Bad credit personal loans are a great option for consumers whose low credit ratings limit their credit options. Personal loans can help you consolidate your debts and finance your most important purchases without using credit cards. In addition, unlike other types of credit, you do not have to risk your home loan or car loan as collateral for unsecured loans. However, it is difficult to get approval for a bad credit personal loan and you may have difficulty applying for a loan.

The good news is that you can also qualify for a limited credit rating or problems with your credit report. Unfortunately, you have fewer options with bad credit and the loans become more expensive.

How To Get A Personal Loan With Bad Credit?

When we say “bad credit,” we’re referring to your FICO score. The FICO rating model 8 rated 579 points and less than bad. If you have slightly better credit, you should look for personal loans to get fair credit. You have more options and can qualify for more favorable terms.

If possible, it is best to minimize lending until your credit improves, but this is not always an option. If you need to apply for a personal loan, start with the following resources. This list should help you find lenders that:

- They are more willing to approve it with bad credit

- They generally offer competitive though not necessarily low-interest rates on personal loans.

Based on this criterion, here is our selection of lenders that offer the best personal loans to people with bad credit.

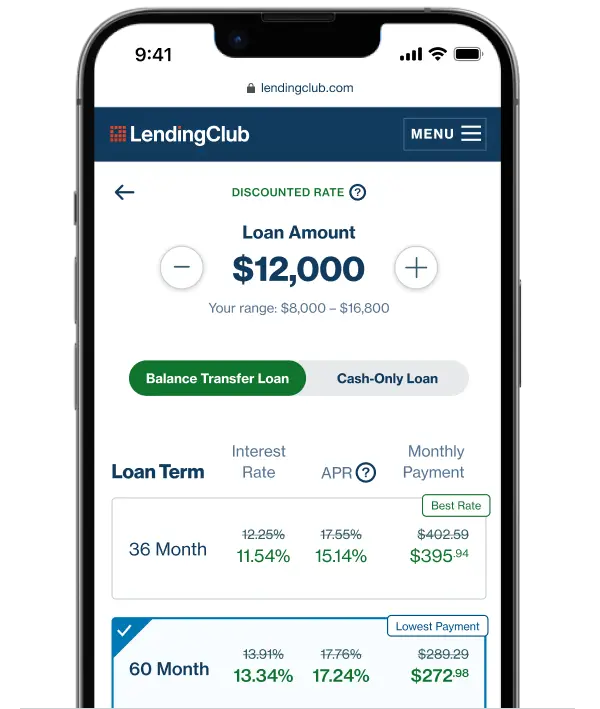

1. Lending Club

LendingClub is a San Francisco-based peer-to-peer company that acts as a broker to engage investors with potential borrowers. You can get personal loans, commercial loans, lines of credit, automatic refinancing, and medical financing.

LendingClub’s unsecured personal loans range from $ 1,000 to $ 40,000 with a relatively affordable annual percentage (APR). However, these loans are not for everyone. The market charges an upfront fee and needs good to excellent credit to qualify.

For whom LendingClub’s personal loan is suitable?

Borrowers can use LendingClub Personal Loans for a variety of purposes, such as debt consolidation, renovation, auto-refinancing, or even holiday payments. It’s a great option for those with a strong credit rating, but you still need to shop to make sure you get the best deal. You can consider one of these loans if:

have a credit score too great: Borrowers need a credit score of at least 600 in order to qualify, according to the company. check your credit score with online sites for free before you apply.

Your income is high: LendingClub borrowers have an average annual income of $ 85,053, which is higher than the average family income of $ 61,372 in the United States.

The Debt to Income (DTI) ratio is low: lenders use this number to compare the amount of your debt with the amount you earn every month. The average borrower of LendingClub has a DTI of 20%, although the maximum allowed value is 40%. You can calculate your debt ratio before submitting the application.

You want to submit a joint application: If you do not receive your own loan, you can turn to a co-borrower. Your combined DTI can be 35%.

To whom Lending Club is not the best option?

LendingClub is not the best option for everyone. You should consider other loan providers if:

Do you have bad credit: If you are approved for a loan but have a high-interest rate and a high starting rate, you might be better off with another type of credit.

