Cashier Checks – How to Avoid Getting Scammed!

Merchants, as well as consumers, mostly depend upon the cashier checks when it comes to major transactions like purchasing a home, buying a car or jewelry. However, in such scenarios, security just indicates that the checks will not get bounced as the entire responsibility of the payment is taken by the issuing bank. But, you must remember that they are not safe from scams and frauds.

In recent years, technology has grown extensively, even in printing and this has made it quite easy for any scammer to get the checks forged in their basements.

Due to this, it has become tough even for a bank employee to identify the fake check from the real ones. It could at times take weeks to discover the counterfeit check.

In addition to this, in case you have already spent the money prematurely, you are also liable to clear off the unpaid check along with the resulting fees, when the bank discovers that it is a fraud.

In order to safeguard yourself from these crimes, there are few instructions that must be followed in order to cross-examine the cashier check validity, identifying the fake checks, and reporting any incident of scam in case you are a victim.

The Most Common Cashier’s Check Scam

A standard cashier’s check scam would be in this manner: A “buyer” intends to buy a specific product using a money order or cashier’s check. The buyer, for any reason, sends a fake check that is issued for the amount which is in excess of the original purchase price.

However, despite this, the buyer tells the seller to proceed with the transaction and get the check deposited. Finally, once this is done, the buyer requests the seller to return the extra money, generally in cash, or wire transfer, or through Western Union. This return payment may go back directly to the buyer or it could reach a third party.

Read Also: How To Transfer Money Between Bank Accounts?

The Main Elements in this must be noted:

- The buyer makes use of a money order or cashier’s check. They might have several reasons for using this mode of payment.

- The seller or the recipient receives a check in the balance of the purchase price

- The seller has to send back the extra money to the buyer or a “third party”

Now, in case you have faced such a situation in the past or are currently facing a similar situation, then it is certain that you are dealing with a thief.

Note that in such a scenario, timing is vital. Do not send across money or stock till you have confirmed that the funds have been sent by the paying bank. This is known as the period of check clearing.

However, this could be confusing for a layman as well as the bank employees. The money from a cashier’s check can be withdrawn within a single business day, post the check deposition. However, this does not indicate that the money exists in real or the money has been transferred to your account.

This process might require many business days. The lesser you know your buyer, the more you will have to wait for the money.

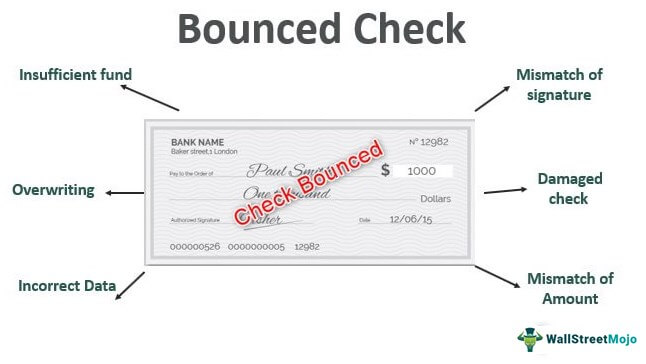

How Do these checks Bounce?

These types of scams become successful as everybody trusts the security of the cashier’s check. The bank assumes the checks are authentic, however, the responsibility of depositing the check lies with the individual. In case the money is used by you, you will have to get the funds replaced.

Once the bank identifies that a check is a fraud, the deposit is reversed by the bank thereby leaving you with a negative bank balance.

Four common Cashier check fraud scams

By now you would know that the fraudsters have just one goal-taking money from you. However, their tactics might differ. Fraud experts, as well as government websites, describe the different scams as:

1. Foreign Lottery Scam:

In this scam, you will be told that you have won a lottery or maybe you have got some inheritance from your relative (someone you don’t even know). You may also get a check, which will bounce later. You will be asked to make payment of a certain amount as fees or even foreign taxes.

There is a variation in this as well, where the scammer will send a fake check to get the taxes and fees covered, but then claim that they have paid the additional money and ask you to pay the difference.

2. Craigslist or the Overpayment Scam:

This happens when you sell something either on an auction site online or on Craigslist. The buyer sends across a check for a higher amount than you have charged. They then ask you to send back the difference, and later on the check that you have received bounces.

3. Mystery shopper scam:

Mystery shopping also known as secret shopping is a legitimate job pertaining to research that consists of making visits to offline as well as online stores. However, in case you are solicited for this kind of work or get an advance payment, it could possibly be a scam.

4. Work-at-home scam:

This is where you get hired by a foreign company to ship or sell products. You will be asked to pay some amount for certifications or the supplies, but you do not get any reimbursement. All you need to remember is that if anything appears to be way too good to be true, then it probably is a scam.

Red Flags

Fraudsters are pretty good at their job i.e. scamming others. However, they do leave behind a few hints. For instance, if a buyer does not enquire about the product you are selling, why would the he/she be so eager to purchase it?

It might be so that they do not intend to use the product that you are selling. Also, you would not blindly trust a person whom you have not met, with a lot of money. Because, if a person can get in touch with you, they can very well give the appropriate instructions to the bank and issue the correct cashier check.

If in case, because of the buyer’s fault, there has been an excess payment, the buyer should ideally pay the fee to get the correct check printed instead of giving someone the option of stealing money.

Also, if they can offer extra money, they can also afford to pay the fee for the correct check or get a different check written.

