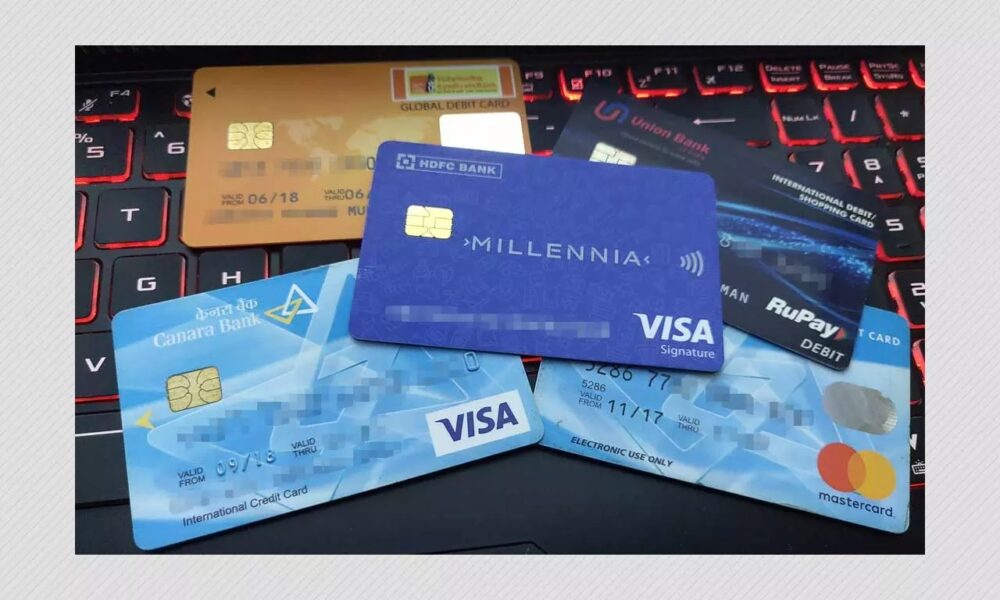

Easily the most misunderstood payment cards of all time, prepaid cards are actually great tools to help stay on a budget when you have been spending recklessly. As opposed to the popular view that anyone who owns prepaid credit cards is a reckless spender, people actually take to maintaining a balance upfront. Yet, if you aren’t pretty convinced, let’s take a deeper look at what they are all about.

From the Top options of Credit cards, one of the best is the credit card. A prepaid credit card is a card issued by a financial institution that is secure with prepayment. These cards, unlike prepaid debit cards, require a credit check and approval from the issuer.

How Does A Prepaid Credit Card Work?

A prepaid credit card works quite similar to the everyday bank debit and ATM cards. What you do is add money to the card, and spend the money wherever you want to. The only requisite is that such platforms must accept MasterCard or Visa debit cards. You can add money to your prepaid credit card out of any of the below-mentioned ways:

- Through Direct deposit – with prepaid credit cards, you can allow direct deposit or transfers of any benefits, paycheques or government cheques onto the card. In most cases, you can avail of the prepaid credit card absolutely free of cost or for a negligible value.

- Through Cash Networks – there can be multiple cash networks that you could use to add money to your credit card, like GreenDot, Western Union and so on. These cash networks are available at any nearby store.

- Through money transfers – a prepaid credit card can also derive money when you transfer some onto it from one bank account to another. This method is not just convenient but also quick and preferable.

What Are The Benefits of A Free Prepaid Card?

It is usual for the ordinary customer to believe that a prepaid credit card is actually not that easy to maintain or difficult to avail. The reality, however, is not the same. There are several benefits that come your way when you are using a free prepaid credit card.

Firstly, as mentioned before, you can avail either direct deposits or direct money transfers into your account, and use that money with your card. This saves you the trouble of manually depositing your salary into your account.

Besides, the money reaches your account immediately, instead of hanging you up for a certain number of business days. These credit cards can use for transactions anywhere, getting you rid of the many issues with cash transactions. At the same time, you can make ATM cash withdrawals.

Next, your credit score doesn’t matter much, and neither does the worry of spending too much. With a prepaid credit card, you are spending only as much as you have planned to, except for some extra cash meted out to be for emergency transactions.

Read More: Best Prepaid Debit Cards

Types Of Prepaid Credit Cards:

There are several different types of prepaid credit cards in the market today –

- Open looped cards – carry the brand logo of the network affiliate to, like Visa or MasterCard. Accepted at all transactions, banks, and merchant outlets.

- Semi-open loop cards – they are hybrid cards, issued by retail chains or shopping malls. They can use at any location with outlets of these brands.

- Closed looped cards – cards accept only at the specific outlet where they are issued.

- Reloadable cards – where customers allow to add funds after exhaustion

- Non-reloadable cards – more like a one-time usage card, these cards cannot be refilled with money once they are exhausted, for example, gift cards.

What kind of prepaid credit card you choose is ultimately your call. It depends a lot on how you want to use it, what is card validity you are looking for, whether you want a card that is reloadable so that you can continue using it after its initial balance is used up or not.

Besides, the choice of the prepaid credit card also varies because of the bank and the kind of cards they offer. Let’s have a look at some of the best-prepaid credit cards in the market for you to choose from.

Axis Bank Smart Pay Prepaid Credit Cards

- Rupee-dominated credit card

- Multi-purpose usage: online shopping, physical transactions at merchant outlets

- Can pick by a customer from any Axis Bank branch

- Reloadable

- Visa is the network affiliate

- Customer need not have a bank account to avail the card

- Immediate and secure payments

- Loan amount allowable – 500 to 50,000 INR a day

- Daily cash withdrawal limit (Axis bank ATM) – 20,000 INR

- Daily PoS transaction limit – 50,000 INR

- Zero lost card liability insurance against fraud activities.