You want to rebuild loans: LendingClub maintains high credit standards, which means that more than 80% of loan applications are rejected. However, the company offers tools and tips to help borrowers rebuild loans.

need your loan fast: Once approved, it takes an average of four days to get the money, though it can take up to seven days.

Living in Iowa: LendingClub does not work in this state or in US territories. UU. As in Puerto Rico and Guam.

Lending Club Loan Terms

LendingClub offers personal loans between $ 1,000 and $ 40,000 with fixed annual percentages ranging from 6.95% to 35.89%. The company that works with banks on credit decisions takes several factors into account:

- Credit history

- Debt / income ratio.

- loan amount

- Repayment period (36 or 60 months).

- All other creditors owed sums

Minimum Requirements of the Borrower

The LendingClub needs a credit period of 36 months to allow consumers to qualify for a loan. In general, however, having a high credit rating, a low debt-to-income ratio, and a long history of debt management mean that the lowest interest rates are achieved.

Your IDT must be 40% or less, which means that your monthly total debt does not exceed 40% of your gross monthly income. LendingClub has other basic requirements. To qualify, you must:

- At least 18 years old

- Be a US citizen, permanent resident, or long-term visa holder

- Do you have a bank account?

- Live where LendingClub operates (LendingClub does not accept apps from Iowa or the US)

Fees and penalties

LendingClub does not charge a prepayment fee, but charges a few other fees:

- An opening rate of 1 to 6%, depending on your ability to pay.

- A $ 15 fee if you do not have enough money in your bank account to cover your monthly fees.

- Late payment fees equal to 5% of the number of outstanding fees, or $ 15, whichever is greater.

2. OneMain Financial

OneMain Financial is a private lender that usually lends to people who usually have little or no credit. The Company may provide personal loans to people with little or no credit rating and may not set a minimum income.

It is important to note that personal loans are not for everyone. You need to borrow a personal loan for a specific purpose, such as B. Debt consolidation at a lower interest rate to save money. Since you may qualify for a loan with bad credit, the interest rate may be higher than other types of loans.

OneMain Loan Options:

OneMain Financial offers various loan options, including secured and unsecured loans.

Unsecured loans: Unsecured loans are typically personal loans that are based on borrowers. OneMain Financial is characterized by offering credit options to borrowers with poor credit ratings. However, it is important to remember that these borrowers will have higher interest rates than those of the most qualified borrowers. Depending on the use of the loan, this may still be useful.

OneMain Financial also offers secured loans: These loans are backed by a kind of guarantee. One of the most common loans is a car loan, which means that your loan is secured by your vehicle. The advantage of a secured loan is that the interest on the loan is much cheaper than on an unsecured loan. The disadvantage, however, is that you can get your car back if you do not pay.

According to OneMain, 43% of the Loans for Bad Credit are insured. After approval, you will receive payment in the form of a check, prepaid debit card or bank transfer.

OneMain Financial Interest Rates And Conditions

OneMain Financial offers its borrowers a variety of interest rates on its terms. These programs can be changed at any time. Therefore, you must ask your lender before proceeding.

With OneMain Financial, you can borrow between $ 1,500 and $ 25,000, with caps varying from state to state. These limits are also better than those you would normally receive with a prepayment loan based on the value of your tax refund.

They offer a repayment period of 12 to 60 months, without requiring early repayment if you pay the loan earlier.

When You Should Go With OneMain Financial

When you make a personal loan with OneMain Financial, there are usually no rules on how you can spend that money. However, depending on what you specify in your request, OneMain may limit the use of funds.

One of the main applications of a personal loan is debt consolidation. If you have many credit cards or other Loans for Bad Credit at a high-interest rate, you can save money by taking out a personal loan and consolidating all the other cards in this loan. Depending on other interest rates, you can save a lot of money each month.

Here are other Common Uses of a Personal Loan:

- Automatic refinancing

- car repair

- Automatic purchase

- Repairs at home

- Improvement of the habitat

Who is Best Suited for a Personal Loan From OneMain Financial?

You can use OneMain Financial personal loans for a variety of reasons, but they can not be used for courses or start-ups. Because OneMain Financial’s interest rates are similar to those of a credit card, your personal loans are only suitable for covering the expenses required or consolidating a debt interest high interest.

