A loan is a liability. That’s a well-established fact. It takes a lot to decide that you need a loan. But then when you finally arrive at a bank or other source, a nightmare manifests itself. You realize you have bad credit! You’re stranded roadside, no help to be seen. In short, you’re rendered helpless.

Rest assured, you’re not deprived of enjoying a loan even though you have bad credit. You can very well set your finances back on track without much hassle. A bad credit loan can help you in filling the huge crevice between a long-term plan and a practical move toward rebuilding your credit.

But before we venture into the best bad credit loans that are currently offered, let us gain an insight into what a bad credit actually is.

Bad Credit – What is it?

“Bad credit” has a direct reference to your FICO score. FICO score is a credit scoring technique developed by FICO (Fair Isaac Corporation) – a technique-cum-model that lenders use to accurately predict a customer’s ability to repay a debt on time.

The FICO 8 scoring model categorizes all scores of 579 or lower as bad credit. This is how FICO categorizes different scores as different types of credits:

- Exceptional (800 to 850)

- Very Good (740 to 799)

- Good (670 to 739)

- Fair (580 to 669)

- Very Poor (300 to 579)

Any score above 579, you can go for personal loans for fair credit, meaning you have more options and enjoy more favorable terms. Below that, you’re only left with two options –

- Wait for credit to improve, or

- Go for bad credit loan

The former isn’t always possible, thus leaving customers with one way out – avail a bad credit loan.

Which Companies Offer the Best Bad Credit Loan?

It’s important to understand that each consumer has different needs. Many lenders specialize in areas designed to meet those needs. However, there are lots of dimensions to consider – eligibility, rates of interest, and features that prove to be useful to customers with bad credit.

Here, we have segregated 6 companies from many who offer the overall best bad credit loans:

1. UPSTART

Topping our list, we have Upstart, wearing the mantle of Best Lender for Borrowers. It offers loans to customers with FICO scores as less as 620.

Established in 2012, the first personal loans that originated through Upstart were in 2014. It is the first AI lending platform designed to improve access to affordable credit.

Till now, more than 344,000 loans have been originated on Upstart platform, with a sum total of $4.4 billion in originations. Upstart flaunts automation, saying that more than 67% of the loans originated on the platform are fully automated, without any manual processing or review.

Here are a few salient features of Upstart:

- Minimum FICO score – 620

- Co-signer option – Not available

- Preapproval/Rate Quotes – Yes

- Loan term – 3 to 5 years

- Loan amounts – $1,000 to $50,000

- Discount – None

- Origination Fees – 0% to 8%

Upstart is our top pick, and as evident, all for very justified reasons. It’s a must consider for personal loans.

2. LENDING CLUB

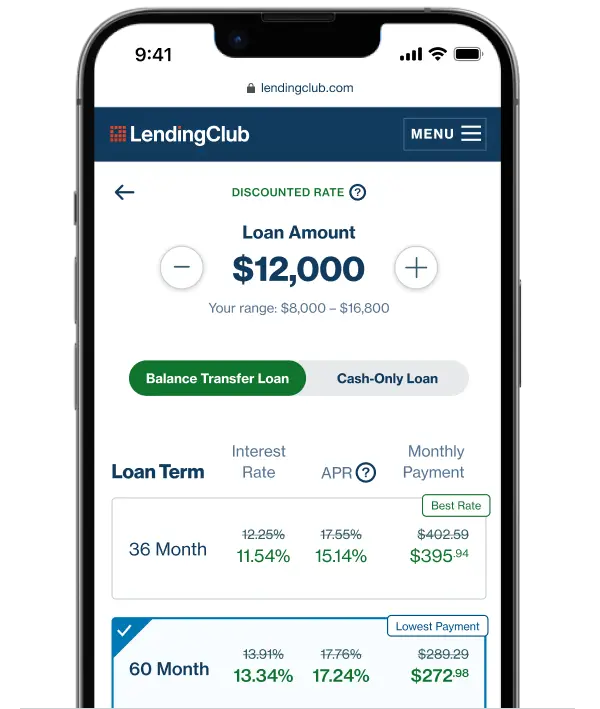

Next, that comes in our list is the well-known Lending Club.

Lending Club is a well-established online lender. Lending Club has had a relatively long history of lending online. It makes a large volume of loans.

With reasonable repayment periods keeping it simple, it results in a payment that works. Although it does not publicly share any minimum credit score requirements for loans, rates of interest for the least creditworthy borrowers can be quite high. But there’s a brighter side – fixed interest rate prevents surprises.

Here are some of the highlighted features of Lending Club:

- Minimum borrowing amount – $1000

- Origination Fee – 1% to 6%

- Loan term – 3 to 5 years.

- Interest rates – relatively high

Lending Club is a viable option, as well. Even though features may not be as appealing as Upstart, they’re quite beneficial too.

3. UPGRADE

The upgrade is the third in our list. It has maintained a good reputation in the market for almost 4 years now.

Personal loans made through Upgrade feature APRs of 6.98%-35.89%. The APR on loan availed can be higher or lower. The loan offers may not have multiple term lengths available too. Also, the actual rate depends on credit score, credit usage history, loan term, and various other factors.

