Nowadays, PayPal has become one of the reputed and preeminent applications for making online transactions. Recently, PayPal has changed its services section and now they have come up with amazing services like PayPal virtual credit line.

PayPal Credit was formerly known as ‘Bill me Later’. Which you might have seen if you have an account on PayPal. For online purchases and transactions, you can use PayPal credit without paying any interest charges up to six months. PayPal credit option is different from the PayPal debit card and credit card, which you can use at stores and online websites as a payment option.

Before we go ahead, let’s discuss What’s PayPal virtual credit line.

What is PayPal Virtual Credit Line?

PayPal credit works just like credit cards i.e. paying the amount at online purchase in installments rather than paying the full amount in the first place. The credit on PayPal is issued by the best Synchrony Bank, which its users can take advantage as a payment option on online websites and stores.

PayPal changed the name of its service in 2014 from PayPal credit to ‘Bill me Later.’ The highlighting part about PayPal is that you can extend the credit limit to make your online purchase a bit easier at any vendor.

Now as proceeding further, you should know how PayPal credit virtual line works.

How Does PayPal Virtual Credit Line work?

PayPal’s virtual credit line is quite easy to use as compared to other methods of using credit. Before you take advantage of PayPal

Credit, you must know how to use and apply for the credit from PayPal.

Read More: Review Of PayPal Prepaid MasterCard

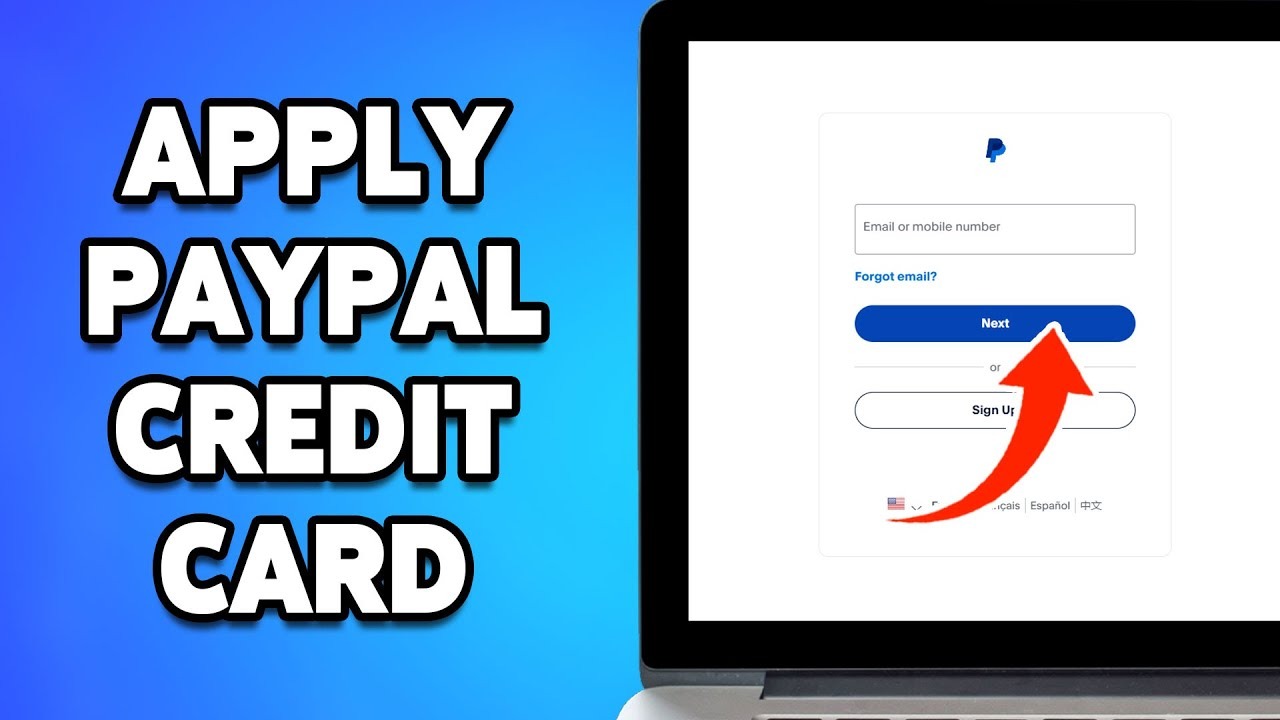

How to Apply For the PayPal Credit?