ICICI Bank PayDirect Prepaid Credit Card

- Cards available in different varieties – gift cards, travel cards, corporate cards

- Card validity of two years

- Efficient and complete payment solution – salaries, incentives, commissions, reimbursements.

- Reloadable

- The card can refill any number of times one wants.

- The maximum amount allowed on the card is 50,000 INRRead More: Anatomy Of A Credit Card

HDFC Bank Forex Plus Prepaid Credit Cards

- There are several sub-types under the HDFC Bank Prepaid Credit Card

- Some of the types: ISIC Student ID Forex Plus Chip Card, Forex Plus Card, Forex Plus Chip Card, Multicurrency Platinum Forex Chip Card, Money Plus Card, Food Plus Card, Gift Plus Card, Apollo Benefit Medical Card, Hajj Umrah Card, and so on.

- One of the HDFC Prepaid Credit Cards that customers rely on is the HDFC Forex Plus Prepaid Credit Card.

- Available as Mastercard or Visa cards.

- The number of currencies in which users can reload the HDFC Forex Plus Prepaid Credit Card are: US Dollar, Euro, Australian Dollar, Japanese Dollar, Japanese Yen, Singapore Dollar, Sterling Pound, Swedish Krona, AED (Dirhams), Swiss Franc.

- Card applicability: cash withdrawals, PoS, net banking.

- Reloadable

- Cardholders can avail insurance facilities for a number of situations (death, personal injury/accident, against fraud/scam in transactions with the card, loss of check-in baggage or passport or if the card gets stolen.

- Card balance and other details can track by using net banking.

American Express Prepaid Credit Card

- The prepaid gift card by American Express card comes in the form of the Taj Gift Card, which can use at hotels for availing room bookings, dining services, etc.

- Cash withdrawals are not allowed

- Card also has an expiry date after which any balance on the card will not be available for use.

- Card validity: 1 year, generally. Read More: American Express Cards’ Spending Limits

Bank Of Baroda Prepaid Credit Card

- Two types of credit cards available – Baroda Gift Card, Baroda Travel Easy Card.

- Baroda Gift Card is a prepaid credit card that can use at multiple merchant outlets.

- The rupee is the only currency that allows for all transactions within India.

- Online transactions are allowed.

- All eCommerce transactions with the card are verified by Visa.

- It cannot be used for the withdrawal of cash from ATMs.

State Bank of India Prepaid Credit Card

- Multiple types of prepaid credit cards available.

- Various cards offered are State Bank Express Money Card, State Bank Smart Payout Card, State Bank Achiever Card.

- No need for a bank account.

- Cash withdrawals allowed.

- eCommerce transactions allowed.

- Smart Payout Card is available in collaboration with Visa – chiefly use for payment of salary or commissions.

- Smart Payout Card allows – online payments, cash withdrawals, other purchase transactions.

- Card validity: 2 years

- Currency available in the Indian rupee

- The maximum amount of loads 10,000 INR. The minimum amount is 100 INR.

- State Bank Xpress money card usage: availing inward transfers across all countries.

- Service availed: Money Transfer Service Scheme (MTSS) by Reserve Bank of India.

- Cash withdrawals allowed.

- PoS allowed, eCommerce transactions supported.

- State Bank Achiever Card: used in the corporate sector for employee payment.

- Reloadable, but with a limit of 1.5 lakh INR.

- Allowed transactions: on-line payments, PoS.

Yes Bank Prepaid Credit Card

- Multiple cards available for different purposes – corporate incentives, travel cards, gift cards, food cards, etc.

- The different cards are available with Yes Bank: Multi-currency Travel Gift Card, Yes Bank Gift Card, Yes Bank Jewellery Gift Card, Yes Bank Incredible India Domestic Travel Card, Yes Bank Payroll Card and so on.

- Yes Bank Multicurrency Card, as the name suggests, supports multiple currencies: US Dollar, Euro, Pound Sterling, Japanese Yen, Australian Dollar, Canadian Dollar, Hong Kong Dollar, SG Dollar.

- Reloadable.

- Refilling can be done at all Yes Bank branches.

- Allowable transactions: Bill payments, flight bookings, hotel bookings, mobile recharges, shopping purchase transactions.

- Several gift cards available with Yes Bank – jewelry, etc.

- The maximum limit allowed: 50,000 INR.

- It can us under the MasterCard variance at multiple merchant outlets.

- Payroll cards by Yes Bank available for corporate usage.

- Card validity is 5 years.

- A great alternative to cash or cheque incentives

- Cash withdrawals allowed, but up to limit of 10,000 INR

- The pos transaction allowed, but up to a limit of 20,000 INR

Conclusion:

Considering the above and many more prepaid credit cards available in the market today, one easily has a number of options before them to make the choice most suited to them. You should try figuring out what your needs are, for what duration you would want to possess the credit card, if there is any special reason or not for you to avail such a card, and so on.

The best thing is that you do not a very high or impressive credit score to avail such prepaid credit cards. All they require is a credit check and credit approval from the account holder or the user. As it is prepaid, it also saves you the guilt of having spent way beyond measure.

You can, therefore, invest your time in analyzing your needs and utility. This will easily help you understand which credit card will be the best choice for you over a short or long-term duration.

Read More:

Lowe’s Advantage Card In-Depth Review

Leave a Reply