Credit Card is that piece of plastic that empowers a shopper who is on a shopping spree, but is also at a huge threat if not used safely. Innumerable cases are reporting worldwide these days, where credit card information is hacking and misuse.

Credit card frauds are happening too often these days, with unsafe online transactions in place. Hackers are out there to trap you in disguise, as a result securing credit card information has become more vital.

Your personal information is vulnerable to misuses. And by the time you realize it, all is over. Card cloning, Phishing, BIN attack, Skimming, etc enables criminals to take full control of your account and make unauthorized transactions. According to the “The Nilson” report, the USA leads the world in credit card frauds with an estimated loss of more than $12 billion by 2020.

Security Features Of Credit Card:

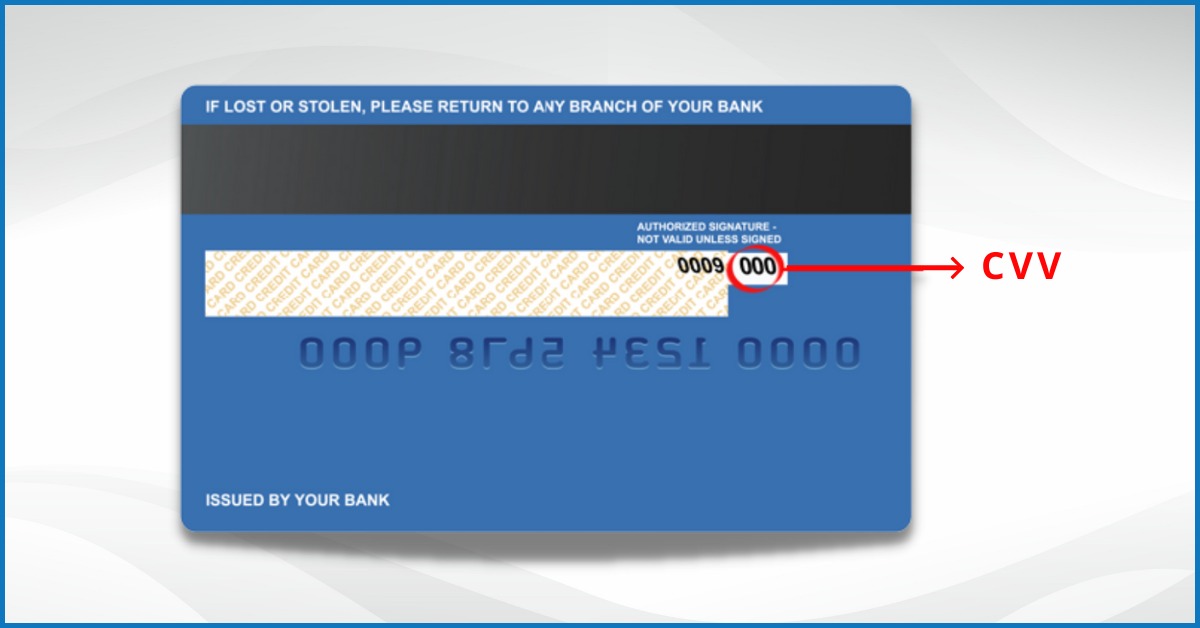

Every credit card comes with some basic security features so that your transactions are safe and secured. As a cardholder one should be well aware of these features so that the fraudsters can’t get away easily. Almost all credit card comes with an expiry date, magnetic stripe, chip, and a CVV – these are something which shouldn’t be shared with others.

1. Signature Panel:

this is a mandatory step one should follow as soon as a credit card is issued. You should sign on the signature panel as per credit card issuer terms and conditions. Leaving the panel blank can invite merchants to decline card acceptance at their store.

2. Chip Card:

also known as EMV cards, these smart cards are chip-enabled that encrypt information at each transaction which is validated by PIN or digital signature by the cardholder. Chip Card is a way to lessen the credit card frauds that are rampant worldwide.

3. Holographs:

This is an added security feature to make forgery difficult. 2D / 3D holograms on a credit card are added to protect it from scammers.

4. Monitoring Usage:

Many credit card has an automated usage monitoring system, where on a high-value transaction, the user is either being called to check for the details of the transaction or it may be flagged to prevent unauthorized usage and the purchase is verified.

5. Photo Cards:

This is another step to cross-check the identity of the card user, but then due to online shopping’s popularity, this has lost all the shine.

6. Virtual Cards:

Few card issuers provide virtual credit card numbers, which is basically the digital version of the physical card. This way credit card frauds can be prevented and identity theft can be controlled while shopping online or over the phone.