Some Other Examples Of Cashier Check Scams

There are many scams that are planted with the help of Cashier’s checks. You must pay attention to some of the situations listed below. However, note that fraudsters can keep changing their tactics.

1. Money mule:

In these tactics, innocent people are fooled by fraudsters into laundering stolen or illegal money through their bank account. In such a case, you will receive the payments and you have to deposit the money in your own bank account, post which it has to be sent to a third party.

This is mostly advertised as a check processing job which is a work-at-home job. It can be quite problematic because in some cases, unknowingly you will be laundering money to and from criminals. And in most cases, you might also lose your money.

2. International Wealth Scams:

This is where some random person gets in touch with you and seeks help in getting a huge amount of money transferred out of some corrupt nation. In exchange, they let you keep a certain fraction of the amount, and the sum might be quite a tempting one.

Of course, the transfer of the entire money has to be done to a third party.

3. Lottery Scams:

Many times we receive messages of winning a lottery which involves a lot of money. However, you would be required to pay a fee or tax on the amount so that the funds get released.

4. Property Rental scam:

This scam is where a person is shifting to your area, and they wish to pay the rent of the initial as well as the last month in addition to the security deposit by way of a cashier’s check.

Note that this person has not visited the property. Once you deposit this check, they indicate that they are not moving to the place and would not be requiring the rental. They state that you could keep the deposit, however, they request a return of part of the rent.

Once you refund the rent, you will realize that the check was a fraud.

There are few signs that you must check when you Get a Cashier’s check:

1. Check the Origin

A cashier’s check that is genuine will show a legal bank name, however, even the fakes will display the same. You can tell if a check is fake by verifying the issuing bank’s legitimate information online or you can verify if the check was sent from overseas.

2. Check the Amount

Fake checks often have an excess amount than what is really required. This is because the intention is to make the victim send the balance back.

3. Safety Features

Fake cashier checks, at times, miss out on the watermarks, the security thread, microprint, bank instructions, the color-shifting ink, etc. On the contrary, they might have these features, however, it could be of poor quality.

4. Payee Name

The payee’s name has to be printed on the cashier’s check (which is done by the teller at the bank). In case the payee line has no information, the check is counterfeit.

5. Phone Number of the Bank

A cashier’s check that is genuine always has the issuing bank’s phone number. A fake check generally does not have this number.

6. Communication that is suspicious

Scammers mostly communicate with the victims in language that has poor grammar or spelling or is completely vague. They also refuse to meet you personally. Most of the time, they send across a text or an email which indicates that they are not from the area that you reside in.

7. Fraud Alert

The OCC or Office of the Comptroller of Currency keeps announcing all the reported fraud cases on its website regularly. In case you get a cashier’s check from any of the institutions that have been implicated — especially when you get it near the date of the fraud being announced — the check might be fake.

Cashier’s Check: How Can It Be Verified?

Though there are a lot of signs which can indicate if a cashier’s check is fake or not, but cannot guarantee it. It is better to get in touch with the bank whenever you deposit the check or encash it, irrespective of whether you have a doubt or not regarding the validity of the check.

However, bear in mind that the contact number printed on the fake cashier check could also be fake. So, do an online search on the contact number of the institution.

Many times, the fraudster also uses a legitimate contact as well as account number, and this might call for further inspections from the bank’s end.

How to Avoid Trouble

There are a few steps which can stop you from becoming a victim of the cashier check fraud:

1. Get the check Inspected

When you verify a cashier’s check, there are some features that can indicate the check is not legitimate.

Firstly, if the check is written for an excess amount then it is unusual. You must ensure that the amount is the same in case you accept the check.

Secondly, the payee’s name and addresses have to be confirmed and you must make sure that they are real. You can get a search done online.

Other red flags could be the signature being missing, missing bank logo, incorrect address, missing watermarks, etc. The check might also have errors in spellings.

2. Question yourself as to why the check is sent to you

If you get such a check in your mail and it appears odd, try to understand why you have been given the check, and what could be the motive of that person. Research on the company or person to check if any of it makes sense to you. Learn to trust your instincts.

3. Don’t Utilize the Money

If you receive such a check, do not encash and use the money. Get in touch with your bank and discuss the issue. If the cashier’s check bounces, the bank has the authority to withdraw that amount from the account.

In case you spend the amount, your account might go into the negative balance. You might also be charged a fee for having a negative or low balance.

4. Alert the Authorities

Now, if you believe that you are a victim of such scams, inform your bank as well as the local law enforcement regarding the situation. The fraud has to be reported by you on the website of the Federal Trade Commission.

Get in touch with the US Postal Inspection Service if the check had been mailed to you.

In case you were contacted online, report this to the Internet Crime Complaint Center of the FBI. This will make a difference as it creates awareness and prevents the scammers from victimizing others.

Conclusion

Counterfeits have increased with the increase in technological developments. The cashier’s check, though fake, looks quite authentic due to the latest devices used to create them.

However, the person responsible is you. If an unknown person has got in touch with you, offering more than what is required, and if you happen to be a seller, you know you are dealing with a scammer.

Always check the authenticity of the person who has got in touch with you regarding the lottery, or buying your product, etc. In short, it is better to be aware and cautious and not be carried away by greed.

amazing! This was a really wonderful post. Thank you for your provided information.

great post. Before read this article, I didn’t even know about this. Informative article for all of us. regards for letting me know.