For example, a personal loan from OneMain Financial can be great if your credit card debt is spread across multiple cards. A OneMain Personal Loan can help you simplify your finances by consolidating them: include everything in a monthly payment and set a payment date. A personal loan can also help you to improve your financial situation, as the revolving credit in relation to your credit report looks different than the installment loan. However, to take full advantage, you must ensure that your payments are made on time.

In addition, OneMain Financial personal loans can be used to cover unforeseen expenses such as medical care or a car repair bill, as these expenses can sometimes be very high and require quick payment. Personal loans from OneMain with their fast response time and a limit of $ 20,000 may be appropriate.

3. Avant

If you have problems getting a personal loan, you should consider having a personal loan first. Unlike other lenders, Avant has less stringent loan requirements and prefers borrowers with a score of just 580 or more.

Although this translates into higher APRs, you can receive Fore-money in a day or two and borrow up to $ 35,000. Before also offers great flexibility as to the timing and method of payment. This is a good option for borrowers who can not afford a more traditional payment plan.

Who Should Apply?

Avant is a great option for borrowers with low credit scores or who would like to have a lot of flexibility in paying. Avant lets you borrow up to $ 35,000 for two to five years. As Avant eased its credit requirements, its annual percentages are 9.95% to 35.99% higher. On average, however, you will receive your money within one to two days. Like most online lenders, Avant does not expect a prepayment penalty. This means that you can pay off your loan sooner and save interest.

If your credit score is at least 580, you have a better chance of getting approval for a personal loan. This means that is a better option for borrowers with a low credit score. Many other traditional and online lenders require a minimum credit rating between 620 and 680 in order to qualify. Avant borrowers average between 600 and 700 with an income between $ 50,000 and $ 100,000.

If you take out a loan before:

you benefit from great flexibility in the payment. Not only can you manage your payments online and through a mobile app, but you can also change your future and future payments up to one day before they expire. This includes the change of the payment amount and the due date. In addition, Avant offers a discount on late payment. If you make three consecutive on-time payments after a late payment, you will be refunded the $ 25 fee.

It also offers flexibility in the method you choose to repay your loan. Unlike other online lenders, Before does not charge a fee that depends on the repayment method of your loan. If you have the option to sign up for automatic payment, you can pay via a bank account through an automated clearinghouse or remotely-created check, credit or debit card, a personal check, a cashier’s check, or money order. This makes Avant a better option for borrowers who do not want to withdraw automatically.

If you apply for a loan from Avant, you can not use it to finance your business, as you would with other lenders’ private loans. Previously, only residents of Iowa, Colorado or West Virginia can provide Loans for Bad Credit.

Who Can Qualify For Avant Personal Loan

One of the main attractions of earlier personal loans is the ease of the application process. Through Avant, borrowers need to announce their full name, address, income information, and social security number through the company’s online lending platform. The loan application is executed through a patented technology system to determine the available credit options based on the information of the borrower.

This information will be completed within a few moments. If the borrower appreciates the terms of the loan, the contract can be signed electronically. Personal credit balances can be paid directly into the bank account of the borrower within one business day after their approval.

Although applying for a new personal loan from Avant is relatively easy, borrowers must meet the loan requirements to qualify.

A minimum credit rating is not required, but borrowers must have a demonstrable income resulting from a payslip or tax return for independent borrowers. In addition, Avant requires that borrowers be at least 18 years old, are US citizens or permanent residents, and can prove their identity through their online verification system. Avant borrowers must also have a valid bank account in the US. UU. This is used for the automatic repayment of the loan.

To qualify for a personal loan, we recommend that borrowers meet the following criteria:

- You must be residing in the USA.

- You must have a social security number

- At least 18 years old

Prior to this, your credit history, information about your application, the intended use of funds, and your repayment capacity will be evaluated when approving a loan offer.

Lending rates, interest rates, and limits before

Avant offers its customers loans with simple deadlines with different interest rates and terms of payment according to their specific needs. The basics of personal loans before are as follows:

- The loan amounts are between $ 2,000 and $ 35,000 in most states.

- The repayment terms vary between 24 and 60 months, depending on the amount of the loan and the requirements of the state.

- The interest rates are fixed and in April between 9.95% and 35.99%

- No prepaid rates, although a 4.75% administration fee is charged

- Having a loan before can be a wise choice for those who need personal loans for bad credit. Since no minimum rating is required and a wide range of loan and interest amounts are available, persons who do not qualify for a traditional personal loan may be eligible for this loan.