7. Temporary Transaction Number:

In order to restrict fraud, some credit cards like Citi and Bank of America helps you to generate single-use card numbers for online transactions. In case your card number is compromised, it won’t matter much since you’ll never use it again.

8. CVV:

This three-digit code is essential while making any online transaction, without which transactions will be declined. The CVV code on the back of the credit card is required for processing and is not something that should be shared with others.

Read More: Instant Approval Credit Cards

9 Ways To Improve Credit Card Security:

It is better to be safe than sorry and this holds true for your credit card. As an owner of this plastic piece, you should take the utmost care to avoid being misused. Keep your information safe and never give away any bit of your card information or personal data linked to your card to the scammers, who may try to trick you in every possible way.

1. Keep Strong And Unique Password:

It is advisable to create alphanumeric passwords that are hard to crack, yet easy for you to remember. Even keep those password recovery Q&A unique which is difficult to guess. You can use password managers like 1Password or LastPass

2. Alter Passwords Regularly:

In order to avoid any kind of fraud, it is always better to keep changing your passwords at regular intervals.

3. Report Lost/Stolen Cards Immediately:

In case your credit card is stolen or lost or misplaced, immediately reach out to your issues and inform them about it. They will immediately block your card and prevent you from being misused.

4. Avoid Autofills:

Make sure your browser’s setting is made such that it doesn’t store data and prompts for autofill. Often credit card data is a go-to store, hence it’s better to avoid. Clearing browser history and cache can get rid of this.

5. Logout After Each Transaction:

To be extra cautious with your data, it’s better to log out after you have completed any transaction. This is very important, especially if your computer is being used by others.

6. Make Sure Of “https”:

When dealing with online transactions, make sure the web address has “https://” and not just “Http://” – that “s” stands for secure, which means the webpage encrypts the data submitted.

7. Avoid Giving Out Credit Card Information:

Do not ever give away your credit card information, even if somebody poses to be officials from a bank or credit card issuer. Also, make sure you shred anything that has got your credit card number on to it – so do not toss your card statement directly into the trash, as it has all those information that would be enough for a skimmer to create havoc.

8. Track Your Transaction:

Don’t wait for your monthly bill to get generated, track your transactions online on a regular basis. This will keep a check on any fraudulent activities that might occur in between.

9. Avail Additional Protection:

There are few card issuers who offer additional protections to online shoppers. You can sign up for the same, which might ask you for a six-digit code when you make a transaction online. Programs like Visa Secure, Mastercard Secure, and Amex SafeKey, can be availed for additional protection.

Credit Card Security Don’ts

Despite all those security features being loaded in your credit card, you can never be too careful with them. Here are some tips for keeping your card safe.

1. Don’t Use Open Networks For Transactions :

These days it’s common to use a wi-fi network at some public place. Be careful of these open networks and avoid accessing your credit card details in any online transaction. These are generally unencrypted and can be accessed by any hacker. So by quoting your personal information along with credit card details can be risky and vulnerable to identity theft.

2. Don’t Share Card Details With Unverified Representatives:

No matter how they introduce themselves to you, do not share card details to an unverified caller, who might claim to be a bank employee. Identity thieves often use these tricks to get your details and then hack into your account. To check if the call is legitimate, contact the bank or issuer through its published phone number or secure messaging system.

3. Don’t Disclose Your Card Number in Emails:

do not become the victim of “phishing”. Often emails are sent and you ask to click a link and then ask to disclose your credit card details. Simply ignore such emails and report them to your bank or credit card issuer.

NOTE: Also, do not disclose your card details while sending an email. It could be misused by hackers.

4. Don’t Post Credit Card Images On Social Media:

Social media has made us lazy, often we click pictures and send it across just to save our time and effort. Do not do the same for credit cards, sending out card images on social media is not a great idea at all. Enterprising hackers are smart enough to use those details and get into your account and wipe out funds without you being aware.

5. Don’t Share Card Details Where You are Audible To Others:

At times certain legitimate financial transactions are conducted over the phone and may require you to verbally give your card number and other personal details. Just avoid making or attending such calls in public places, as outside disturbances might force you to narrate those information louder than usual. Thereby making your information vulnerable to identity theft.

With advancing technologies, scammers are also finding newer ways to thug credit card members and use those details for unauthorized transactions. A little awareness and a constant check can prevent the mishaps of identity theft.

Read More:

Best Investment Accounts For Young Investors

Best 11 Websites For Finding Coupons And Deals Online

Leave a Reply