If you are using PayPal in your mobile devices, then you can apply for the PayPal credit. Even if you don’t have an account, your account will be created on PayPal when you will apply for the credit.

To apply for the PayPal credit, you have to submit an application, which has all the personal details including the date of birth, exact income amount after deduction of taxes, and lastly, the last four digits of your social security number. Once you submit your application form for the PayPal credit, then instant approval will come from their team.

You might be confused about whether you are eligible for the credit loan or not, right? Thus, you must know the fact that there are no specific and clearly stated criteria for PayPal credit. However, if in any case, your credit score is poor, then chances are PayPal team will decline your application form.

On the contrary, If your credit score is good as evaluated on the basis of previous credit history, then the approval will come instantly and your account will be credit with an amount. Also, the PayPal team evaluate your account and either they decrease or increase your credit limit as per your usage.

How to Use PayPal Credit?

Once your account has been set up on PayPal, then you can easily and quickly take the PayPal credit within no time. To use the PayPal credit, the vendor should accept PayPal in online payments and you have set up PayPal credit as a default payment option.

To manage your PayPal credit, you can either use it on the installed application on your mobile device or simply on a web browser. Just like any other credit card, you can use PayPal Credit to send money or for online transactions.

What are the Terms and Conditions Of PayPal credit?

Here are some of the mandatory terms and conditions by the PayPal team for PayPal credit advantage.

The user has to utilize the PayPal credit i.e. some of the monthly payments are required on your balance. At the end of the month, you can make minimum payments as per your balance and then pay the amount as per your requirements. Secondly, if the user is new on PayPal, then there is a variable APR that fluctuates along with the prime rate of interest.

Furthermore, if you choose to send money to someone through PayPal credit, then a flat fee will be charged 2.9% + regular charges per transaction. This is actually the same amount you pay when you use debit or credit on PayPal to send money.

Advantages and Disadvantages of PayPal Virtual Credit Line:

Every application for online transactions has its own advantages and disadvantages. Therefore, below listed are the advantages and disadvantages of PayPal virtual credit line.

Advantages of PayPal Virtual Credit Line:

-

Quick and Easy to use

You cannot say that PayPal’s virtual credit line is hard to understand and use. PayPal Credit can be easily and conveniently used to make an online purchase quickly without worrying about the cash. If you have applied for the PayPal credit card, then you will definitely receive it within a period of one week.

-

Anywhere and Anytime

You can use PayPal credit anywhere and anytime. Which includes all sorts of online stores and websites to make a quick payment.

-

Security Of Transactions

At PayPal credit, you have the benefit of online purchases. The product or item isn’t the same or arrive in good condition. Then the full price will be refunded to your PayPal account along with the shipping cost that had been charged.

Disadvantages Of PayPal Virtual Credit Line:

-

Low Credit Limit

If you are using or planning to use PayPal credit, then you must know that it offers a low amount of credit to its users. As compared to credit cards, the limit range of PayPal credit is a bit lower.

-

PayPal Credit won’t Help in Score

Whenever you buy something from your credit cards or take a loan against your credit card. There will be a report sent to the credit agencies for the evaluation of the user’s history, which helps in building the credit score. The PayPal team doesn’t send any report to such agencies, thus it won’t be beneficial in building your credit score!

-

Extravagance

When it comes to PayPal virtual credit line option, the users become more extravagance i.e. They likely to spend more on online purchases through PayPal credit balance in comparison to regular PayPal

To increase the credit limit of your PayPal credit virtual line. Firstly, you will be evaluated on the basis of your previous payments and the entire history of returning the credit amount. There is a strict pattern followed by the PayPal team, which also includes inquiries regarding the account details, payments, etc.

However, it is always suggested that the user has to be cautious when it comes to instant credit. Not only the convenience and quick payments are the consideration factors in such cases.

Conclusion:

To conclude, here is the comprehensive guide about PayPal virtual credit line, what exactly it is, how it works. What are the advantages and disadvantages of using it? Your PayPal credit has been approved, then it is advised to use it wisely and return the payment.

In your PayPal wallet, you can choose the PayPal credit option and set it in default. Especially for your individual transactions! Hopefully, this guide is beneficial in resolving all your questions regarding the PayPal virtual credit line.

Read More:

15 Tips And Ideas For Cutting Car Insurance Costs

6 Dental Insurance Plans With No Waiting Period

Leave a Reply