Read More: Best Bad Credit Car Loans

4. Upstart:

Upstart was founded in 2012 with the goal which migrates artificial intelligence and machine learning to automate the lending process. It aims to set the price of credit appropriately by going beyond the credit scores to take account of their employment, income, education, and other key factors.

It has a direct consumer credit platform where borrowers can obtain personal loans and make their technology available to other financial institutions, including banks and credit unions.

With Upstart Personal Loans, you have a wide range of funds. Interest rates are appropriate for most Upstart loans and you have a payment term option. Unfortunately, you may have to pay high origination fees.

The Benefits Of Upstart Personal Loans

Upstart Personal Loans have many advantages. Some of the big advantages are:

- You can borrow $ 1,000 if you wish: many competitors have higher minimum loan limits. For example, with LightStream, you’ll need to borrow at least $ 5,000.

- Upstart offers competitive interest rates: the range of interest rates ranges from 5.59% to 35.99%. By comparison, LendingClub loans have annual percentages between 6.95% and 35.89% and similar competitors like

- High APR: While Upstart rates are slightly higher, their exit rates are lower than some alternatives such as Avant loans, which have an APR of at least 9.95%.

- You can quickly access your money: Accessing your next business day’s work is a big plus if you need quick access to cash. Fast funding means that Upstart could save you from getting an expensive payday loan to quickly get your money. Other alternatives, such as Prosper and LendingClub, take between five days and one week to get your money back after you agree to the terms of your loan.

- You can qualify, even if your credit score is not high: If you still accumulate credit, it can be frustrating if you are unable to take out loans when you need them. Upstart facilitates qualification by taking into account several additional factors, such as B. Your field of study.

You will receive a grace period of 10 days for late payments. If your payment falls outside of the grace period, Upstart will charge you a fee equal to 5% of the outstanding amount or $ 15, whichever is greater.

You Can Choose The Loan Period With Your Own

Upstart also gives you the choice of the term of your loan. You can choose a repayment period of 3 or 5 years. Longer loans can have higher interest rates and will cost more in the long term as you pay the interest for longer. However, the monthly payments are lower than the short term repayment loans because you have more time to repay the loan.

As a rule, you will receive a first-rate proposal and a loan offer from Upstart. Once you have agreed, submit your complete application. Sometimes you may need to submit additional documents, which may delay the application process. When your final loan application is approved, you will immediately receive your money. In fact, 99% of Upstart borrowers have the money in their bank account on the business day following their loan.

Upstart Interest Rates, conditions, and limits

If you want to borrow Upstart Personal Loans, here are some key facts about the terms of these loans:

- They pay an interest rate between 5.59% and 35.999%. The exact interest rate you pay depends on your credit rating, your educational background, your career, and other factors. Opening fees are charged for certain Upstart personal loans. The interest rate varies between 0% and 10% depending on the qualifications of the borrower.

- The minimum loan amount is $ 1,000 and the maximum amount you can borrow is $ 50,000. The initial loans are fixed-rate loans, which means that the interest rates remain the same throughout the term of the loan and your payment never settles when settling your debt

- You can repay your loan within 3 or 5 years. Payments are made monthly and there are no prepayment charges. Borrowed funds are available to 99% of borrowers applying for a personal loan from Upstart on the next business day following the loan approval.

- Initial loans are available to borrowers with average and lower credit ratings. It is known that Upstart has approved borrowers with a credit rating of only 600, well below the minimum credit rating required of many other lenders.

Some Disadvantages Of Upstart Personal Loans

The disadvantages of Upstart personal loans are:

The maximum loan amount is lower than some competitors: you can only borrow up to $ 50,000 at Upstart. For some competitors, such as LightStream, you can borrow up to $ 100,000. If you have debt consolidation or large purchases, Upstart may not provide you with all the financing you need.

The original rate is high: the rate for Upstart could reach 8%. This is far above the maximum rate required by others. For example, the maximum source rate for Prosper is 5% and that for LendingClub is 1% to 6%. And many other loans, such as Discover Personal Loans do not even charge opening fees.

5. Prosper

Prosper is a good option for those who can not get credit from a traditional bank and do not want the high-interest rates of credit cards and payday loans.

