

- Duration of loan terms: Three to five years

- Restrictions: None

- Discounts Offered: None

- Origination fee to be paid: 1% to 6%

Availability Of Co-Borrower Option:

SoFi:

SoFi has been offering online personal loans since 2011. Borrowers can choose to apply for fixed as well as variable-rate personal loans ranging from $5,000 to $100,000.

- Minimum FICO score required: 680

- Maximum debt-to-income ratio required: N/A

- Co-signer option available: Yes

- Rate quotes available: Yes

- Loan amounts range: $5,000 to $100,000

- Duration of loan terms: Two to seven years

- Restrictions: For personal use only

- Discounts available: Autopay, additional SoFi loan

- Origination fee to be paid: None

Minimum Fees:

Discover:

![]()

Discover offers personal loans for a diversified range of options like debt consolidation, home improvement and also for major purchases. Loan terms are available with durations from three to seven years.

- Minimum FICO score required: 660

- Maximum debt-to-income ratio required: N/A

- Co-signer option available: No

- Rate quotes available: Yes

- Loan amounts range: $2,500 to $35,000

- Duration of loan terms: Three to seven years

- Restrictions: Only for debt consolidation, home repairs and improvements or major purchases.

- Discounts available: None

- Origination fee to be paid: NoneImmediate Availability Of Funds:

LightStream:

LightStream was launched as a division of SunTrust Bank in 2013 and offers personal loans of up to $100,000. They also accept Co-signers.

- Minimum FICO score required: 660

- Maximum debt-to-income ratio required: N/A

- Co-signer option available: Yes

- Rate quotes available: No

- Loan amounts range: $5,000 to $100,000

- Duration of loan terms: Two to seven years

- Restrictions: Can be used for approved loan purpose only

- Discounts available: None

- Origination fee to be paid: None

Best For Customer Service:

Marcus by Goldman Sachs:

With Marcus by Goldman Sachs, borrowers can apply for fixed-rate unsecured personal loans. Personal loans taken from Marcus by Goldman Sachs leads to no origination, prepayment or late fees.

- Minimum FICO score required: Not disclosed

- Maximum debt-to-income ratio required: Not disclosed

- Co-signer option available: No

- Rate quotes available: Not disclosed

- Loan amounts range: $3,500 to $40,000

- Duration of loan terms: Three to six years

Restrictions: Can only be used for debt consolidation, home repair or improvement, major purchases, on special occasions or other services like moving and relocation and vacations

Discounts available: After you’ve made 12 or more consecutive monthly payments in full and on time, you are allowed to defer a payment interest-free for a month.

Origination fee to be paid: None

For Small Amounts:

Prosper:

Since it was founded in 2005, Prosper serves more than 880,000 borrowers. Borrowers with a debt-to-income ratio of up to 50% can also get approval for personal loans.

- Minimum FICO score required: 640

- Maximum debt-to-income ratio required: 50%

- Co-signer option available: No

- Rate quotes available: Yes

- Loan amounts range: $2,000 to $40,000

- Duration of loan terms: Three to five years

- Restrictions: No student loan debt is allow

- Discounts available: None

- Origination fee to pay: 2.41% to 5%Check Also : Best Bad Credit Personal Loans

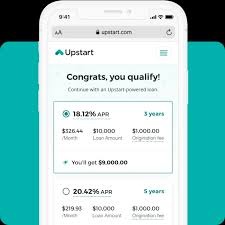

For Borrowers with Low FICO Scores:

Upstart:

Upstart uses automation to originate credit and has been funding more than $3.2 billion to 250,000 borrowers. You can avail loans with amount as small as $1,000 with this lender.

- Minimum FICO score required: 620

- Maximum debt-to-income ratio required: Not disclosed

- Co-signer option available: No

- Rate quotes available: Yes

- Loan amounts range: $1,000 to $50,000

- Duration of loan terms: Three to five years

- Restrictions: Borrower has to adhere to Upstart’s acceptable use policy

- Discounts available: None

- Origination fee to pay: 0% to 8%

Risks Associated with Personal Loans:

It Affects Your Credit:

When you plan to apply for a loan, the lender will make sure to check your credit. There are two ways for the lender to check it. The first is a soft inquiry and the second way is a hard inquiry. A soft inquiry is only visible to you and will not negatively affect your credit score.

Whereas, a hard inquiry will eventually show up on your report and will then be visible to all the creditors who view the report. It is usually going to stay on the report for almost two years and may end up negatively affecting your score for another year.

These hard inquiries end up affecting the new credit portion which makes up 10% of your FICO credit score and this is the score most lenders use while evaluating applicants. New credit is a testament to how many new credit inquiries you have had and how many new lines of credit you have opened recently.

Any time you open a new loan, you eventually end up altering the average age of your credit. The length of duration of your credit history accounts for 15% of your current FICO credit score while the average age of your accounts is a significant factor in the length of your credit history.

Therefore, if you haven’t taken many loans or used other types of credit, then a new account may end up significantly affecting the average age of all your credit accounts.

Risk Of Defaulting:

If you don’t make regular payments on a personal loan, then you risk defaulting on the loan and eventually damaging your credit.

If you are taking out a personal loan where you don’t have to risk losing your home or your car then that doesn’t mean this loan is risk-free. Because failing to pay the loan back which is also known as defaulting can seriously damage your FICO score. This will make it tougher and more expensive if you want to borrow money in the future.

By paying attention to the details of the loans mentioned above and by also taking into consideration the risks associated with personal loans, we hope you will make a great decision and get the best personal loan for yourself.

Read More:

I read this whole article and i appreciate your writing efforts on this blog! As per my experience, Lending Club is the best company for Personal Loans. Thanks for sharing!

Hello very cool web site!! Amazing .. I will bookmark your site and I am glad to find a lot of helpful information right here. thank you for sharing.