An upgrade can be a decent option to avail a personal loan for customers with a bad credit score. That’s why Upgrade has been named the Best Lender for Bad Credit Loans of Small Amounts.

Here are some of the many features of Upgrade:

- Minimum FICO credit score – 620

- Co-signer option – Not available

- Maximum debt-to-income ratio – 45%

- Preapproval or rate quotes – Available

- Loan terms – 3 years to 5 years

- Loan amounts – $1,000 to $50,000

- Origination fee – 1.5% to 6%

- Discount – None

‘Upgrade’ is in the competition too. It is a good option, probably the best, if you want to loan small amounts.

4. AVANT

Avant, as a lender, is a famous money lending company. It has stayed in the market since 2012 – almost 8 years now.

Having provided access to personal loans to more than 600,000 borrowers nationwide conveniently, Avant has made its presence well known. This, along with many things considered, Avant is termed Best Lender for Bad Credit Loans With Fast Access to Funds.

Avant flaunts an impressive $4 billion loan portfolio. It employs 500+ people and has a $1.8 billion funding.

Following are key features of personal loans offered by Avant:

- Minimum FICO credit score – Case-by-case consideration; credit score 600 to 700 for most approved borrowers

- Maximum debt-to-income ratio: Not revealed

- Preapproval or rate quotes – Not revealed

- Loan amounts – $2,000 to $35,000

- Loan terms – 2 years to 5 years

- Co-signer option – No

- Discounts – None

- Origination fee – 4.75% or less

If you’re rooting for satisfaction, Avant is the one for you. With a good track record, it’s the best option if you want fast access to funds.

5. LENDINGPOINT

Coming next in our list is another well-known company LendingPoint. It has been in the market for almost five years.

LendingPoint specializes in loans for borrowers, both with fair credit and bad credit. If you have poor or fair credit and you’re focus on rebuilding it, then LendingPoint is the one for you. It currently operates in 49 states and the District of Columbia.

Though it has tonnes of features, the best one, however, is the fact that loan funds are available really quick – as soon as one day after approval. LendingPoint personal loans can be used for any legal personal expense or purchase. Therefore, we term it Best Lender for Bad Credit Loans With Very Few Use Restrictions.

Some salient features include-

- Minimum FICO score – 585

- Maximum debt-to-income ratio – 35%

- Co-signer option – Not available

- Preapproval or rate quotes – Available

- Loan terms – 2 years to 4 years

- Loan amounts – $2,000 to $25,000

- Discounts – None

- Origination fee – 0% to 6%

LendingPoint made its way to the list for justified reasons. It’s very limited use restrictions has attracted customers throughout the country.

6. ONEMAIN FINANCIAL

OneMain Financial is the last but not the least in our list. Not to be mistaken as inferior, it’s just as good as its competition.  What was found in 1912, it came into recognition in 2011. Having served 15 million total customers so far, it keeps growing. It has a nationwide branch network with almost 1,600 branches across 44 States of the U.S. It has employed more than 10,000 people.

What was found in 1912, it came into recognition in 2011. Having served 15 million total customers so far, it keeps growing. It has a nationwide branch network with almost 1,600 branches across 44 States of the U.S. It has employed more than 10,000 people.

OneMain Financial offers different types of loans, unsecured personal loans being one of them. Loans offeres to borrowers with bad credit. The best part is that there is no minimum credit score required to apply!

Following are the features:

- Minimum FICO score – None

- Co-signer option – Not available

- Maximum debt-to-income ratio – Not revealed

- Loan Amounts – $1,500 to $20,000

- Loan Terms – Up to 5 years

- Origination Fee – None

- Discount – None

Although last, it still says in the competition. Although loaded with many attractive features, what makes OneMain Financial stand out is the fact that there’s no restriction on minimum FICO score required to avail a loan. This continues to attract customers.

Thus, we end our list of best bad credit loans for 2022. As mentioned, different customers have different needs, no two alike with many good options for personal loans, these six top the others. Loans can be liabilities, but their importance shouldn’t overlook. They help people rise from the dust and stand on their feet. Depending on your own needs, financial standings, and lots of other features that should be considered and discussed, you can choose what’s right for you.

People also search for like : What is the easiest loan to get with bad credit? , How to get a loan with very bad credit?, Can I get loan if I have very bad credit?, What type of loan can I get with a 500 credit score?, What is the minimum credit score for a loan?

Read More:

1. Best Ways To Increase Social Security Benefits

2. Lyft Vs Uber : What’s The Difference?

3. 7 Reasons You Haven’t Received Your Tax Refund

I read this whole article and this is the best info about Credit Loans. Thanks for this wonderful piece of article and keep posting.

Hello! This is my first visit to your blog! We are a group of volunteers and starting a new project in a community in the same niche. Your blog provided us useful information to work on. You have done a extraordinary job!|

I have been surfing online more than 2 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. Personally, if all web owners and bloggers made good content as you did, the internet will be a lot more useful than ever before.|