It is a peer-to-peer lender, meaning that ordinary people invest small amounts of money to cover their credit. Through the payment, investors receive their money back with interest. Prosper accepts risky borrowers who are not accepted by a traditional bank or credit union.

Although high-risk borrowers pay much higher interest rates. The application is simple. In minutes, after completing a short online application, you can see if you qualify and receive a quote for your plan. Then all you have to do is create a loan list that shows what you need money for, publish it, and wait for the money to be paid.

However, if you wait for a deposit the same day, Prosper is not the right lender for you. Since your loan is not paid by one investor but by several investors, you will not receive your money immediately. also charges an opening fee of two to five percent of your loan amount. Another potential danger is that it only offers maturities of three and five years. If you are interested in a shorter loan repayment period, you may choose to pay a little more every month, but if you need more time, you may need to call another company.

Benefits of choosing Prosper:

Available for those with a Low Credit score:

This is a great option for those who have been rejected by banks and for those who can not get a reasonable interest rate. It provides loans to people with a FICO score of just 640. Even though high-risk borrowers demand higher interest rates, they are certainly cheaper than with a payday lender.

Fixed-Rate Loans:

All Prosper loans have a fixed interest rate, so you do not have to worry about increasing them over time.

Borrow up to $ 35,000: With Prosper, you can borrow between $ 2,000 and $ 35,000. Most private lenders do not allow you to borrow more than $ 25,000. Prosper is, therefore, a good option if you need to borrow more money.

Fast Online Application:

When you answer basic questions about yourself and your finances, you will receive an estimate of your interest rate, which indicates whether it is the right choice for you.

Originator Fee:

It will charge you an origination fee of between two and five percent of the amount of your loan. The exact percentage depends on your creditworthiness.

Temporary Loan Requirements:

For Prosper, you must choose a term of three or five years. While this should be good for most people, most lenders give their borrowers more flexibility in the way they want to pay the loan.

No Early Redemption Fee:

If you repay your loan before the maturity date, you will not be charged any additional fees to offset the interest loss.

Earn Money by Investing:

If you have money to spend, you can make money online by paying off the credits of others. When you pay the loan, you receive the money you have entered plus interest. The amount of interest you earn depends on the interest rates on the loans you contributed to.

Money Management Mobile Apps:

With Prosper apps for iOS and Android devices, you can track your spending and credit over time. Track all purchases to see how you spend your money and look for savings. You can also see your credit score and track your progress over time.

Interest Rates?

Loan lending rates range from 5.99% at low levels to a staggering 36% at the top of the APR.

It will definitely not refuse to reject a person solely on the grounds of their creditworthiness, the risk may be higher, which means a higher rate. This is also due to the nature of the peer loan, for which Prosper not only has to make money but also the borrower hopes to achieve a return.

Loans can have a term of three to five years. As a result, interest rates vary depending on the time required with a higher annual percentage for longer loan periods. As long as your loan exists, the interest rates remain fixed at all times.

Personal Loans Fees

The prosper charges a fee for their personal loans. This means that you can expect to pay the original fees and pay a fine if you do not make any payments.

The opening rate varies between one and five percent, depending on your rating, which you get based on a large amount of your data, not just your credit rating.

Late fees will be charged 15 days after the due date if you pay $ 15 or 5% of the outstanding bill, whichever is higher. If your payment falls due to insufficient credit, a fee of $ 15 will also be charged.

If you decide you do not want to pay with automatic payment, you can pay by check, but it will cost you. The check is charged at 5 or 5%, which is cheaper.

Conclusion:

Lack of knowledge, insufficient resources, or limited funds to pay off debts can quickly affect your creditworthiness. But remember, bad credit is reversible. You still have the opportunity to build a working financial life and a loan with bad credit could be profitable.

In this article, I have covered the best bad credit personal loans guaranteed approval and you can choose them which suits your needs. Let me know in the comments section below what you think is the best bad credit personal loan for you.

People also search for like: What’s the easiest loan to get with bad credit? , Can I get personal loan with bad credit score?, How to get a loan with very bad credit?, Can I get a loan with a 400 credit score?, Who has the fastest loan approval?

Read More:

1. American Express Cards’ Spending Limits

2. Best Investment Accounts For Young Investors

3. Best Websites For Finding Coupons And Deals Online

Pingback: Paul Nelson